The weight of the task at hand is not lost on the Energy Security Board, which noted in the introduction of its Options Paper for the Post-2025 Market Design: “Managed well, Australia will benefit from a secure and reliable energy future. Managed poorly, our energy future will be less secure, more unreliable and potentially very costly.”

The Energy Security Board was tasked with redesigning Australia’s electricity systems by the government coalition in March 2019, and its shortlist of options follows extensive deliberations with stakeholders. It seeks to define a national path forward for Australia that will give clear direction to energy transition, hopefully providing clarity for markets and areas of focus for governments.

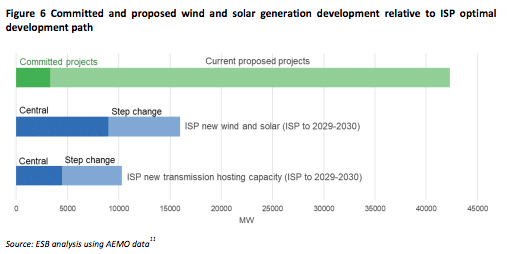

“The scale and pace of change occurring across the [National Electricity Market] cannot be overstated,” the Board said. “We are already exceeding the step change scenario forecast in the Integrated System Plan (ISP) in 2020,” the Board’s Independent Chair, Dr Kerry Schott, added.

Energy Security Board

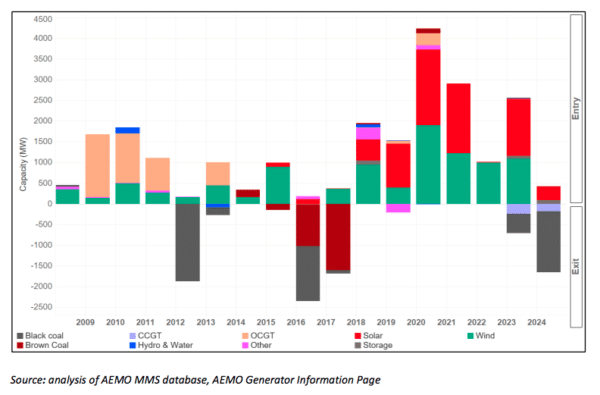

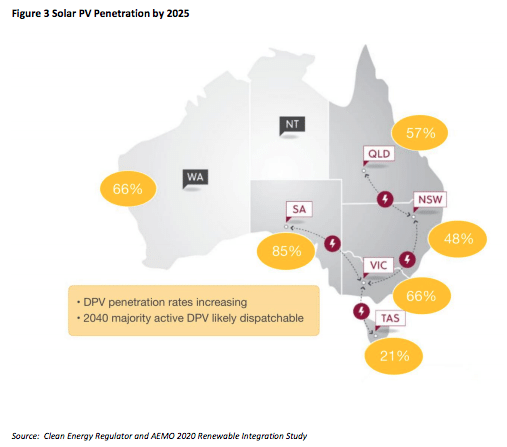

Over the next 20 years, between 26 GW and 50 GW of large-scale renewable energy is expected to come online in Australia, along with between 13 GW to 24 GW of distributed solar. This, the Board noted, is in addition to existing and committed projects. The colossal scale of incoming renewable energy means between 6 GW and 19 GW of new, dispatchable resources like big batteries will be necessary, also to compensate for the loss of two-thirds of Australia’s fossil-fuel generation plants by 2040.

“Our generation mix is changing fast, but the physics of our power system cannot change in the same way,” Schott said.

She goes on to note that on top of the complicated physics of electricity, each state and territory in Australia has different priorities and risks when it comes to its electricity systems. “We are taking a pragmatic approach to clearing the path for technology to make people’s lives easier while keeping the lights on at the lowest possible cost.”

In the paper, the contents of which are detailed below, the Board tackles four key areas: the retirement of coal plants, system security, the integration of distributed energy resources, and finally transmission and grid congestion. Each of these four categories includes a selection of reforms which were classified by urgency, from immediate to those which can be implemented in the coming years.

The options, some of which are controversial, will be resolved by the middle of the year following a period of six weeks for stakeholder feedback.

Retirement of coal-fired power plants

Certainly the most controversial of the options put forward by the Board is its “physical certificate scheme” for reliability, which would essentially subsidise coal plants to remain open until their forecast retirement dates.

The thinking which underpins the proposal is essentially that the economic unviability of Australia’s coal fired power stations will see many retire ahead of schedule. In other words, Australian coal will be driven out of the market by economics before it is driven out by climate considerations.

The Board’s proposal to retain the plants is not about keeping jobs (as it often is with governments) but rather about maintaining system stability. Fossil fuel generators still supply the bulk of Australia’s dispatchable electricity capacity. If they all close early due to falling profits, the Board fears Australia’s electricity systems may not have the inertia necessary to keep it stable.

The Board is cognisant that energy storage offers a neat solution to this, but evidently it is concerned the incumbent systems will close before the replacement systems are ready.

Specifically what the Board is proposing are changes to the Retailer Reliability Obligation (RRO), which is a scheme that requires electricity retailers to enter into contacts to provide reliable electricity at predictable prices. The Board is proposing to shift the scheme away from financial contracts (based on prices) towards physical contracts, which would be underpinned by actual capacity to deliver electricity into the market.

Since coal and gas are physical entities that can be burned on demand, the reform would favour and ultimately offer them a pathway to remain in operation even if they no longer provide profits.

The proposed pathway has predictably stirred controversy. It’s important to note here that the Board were not tasked with redesigning the electricity market to cut emissions, but rather to ensure a smooth transition. In the majority of cases, these two prongs comfortably align – here they butt up against one another.

Critics fear such a reform sends mixed signals to the market by subsiding coal even as we declare devotion to renewables. It may also hinder the innovation which could see the market plug the ‘hole’ left by fossil fuels with greener technologies sooner. The Board openly acknowledge these flaws.

Image: Marcus Wong Wongm/ Wiki Commons

The other option the Board has proposed in lieu of subsiding coal stations involves changing only the ‘trigger’ aspect of the Retailer Reliability Obligation. Currently, the obligation only applies if it is ‘triggered’ by analysis flagging a future shortfall. Retailers are then given years to secure contracts to ensure reliability.

The Board is considering canning this trigger rule altogether. This, it says, would incentivise retailers to maintain adequate storage in their portfolios.

System security

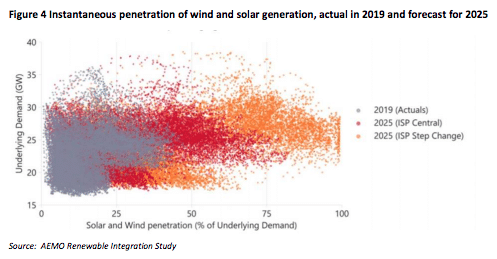

The growing role of renewable generation and battery storage in the power system will increase the need for services to maintain system security, the Board notes.

Essential services, therefore, need to be identified and procured “including procurement from non-traditional and new sources,” it says.

The most immediate reform it is proposing here was actually released last week by the Australian Electricity Market Commission, which the Board works with. Last week, the Commission communicated its intention to incentivise new, ultra-fast frequency services in the electricity market.

The AEMC said the fast frequency services will come largely from batteries – but also from wind and solar PV through their inverter systems. These new services will need to respond in two seconds or less – compared with the existing fastest services that operate over timeframes of six seconds.

In the more distant future, the Board said it has identified a spot market approach for valuing and procuring inertia as a long-term priority, and these will be refined in time as renewable penetration grows.

Integration of Distributed Energy Resources (DER)

In this field, it seems the Board is hoping to formally structure many of the shifts already underway in the industry. For instance, emphasis has been put on Virtual Power Plants (VPPs) as a means of lowering the overall cost of electricity in the system.

A number of VPP trails are already underway in Australia, with numerous private companies working to develop them in networks.

In terms of reforms, the Board said a package is already underway which includes “expanding the responsibilities of distributors to hosting distributed generation and storage and introducing technical standards for DER that will assist to ensure the security of the power system.”

Energy Security Board

Grid congestion and transmission lines

Renewable Energy Zones remain a priority in the Board’s vision.

It is also considering implementing a system which would make grid congestion information available in real time, in turn paving the way for real time management.

In the longer term, the Board said its preferred solution for grid access reform is to shift to locational marginal pricing and financial transmission rights. “It is a more comprehensive access solution to the issues raised, and it is a well-established model that has been successfully applied in numerous overseas markets for decades.”

Responses

While the Board’s option to subsidise unprofitable coal-fired power plants has been received predictably cooly by the renewables industry, groups like the Clean Energy Council have welcomed the Options Paper, saying it sets Australia in the right direction.

Energy Networks Australia have also offered support, with its Chief Executive Officer Andrew Dillon saying that while Australia’s transition poses immediate challenges which must be addressed, it’s important “not to act recklessly.”

“We need to be mindful that the challenges posed by the transition to renewables risk posing additional costs to customers. It is important we don’t over-engineer a one-size fits all system design, but instead adopt a balanced approach that unlocks the opportunities from the energy transition and supports investment as it is needed,” he said.

Next steps

The publication of the Options Paper marks the opening of the final feedback phase, in which for the next six weeks stakeholders are able to offer responses to the possible pathways. This feedback period will close in June, and pathways will be finalised ahead of the Board delivering its recommendations to ministers in the middle of the year.

The implementation of the proposals will follow, hopefully setting a new, clearer tone for Australia’s energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.