At a series of well-attended roadshows around Australia this month utility-scale solar developers, representatives of EPC companies and plant operators, were introduced to SMA’s new service products that, in the first instance, respond to the complexities of grid connection amid ongoing “regulatory inconsistency” in the Australian utility environment, says Michael Rutt, Managing Director of SMA Australia.

Bringing plant engineering and planning services to the Australian market “is about risk mitigation,” said Rutt. “The earlier we’re involved in the project, the more we make sure that the right product and the right design are implemented, and the better the project will run.”

“The inverter is the real key to the power plant, to the way it behaves and interacts with the grid,” said Sydney roadshow attendee, Sam Hill, a project developer with Edify Energy. Edify’s latest project is the 333 MW Darlington Point solar farm in western New South Wales. “Having the supplier of the inverter do the engineering for the whole plant would provide benefits in ensuring everything works properly,” he added.

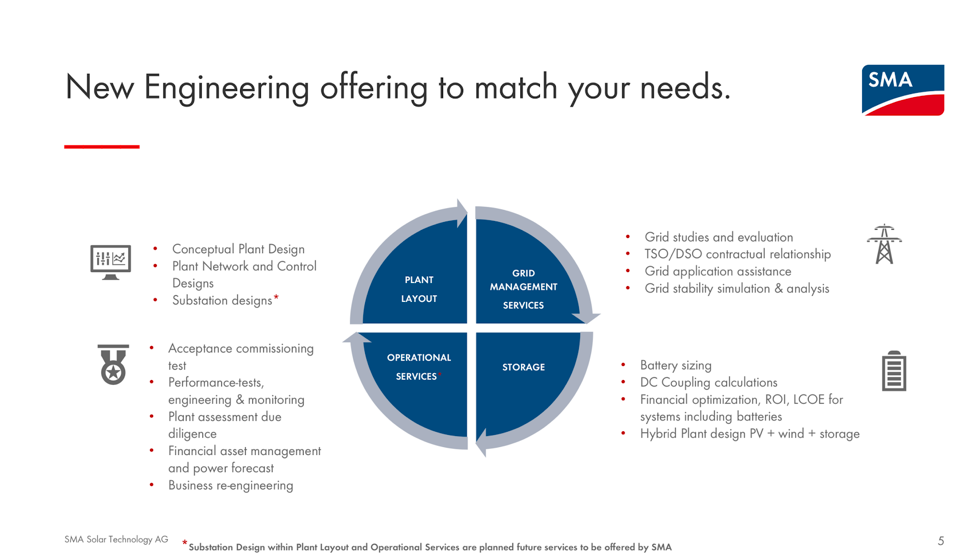

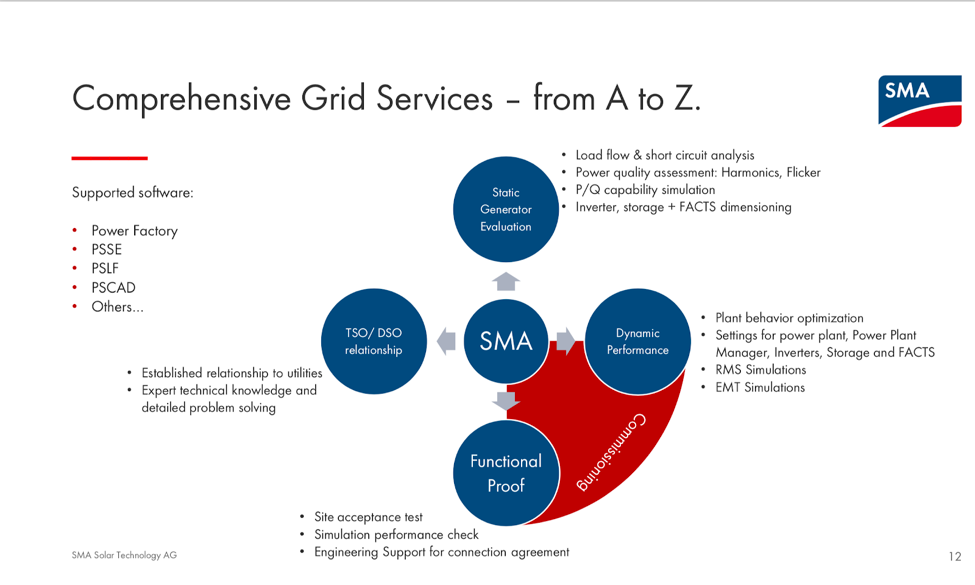

The engineering services from SMA include: conceptual plant, network and control designs; grid studies and evaluation; management of the contractual relationship with the transmission system operator (TSO) – in this case the Australian Electricity Market Operator; battery-sizing and DC-coupling calculations; and grid-stability simulation and analysis. Part of the engineering costs, says SMA, are reimbursed upon purchase of SMA hardware.

Carmen Garralaga, SMA’s new global Engineering Services Platform Manager, who travelled from the company’s European headquarters to address the roadshows and elaborate on the new service products, said SMA, which installed 1.3 GW of inverter power in Australian utility projects in 2017 alone, has for years been the natural go-to for customers seeking advice and support on plant planning and performance optimisation.

In 2018, SMA realised it could add value to its hardware by dedicating human and analytical resources to delivering engineering and planning as a product, thereby driving efficiencies from equipment not always understood by consultants, and expediting successful grid connections.

“If a consultant does not fully understand how the inverter works, their grid modelling may not be properly done,” says Garralaga, who adds, “then we have to respond to a lot of questions”.

SMA claims that being involved in plant and grid modelling from the outset will allow the company to better leverage its inverter capabilities for each plant and connection: “We know how the inverter works, so if we do the model, the parameters will be properly set up and the model will more closely reflect the way it functions in real life,” says Garralaga.

She provided proof of concept of SMA’s new engineering services in the form of a case study of a Chilean solar plant which needed to achieve the lowest possible levelised cost of electricity (LCOE). Garralaga says given site, weather, equipment and financial data on the project “our software ran different scenarios that helped to find the optimal plant layout to achieve the developers’ aim”.

Rob Mailler of solar-project developer Kinelli – Dunblane Solar Farm (finalist in the Clean Energy Council 2018 design awards) in Central Queensland, and most recently Kanowna Solar Farm near Moree, NSW – said, SMA’s engineering services would be of most value in projects where the developer has to hire engineers under contract.

Kinelli has “good engineering capacity” he says, “and I wasn’t convinced that SMA would be able to improve our deployments, but I can see that for developers who don’t have as much inhouse engineering capacity, it would be attractive.”

Operations and maintenance

Mailler was, however, open to SMA’s new operations and maintenance (O&M) services. “In order to develop a project and win investor support you need to have a good long-term plan,” said Mailler. “SMA is a brand that investors are comfortable with, and if you can extend its involvement into plant management, it’s more bankable.”

He was particularly interested in SMA’s ability to provide more informed analytics of plant performance, given its large worldwide installed base.

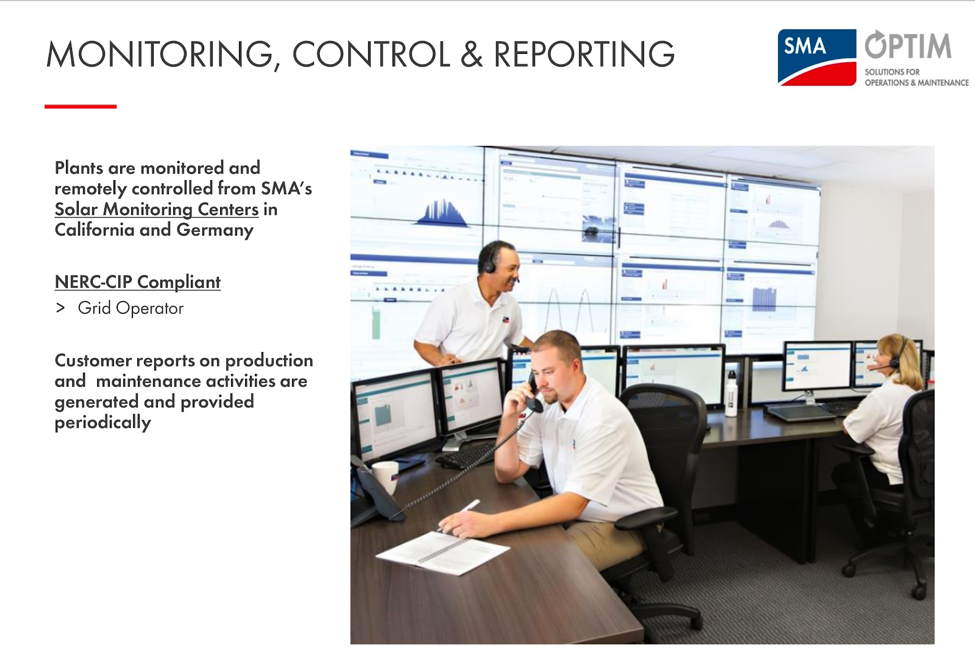

Chuck Smith, Executive Vice President of SMA Global O&M Solutions and Sales presented the technical optimisation and asset-management aspects of the new service packages. These services range from the prosaic vegetation and pest control, for example – to providing high-tech insights, including 24/7 monitoring of solar-farm performance, and drone-mounted aerial thermal imaging of plant.

He said a customer had recently requested that SMA conduct an aerial scan of a plant managed by a competitor. The outcome was that, “We found that 6% of the panels were degrading and close to 1% were offline,” says Smith.

Preventative and planned maintenance based on remote and onsite monitoring can reduce the costs of maintenance by carrying out tasks such as panel cleaning or component replacements as needed on each project, rather than according to a one-size-fits-all prescribed schedule.

As part of SMA’s corrective maintenance/repair and warranty administration, it undertakes to respond to a malfunction by determining the root cause, initiating and managing the repair and managing the warranty administration for the customer.

SMA currently has 3.5 GW of plant under O&M contracts worldwide, and confidence in its own expertise in the O&M field has enabled it to also offer performance guarantees of plant availability and energy-based availability as part of its O&M packages.

“It’s a good market for SMA to enter into,” says Andrew Coughlan, Manager of Utility Scale Solar at Zenviron, engineering, procurement and construction (EPC) provider for projects in Australia and New Zealand. He says it will suit, “developers and asset owners who are looking to swap out the contractor who’s covering the defects-and-liabilities period for somebody who’s really interested in looking at performance as a long-term prospect”.

Asked whether SMA’s O&M services could potentially extend the expected lifespan of Australia’s solar-farm assets, Smith says, “The answer is yes. But the big questions is, honestly, in 20 years, what will a PV plant look like?” With developments in inverter capabilities, and storage capabilities, he says, “I can see fairly low-cost repowering of major components creating tremendous extra generation” from existing assets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.