Arctech unveils new single-axis tracker

The device, conceived for large scale solar, is said to solve the instability issues associated with the two-modules-in-portrait structure and to have the largest south-north slope seen in the tracker industry.

SMA posts first-quarter loss

Sales revenue declined at the start of the year despite steady inverter shipments. The reverse was mainly due to sluggish project business and SMA is predicting significant increases in sales and earnings in the second half.

SolarEdge just keeps growing

The Israeli power electronics maker’s revenues and shipments keep rising as it absorbs more companies, but the pending increase in Section 301 tariffs in the United States leaves some clouds in the future.

Battery storage market will be worth $13 billion by 2023

Analyst Globaldata says falling system prices, and the need for more resilient grids and favorable policies, continue to fire the energy storage industry around the globe and the Asia-Pacific region is likely to remain the biggest market.

Tesla’s solar business shrinks as Musk focuses on Model 3

The EV, energy storage and solar company deployed only 47 MW of solar during Q1, as Tesla moves away from traditional sales methods towards web-based sales for its products.

Australia and India helped make up for Chinese solar retreat last year

The world had more than half a terawatt of PV generation capacity at the end of last year as emerging solar markets picked up the slack caused by Beijing’s subsidy about-turn to the tune of a 20% rise in installations outside China.

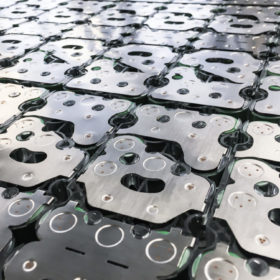

DuPont unit and Fraunhofer ISE to work on c-Si module testing

The PV solutions division of DuPont Electronics and Imaging has revealed plans to work with the Fraunhofer ISE on optimizing testing protocols for crystalline silicon solar modules.

Getting (almost) all our energy from the sun by 2050

Solar could meet approximately 68% of global energy demand with other renewables making up the rest, according to a new report. A 100% renewable energy system could also create 22 million solar jobs by 2050, the study claims. Keeping global warming below 1.5 degrees C, though, would require FITs for projects up to 40 MW in capacity, auctions for bigger systems, removing fossil fuel and nuclear subsidies and providing more education and R&D and less red tape.

Sonnen reveals plans to expand with Shell’s support, starts cobalt-free battery initiative

German battery maker sonnen is following its takeover by Shell with plans to expand its market reach. It says it will use the opportunity to jointly push the energy transition. With an eye on sustainability, sonnen has launched an industry-wide initiative to push cobalt-free lithium-ion batteries for home storage systems.

Tesla, GAF, RGS and now Hanergy: will solar roofs finally heat up this year?

Hanergy displayed the newest rendition of its 18.7% Thin Film Flat SOLARtile in Australia last week as it gears up for the U.S. and global product launch later in 2019.