Analysis released by research and consultant group Cornwall Insight Australia on Friday showed that large-scale battery energy storage systems deployed in South Australia in the financial year to June 2020 would have earned $290,000 more per megawatt enabled in providing Frequency Control Ancillary Services (FCAS) than if they had been located in Victoria — and that was excluding the month of February 2020, when South Australia was islanded for 18 days after an extraordinary storm knocked out six transmission towers of the main electricity interconnector between South Australia and Victoria.

“That one event would have skewed the figures quite a lot,” Cornwall Insight Principal Consultant Ben Cerini told pv magazine. As it is, he says, the total sum of ancillary service markets in the NEM in Q1 2019 was around $50 million, whereas in Q1 of 2020, when the Heywood Interconnector was disabled for more than two weeks, it was just over $230 million .

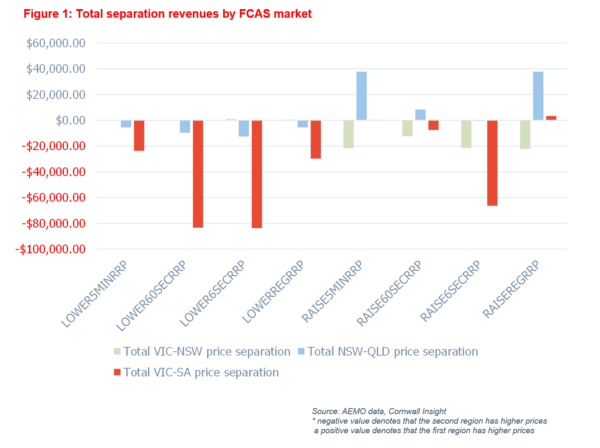

The ability to reliably monetise battery storage services is still “lumpy”, as Cerini puts it, in the Australian energy market, and Cornwall Insight’s analysis was undertaken to determine what benefits there might be to locating storage for FCAS purposes in particular states.

The consultancy reported that most utility-scale battery assets currently in the NEM derive some 75% to 80% of their market revenue from supplying FCAS, making major geographical deviations material.

Picking the differences

“There are opportunities for revenues, and we’ve tried to look at what happens when there are splits, or congestion, or islanding,” says Cerini. “Which regions attract the value because one state perhaps relies more on these services for support than others do?”

Image: Cornwall Insight

Cornwall Insight confirmed that FCAS markets are generally fairly equal, with services procured throughout the NEM, and prices settling to similar “low-ish” levels across the states. Major disturbances, such as the failure of a significant generator or the snapping of interstate connections or other specific local requirements, however, show the value of location.

It was to be expected that South Australia would be a potential bonanza for FCAS supply, says Cerini. He explained that, despite having a significant battery of batteries — including the then 100 MW Hornsdale Power Reserve, 25 MW Lake Bonney and the 30 MW Dalrymple project, also known as ESCRI (Energy Storage for Commercial Renewable Integration) — South Australia has a shortfall in available local FCAS provision given its high penetration of renewables (large scale and rooftop solar) and low access to synchronous generation.

“Obviously, a number of those services are provided by being able to connect to Victoria,” he said.

New South Wales well positioned to capitalise on FCAS

The surprising aspect of Cornwall Insight’s findings, Cerini told pv magazine, was “the benefits of having battery storage located in NSW, comparative to Victoria”.

In FY20 batteries in NSW would have been around $76,000 better off than batteries located in Victoria, and $50,000 more lucrative than those hypothetically situated in Queensland.

If FCAS requirements to “raise regulation” in response to frequency deviations were the priority for battery storage, Cornwall Insight findings indicate that NSW would be the state of choice for siting a battery aimed at delivering this service, as it showed the highest potential prices for that category.

AEMO has signalled the need for 115 MW of fast frequency response capacity in the NEM by FY21, and 200 MW by FY22, says Cerini, “so there’s already a market for another 12-25 MW in the next 12 to 18 months, and another 130 MW in the next two years”.

Despite energy markets showing promise for dealing in contingency services, there is still significant risk to investing in big battery development: Says Cerini, “The issue becomes how do you get some certainty and hedge for those revenues, sell some caps into those higher price periods to have the battery available; or be able to contract for use during particularly high-demand periods.” He believes first movers will have an advantage.

Although asset developers can’t accurately predict the occurrence or frequency of future contingency events, he said, they can review the price outcomes of past events.

“This will help them ensure that when these events happen again — and they will — their assets are in the best position to take advantage of these FCAS price-separation events,” said Cerini.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.