The administrators appointed at Western Australia’s developer Carnegie Clean Energy have revealed the highest of four bids it managed to attract for its solar microgrid business Energy Made Clean (EMC) was only $200,000, while the lowest one stood at mere $40,000. This is well below the $13 million the company was bought for in 2016. According to the administrators’ report, the highest bidder subsequently pulled out of the process.

The developer and its three subsidiaries EMC Co, Energy Made Clean and EMC Engineering Australia entered administration last month just days after the Western Australia government had terminated the $16 million financial assistance agreement for the Albany wave energy project. The government said the unexpected proposal to change Federal Government’s R&D tax incentive scheme contributed to destabilization of the company’s financial position.

After they found Carnegie had just $3200 in the bank while its subsidiary EMC only had $52,000, administrators KordaMentha recommended both EMC and EMC Engineering be liquidated, while the core Carnegie wave energy business be saved with a capital raising. Shareholders voted unanimously to wind up the EMC businesses.

On Wednesday, creditors unanimously approved the restructuring plan, which targets a capital raising of up to $5 million, and the re-listing of the collapsed wave energy developer on the Australian stock exchange (ASX) in the next four months.

According to Carnegie’s earlier statement, director and shareholder Grant Mooney, alongside Mooney & Partners’ key stakeholder Asymmetric Creditor Partners, agreed in principle to provide interim funding support to administrators KordaMentha. Carnegie said in a statement on Wednesday that major shareholders and directors who have provided cash to keep the company going before and after administration would swap debt for equity. Some debt will be restructured and carried over to the relisted company. Unsecured creditors would receive up to 10 cents in the dollar back on their claims, the administrators said.

“This is a significant step for Carnegie as it strives to emerge from voluntary administration in a well-capitalised financial position, to continue its core business of transforming the global renewable energy market through its world leading wave energy technology,” KordaMentha’s Richard Tucker said.

Before entering administration, Carnegie posted its overdue half-year results, revealing a loss of $45 million, including write-downs on the value of its CETO wave technology and its solar microgrid business of nearly $40 million. The company’s wave technology was written down by $32 million, which came on top of a $35 million write-down it posted for the first half of 2018.

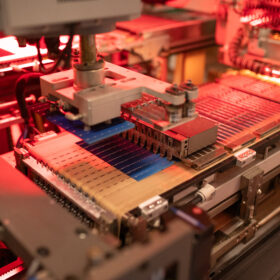

Carnegie’s troubled solar microgrid subsidiary Energy Made Clean ended with a $6 million write-down, despite the completion of CSIRO Pathfinder and RAAF Delamere microgrid projects, a microgrid at a naval base on Garden Island, and WA’s first operational merchant utility solar project, the 10 MW Northam Solar Farm.

Identifying the EMC losses as one of the main reasons for the reduction in market capitalization, the developer stated earlier it was looking at divestment opportunities, following a failed deal to merge its microgrid subsidiary with TAG Pacific’s M-Power. At the second meeting of creditors held in Perth on Wednesday, it was confirmed EMC will be liquidated under the restructure.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.