More than 2 GW of large-scale solar came online in Australia in 2018. An even greater volume is in the pipeline, with every new project potentially facing grid constraints, and changes in financial returns caused by falling wholesale electricity costs, marginal loss factors and extra firming required by regulators. Operational efficiency and longevity of plant are increasingly critical to viability and delivering on power purchase agreements.

“Australia has seen a recent boom in solar project development. This is the right time to start the conversation that goes beyond the development phase,” says Lisette Buist, Project Manager of the Solar Asset Management conference for Solarplaza which has partnered with Australia’s Smart Energy Council to bring global best practice and local insight to the O&M space.

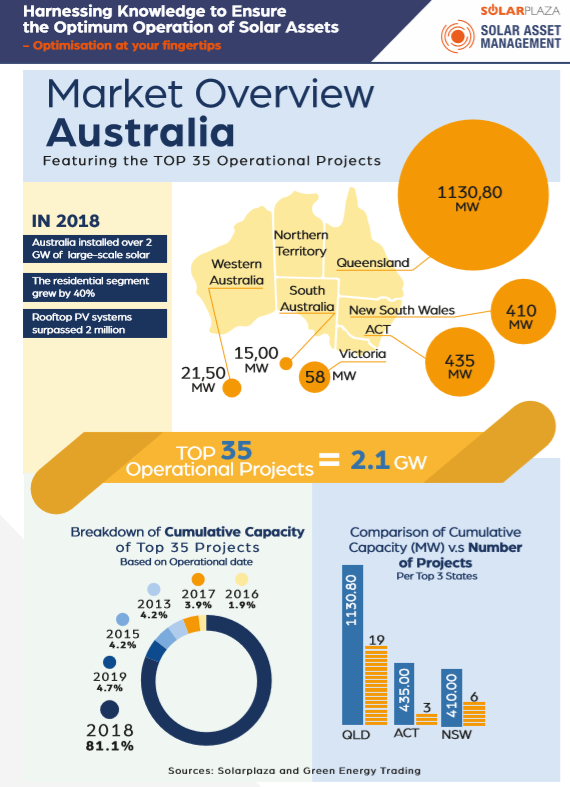

“Based on our overview of the top 35 operating solar projects in Australia, you can see that over 80% of the largest operational projects came online very recently,” Buist told pv magazine, one indicator that the understanding of O&M options and impacts in this country is ripe for guidance.

Graphic: Solarplaza

In a Solarplaza/SEC-organised online webinar held earlier this year to gauge interest in the topic, speakers Tristan Edis, Director of Analysis and Advisory at Green Energy Markets and Simon Chau, O&M Sales manager at Canadian Solar polled their audience of primarily solar farm developers, EPCs, asset owners and investors, and equipment manufacturers and suppliers on their greatest concerns for future investment in large-scale solar. Some 68% nominated grid connection and stability as their greatest challenge. It was followed by securing PPAs (12%) and finding the right construction partners (12%), with 5% nominating hire of talent and skilled labour.

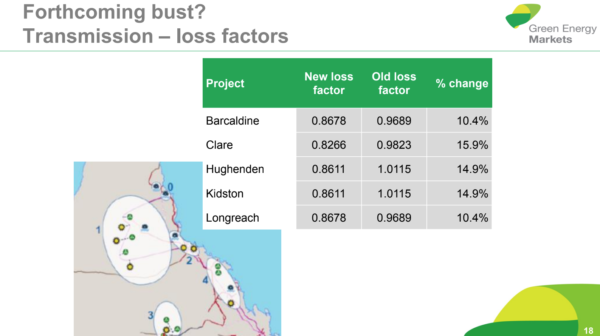

Image: Green Energy Markets

Buist confirms, from her experience engaging with the Australian industry at the Smart Energy Conference in this month, “One of the most pressing issues is of course the curtailment of plants and marginal loss factors that are being adjusted throughout the lifetime of a project, and how to account for these in the management of your plants and assets.”

Speaking at a solar-energy conference earlier this year, Wayne Goodwin, Project Development and Technology Lead at Edify Energy, which has developed several of the Solarplaza-identified top 35 large-scale projects in Australia (including Daydream, Hamilton and Gannawarra solar farms), said that in Edify’s experience management of the interfaces for grid connection during the construction phase of a solar farm is crucial: “You’ll always have a grid-connection agreement, you will always have multiple parties, and managing your EPC contractor interface with your connection agreement, your ESP and AEMO is vitally important. It’s an exercise in risk management.”

At Solar Asset Management, these topics will be addressed in sessions such as EPC & System design implications for long-term performance; and Predicting Curtailment, which will cover quantifying the impact of grid congestion, and curtailment mitigation strategies.

Solarplaza’s conference on June 26-27 in Sydney will begin with A holistic view on Solar Asset Management, including bankability for the full lifetime of solar assets in Australia. Managing Director of innogy Renewables in Australia, Alba Ruiz Leon is one of the speakers contributing to the discussion of innovations that will help future proof assets, the various definitions of solar asset management, and how to drive efficiencies throughout the solar-generation value chain.

Canadian Solar’s Simon Chau will address conference attendees on the learnings the company has gained not only as one of the world’s largest manufacturers of solar modules, but as a supplier of O&M services in Canada since 2010 and a company which has 130 MW under management in Australia, and a further 663 MW contracted.

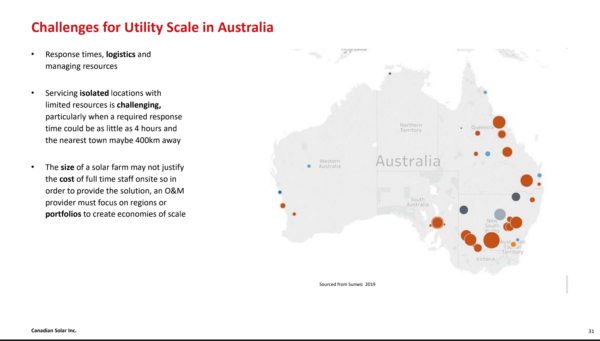

Chau identifies some of the unexpected challenges of O&M in Australia as relocating endangered wildlife populations, and finding field technicians to service Queensland’s remote solar farms which may be 400 kilometres distant from the nearest population centre.

Image: Canadian Solar/SunWiz

He also says that, compared to Canadian solar farms, “We don’t have snow falls at any of the plants here, but we do have soil reactivity in response to heavy rainfalls, which creates mud and cracks and ground movement. Environment affects efficiencies — it’s a key watch point.”

Chau raised the emerging challenge of cleaning bifacial panels. Buist says the conference will get down to the gritty how-tos of cleaning bifacial panels and maintaining solar-panel trackers commonly used in Australia — “Having the know-how to navigate such topics can drastically alter the ROI and output of solar farms,” she says. And it will investigate the latest data-analysis tools and models for helping solar-plant owners transition to cost-saving predictive maintenance rather than schedule-based maintenance.

The March webinar conducted by SEC and Solarplaza also polled its audience on their most vexing O&M topic. Choosing between scheduled and preventative maintenance and reactive maintenance topped the list for 37% of respondents; whether to opt for onsite or offsite monitoring was the hot topic for 28%. How to choose the right O&M provider ranked third at 19% and negotiating the ideal term for an O&M contract occupied 16% of those tuned in.

Details of O&M integration and management during the life of a solar farm will be unpacked in June, and Buist also expects the Coupling Battery Storage session on Day 2 to be extremely well attended as it covers the topics of Revenue Stacking: business model considerations for storage monetisation and the O&M implications of storage.

Editions of the Solar Asset Management conference have been running at around annual frequency in North America, Europe, Asia and South America since 2013, and Buist expects at least 150 attendees at the inaugural Australian gathering.

She says, “It’s the first platform in Australia where the operations and maintenance of solar plants is discussed in detail with representatives of the entire value chain together on stage, allowing for the exchange of knowledge and learnings between high-level decision makers.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.