At its heart, insurance comes down to an exceptionally simple formula: premiums must be greater than claims paid. For renewable energy projects though, the numbers just aren’t stacking up, according to a report from the Australian team of the specialist insurance broking group BMS in partnership with renewable energy insurance business GCube Underwriting.

“The reality is the renewables energy sector has been underperforming for many years due to a sustained period of claim activity,” the report reads.

BMS Group

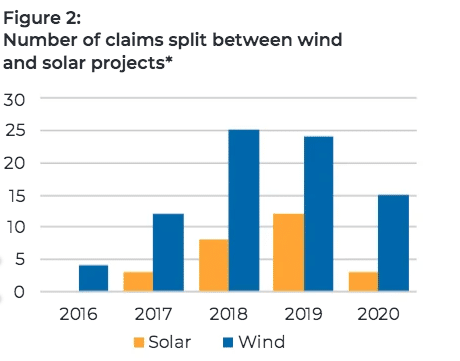

This period of sustained claim activity, which has grown with the booming industry, will likely mean insurance premiums, along with deductibles or excesses, will increase for the sector, continuing the trend of 2020 into 2021.

The report also predicts policy coverage is set to decrease, with BMS recommending insurers pay far closer attention to subcontractors and project locations.

Although it was not fleshed out, a provoking quote from GCube’s CEO, Fraser McLachlan, is included: “More than ever we’re seeing repeated incidents across the globe from certain OEMs [Original Equipment Manufacturers] in both wind and solar… there will be a time when these incidents are no longer fortuitous.”

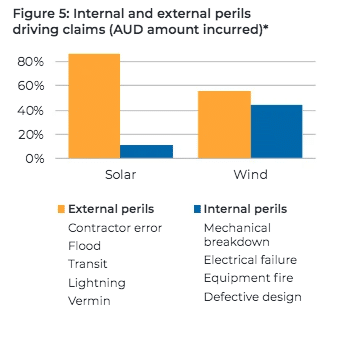

External Perils on solar projects is reflective of

their location in more flood prone, hail and/

or wind exposed locations.”

BMS Group

Data based on GCube’s portfolio

For the report, BMS analysed data provided by GCube based on its client portfolio performance. “Whilst this data will not capture all claims activity in the Australian Renewable Energy market, as a major global insurer in the sector and one of the early participants in the Australian market, [GCube’s] data provides a broad representation of the market losses as a whole,” the report said.

Main claim sources

The report found renewable energy project claims stem primarily from:

- Contractor error during construction

- Mechanical and electrical failures

- Defective equipment/workmanship

- Ageing/out of warranty technology

- Natural catastrophes

BMS Group

BMS Group

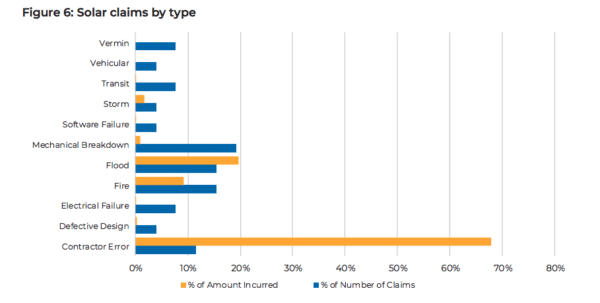

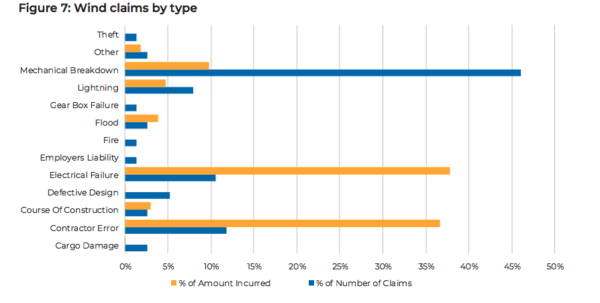

“As illustrated in Figure 6 and 7, the data demonstrates that significant claims activity across both wind and solar projects originated from Contractor Error which has accounted for ~68% of claims quantum for solar projects and ~36% for wind projects. This risk has been a major focus for insurers and for new construction projects insurers are seeking increased information on whom are the contracting parties involved in the projects and their experience on projects of a similar nature,” the report says.

Wind projects consistently perform worse for insurers than solar projects, the report found. This is primarily because components in wind projects are considerably more expensive.

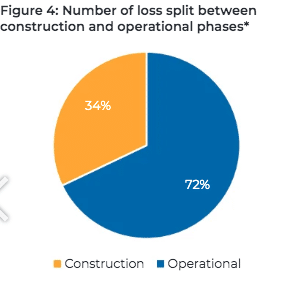

The majority of claims occur during the construction phase of both wind and solar projects.

of claims occur during the construction phase

of wind and solar projects. These claims are

driven by all perils associated with the marine

and inland transit of equipment to site and

the construction of the project, testing &

commissioning, balance of plant and grid

connection activities.”

BMS Group

BMS’ recommendations

“As part of the insurer engagement process, presenting the project in the best possible light will assist insurers to make informed decisions around their potential participation,” the report says. BMS goes on to recommend a “structured approach to market engagement,” saying early preparation and planning, risk workshops, a focused engineering & operations approach and risk prospectus are crucial.

In closing, the insurance broking specialist recommended insurers pay close attention to key areas of underwriting criteria, including:

- Project location

- Technology

- Experience of personnel, including all contractors

- Grid connection

- Risk management

“Insurers continue to focus on increased levels of underwriting information, notably contractor / sub-contractor experience and site location data / project design specification, to support their revised underwriting guidelines and to drive profitability back to a sector that has underperformed for a sustained period of time.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.