The 2018 NSW Smart Energy Summit, hosted by the Smart Energy Council in Sydney yesterday, was associated with considerable hype due to the attendance of former PM Malcolm Turnbull. However, the Summit’s focus on corporate PPAs and C&I applications pointed to solar and battery storage’s bright future, with or without the support of federal governments.

The increasing corporate and business uptake of renewable energy was highlighted, for its potential to both drive down the cost of renewables and wholesale electricity. In the absence clear Commonwealth government energy policy, summit attendees heard how the industry anticipates that corporate buy in will also encourage confidence and investment in the sector. Importantly, corporate and bilateral PPAs can also incrementally reduce carbon emissions.

Coming just three days after the strike by Australian school students in protest at the Government’s inadequate response to climate change, the Smart Energy Summit was charged with a national context of urgency.

Here, three varied Summit views on the opportunities posed by renewable energy and smart energy storage.

Renewable energy is good for business

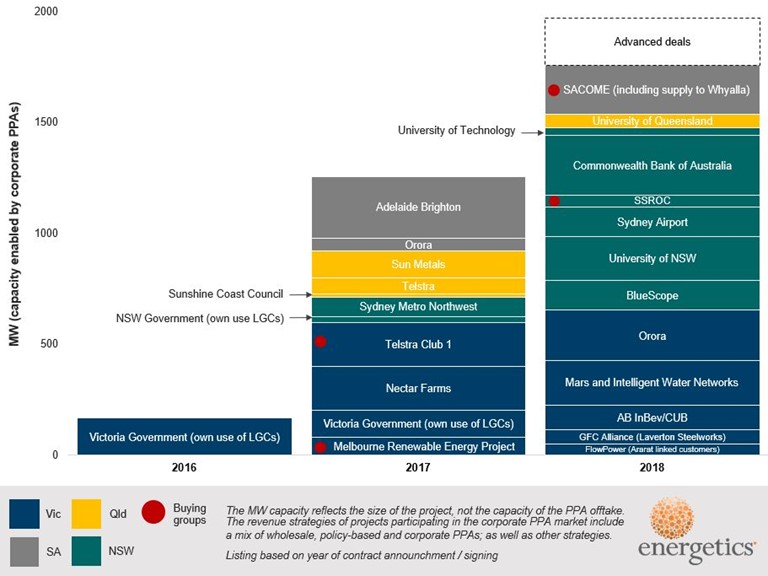

In 2018, almost 200 MW of renewable energy have been supported by Power Purchase Agreements (PPAs) signed by corporates in Australia, according to the Energetics Corporate renewable energy PPA deal tracker.

Summit speaker, Jon Dee, presenter and producer of Sky News Channel Smart Money and special advisor to Arup, said, “What’s been interesting is how much money can be saved.”

He reminded attendees that since 2008 the cost of solar has reduced by about 80%, and that today, “a PPA can reduce the cost of electricity far below the standard retail offer.”

Dee quoted Energetics modelling revealing: “A well-negotiated PPA can potentially provide savings of between 15% and 47% on the energy component of a typical bill expected in 2020.”

Among the 2018 Australia-wide converts are Carlton United Breweries, Mars, Bluescope, the University of New South Wales, Sydney Airport and the Commonwealth Bank.

In November this year, Commonwealth Bank also became the first Australian business to join the RE100 list of corporates — the so far 156 businesses committed to achieving 100% renewable energy use within self-imposed timeframes.

Dee is helping to develop the RE100 group in Australia, and says that while some companies are signing up to reduce their climate impact, “The bottom line is it’s better for the bottom line.”

Innovation drives more dramatic reductions in solar costs

“There has never been a more exciting time to be in the Australian energy industry,” said former Prime Minister Malcolm Turnbull. A wry reference to his effort to introduce a National Energy Guarantee, a policy play that arguably led to his overthrow among his Liberal Party colleagues, also found an audience at the Summit.

Turnbull hailed as “great news” the dramatic fall in the cost of solar PV over the past eight years, from almost $2 a watt to around 20 cents a watt, before offering an example of where the next reductions will come from

The former PM specifically referred to research in progress at the University of New South Wales that is expected to see the efficiency of solar panels dramatically increase: “You will have a solar panel that currently costs, say 40 bucks, and instead of being a 300 W panel, it’ll be a 500 W panel. Imagine what that does to the cost of solar generation;” said Turnbull.

Ultimately, Turnbull said that the combined reduction in the cost of renewables with decreasing costs of battery technology has left coal fired generation unable to compete.

Turnbull did address the ‘elephant in the room’ and expressed concern at the present lack of a long-term Federal energy policy to support investment.

“Renewable energy backed by storage is the cheaper form of new electricity generation, that’s clear,” said Turnbull. “But what we’ve got to do is have the political consensus and degree of certainty backed by industry and business, to enable that.”

Business models can be reconfigured with energy storage

Utility-scale battery storage cannot only help to fill troughs in renewable supply, but it can be used to even out price spikes and enable innovative approaches to business growth, said Mark Leslie, Managing Director in the Asia Pacific region for Fluence Energy.

Speaking at the Summit, Leslie outlined one simple application: “Energy storage is very helpful for commercial industrial users when they have spikes in electricity use that coincide with peak cost hours in the grid”. It can discharge energy stored at a time when demand and costs are lower.

Then, said Leslie, consider if a mine or industrial facility is located at the end of a transmission line, and the owner’s visibility into its future operations indicates that in the short to medium term it could expand production, which requires the availability of more electricity.

The costs of increasing transmission capacity and potentially building out the substation capacity may run to tens of millions of dollars.

Leslie suggests that “instead of taking the time to get the permitting and taking responsibility for the cost of the line and the substation, the facility embeds energy storage on the demand side of the substation, so that during peak load times, it can access energy delivered in off-peak hours.”

Energy storage systems can be portable, therefore moveable, and can be leased rather than purchased outright. They can be incrementally added to or reduced. They pose none of the risks associated with a potentially stranded asset.

The flexibility of energy storage is creating new possibilities, whether power is delivered via transmission line, or generated by renewable sources in situ.

Author: Natalie Filatoff

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.