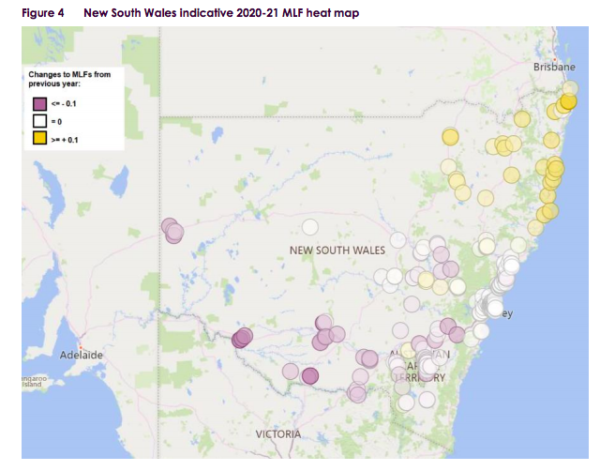

In addition to strict new connection rules and system strength requirements, Marginal Loss Factors (MLFs) have been one of the greatest challenges facing solar and wind proponents in Australia. In an early assessment of MLFs for 2020-21, the Australian Energy Market Operator (AEMO) has revealed network losses are likely to worsen in already vulnerable parts of the grid.

The indicative intra-regional loss factors send a warning to prospective investors that additional generation would put further downward pressure on MLFs in remote areas of the network, primarily south-west News South Wales and north-west Victoria. To make the assessment, AEMO has used the last year’s network model, which means that the final MLF values may differ once the committed network augmentations for the 2020-21 financial year are incorporated in the final calculations due to be released by April.

MLFs are of vital importance for project economics as they represent the loss of electricity as it flows through the transmission network from a power plant to load capacity and determine how much of the output is credited for payments. For instance, if an asset is credited with a MLF of 0.80, it will receive payment for only 80% of its output. Similarly, a rating of more than 1.0 means the generator will be credited with more than its nominal output.

Due to the insufficient carrying capacity of transmission lines and their location far from load centres, MLFs translated last year into major dents in revenues of 10% or more for some utility scale PV projects. The latest calculations from AEMO released on Friday show transmission losses will further deteriorate, most dramatically in south-west NSW.

“South-west New South Wales has again seen the largest reductions in the region, compounded by both an increase in imports from Victoria and a large increase in generation capacity within the area,” AEMO says. “The average reductions in south-west New South Wales is 1.83% for load and 2.97% for generation.

“While no additional generation has been considered in south-west New South Wales for the indicative 2020- 21 MLFs, all new generators included in the 2019-21 MLF study will be operational for the full FY in 2020-21, resulting in significantly increased generation levels in the area.

“It is expected that if further generation (except for storage) were to connect in south-west New South Wales, the MLFs in this area would see further declines. Given the historical sensitivity of the area, it is expected that any reductions resulting from increased generation capacity would be more severe than if located in other locations in the NEM.”

One of the worst affected projects in NSW is the Broken Hill Solar Farm in NSW, with MLFs as low as 0.725, followed by the Coleambally (0.8271) and Finley (0.8376) solar farms.

The latest calculations show generation MLFs in north-west Victoria have continued to decline, with an average reduction of 1.07%, while load MLFs within north-west Victoria have increased by 1.66%, which have largely been driven by interconnector flows. Nonetheless, according to AEMO, “it is to be expected that if further generation (except for storage) were to connect in north-western Victoria, the MLFs in this area would see further declines”.

In Victoria, the Karadoc (0.7866), Bannerton (0.7937), Wemen (0.7937) and Ganawarra (0.882) solar farms will be among the worst affected. The bad news is that such losses would come on top of system strength issues, which have already plagued some of the afore mentioned projects. In September, AEMO constrained the output of five large-scale solar generators by 50%, including four solar farms located in north-west Victoria: Gannawarra, Karadoc, Wemen and Bannerton; and Broken Hill in NSW.

Good news

However, there is also good news for a number of major projects, which have received increases in MLFs in AEMO’s latest calculations. MLFs through central and north Queensland have generally increased since 2019-20, as seen on Kidston, Hughenden, Daydream, Hayman and Ross River solar farms, some of which were among the ten worst affected projects last year.

North Queensland has seen average increases of 1.06% for load and 1.59% for generation, while Central Queensland has seen average increases of 1.25% for load and 1.18% for generation. “The increases in MLFs are largely being driven by a reduction in output of large scheduled generators within Queensland and a large increase in the level of semi-scheduled generation in Victoria and New South Wales,” AEMO says.

In South Australia, MLFs have remained mostly strong even though south-east South Australia and the Riverland area have seen a reduction in MLFs of 1.52% and 1.97% respectively for load and a reduction in generation in south-east South Australia of 1.89%. For instance, Bungala 1 and 2 have received MLFs of 0.9684, while Tailem Bend Solar kept a positive rating of 1.0002.

New rules on MLFs in the works

Since MLFs are adjusted throughout the lifetime of a project, their effect on the project revenues is impossible to predict. Such uncertainty has led to calls for the mechanism to be re-examined.

In June, the Australian Energy Market Commission (AEMC) started consultations on the rule change about how MLFs are calculated. The AEMC was due to publish the draft decision on proposed changes to MLFs on September 26 but has delayed the publication to November 21 “due to complexity of and volume of issues raised by stakeholders in submissions an discussions”.

In a submission, a group of 20 major investors, representing over 6.3 GW of generation investment in the National Electricity Market (NEM) and a future development pipeline in excess of 10 GW including names such as John Laing, Macquarie Group, BlackRock and Neoen, called for immediate changes to MLFs.

They argued that long-term MLF reductions have materially impacted the projects commissioned or committed to many years ago, when such reductions were unforeseen, as well as affected recently developed projects, which have seen lower MLFs than forecast by industry experts only a few months prior. The investors proposed moving to an Average Loss Factor (ALF), calculated as the square root of MLFs, which would reduce volatility of investment returns.

In August, John Laing, which made the submission on behalf of the investor group, reported losses in Australia of some $121 million — said to be due to transmission factors on three of its renewable-energy projects — leading the company to write down the value of those projects and suspend new investment in Australian renewable generation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.