In its eight years of existence, One Stop Warehouse has come to dominate Australia’s solar distribution sector. The company reached a record revenue in the 2020 financial year, hitting $512 million. That same year, Zhang opened Discover Energy, moving into a disparate role as an electricity retailer. “At its core, Discover is really a tech company though,” Aaron Chen, Discover Energy’s Director of Corporate Finance, told pv magazine Australia.

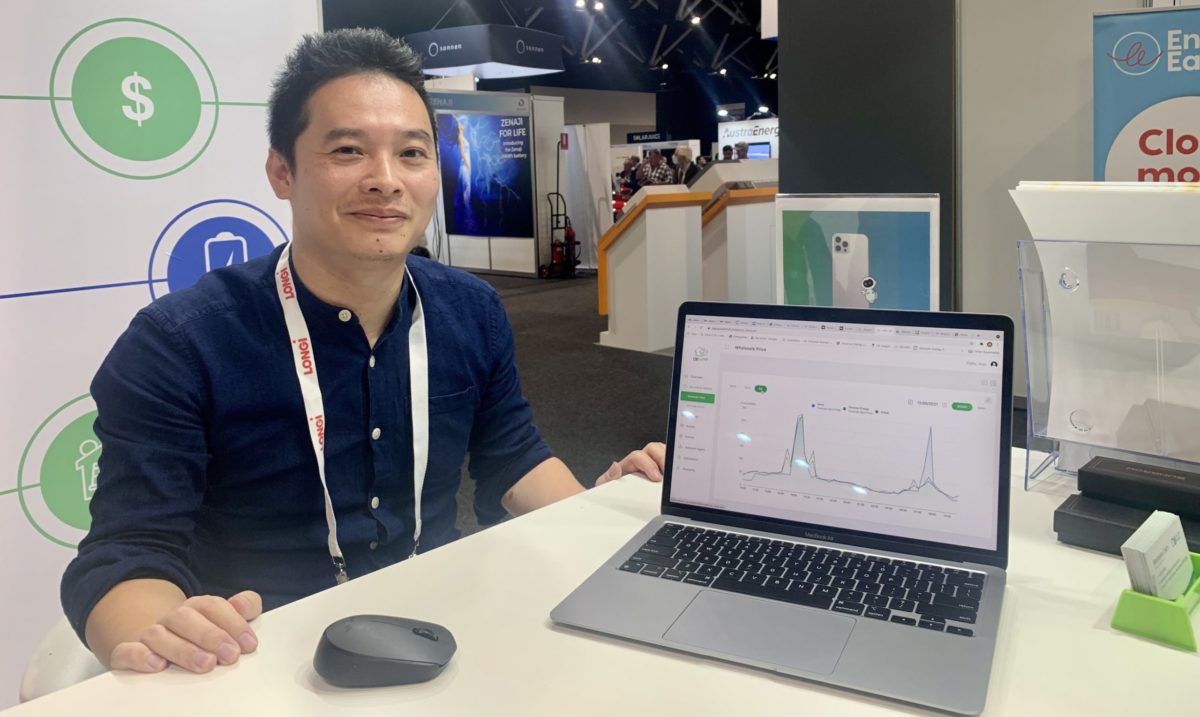

Sitting across from me in the bustling Smart Energy Conference held in Sydney’s International Convention Centre last week, Zhang and Chen laid out their interlocking vision for the two companies – for which IT (Information Technology) is the centrepiece. “The company’s DNA is very different,” Zhang told pv magazine Australia.

Forget bricks and mortar

One Stop leases tens of thousands of square metres in almost every state, using it to house the solar equipment like PV panels, storage batteries and inverters it then supplies to solar installers and retailers. As crucial as the physical aspect of the business has been launching One Stop, it’s hardly the most important part of Zhang’s businesses’ future. IT, he says, is really where the money is.

Bella Peacock

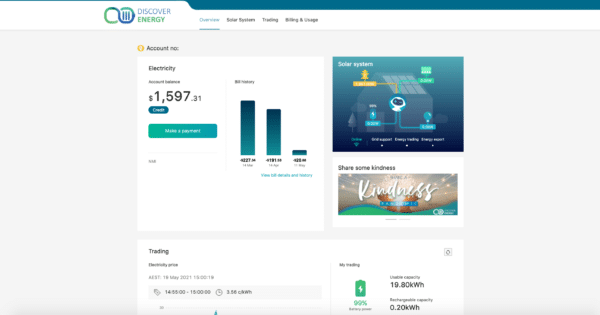

Which is why he started Discover Energy. The point of venturing into the electricity retail space, Zhang and Chen explained, is to understand Australia’s electricity markets, to be up close to the action, to see what happens there. “As a tech company, we need data. You only get data if you have customers,” Chen said.

“The more customers, the more data, the more accurate [your algorithms become].”

Algorithmic backbones

Who knew maths equations would prove so sexy in this brave new world? But sexy they are. Algorithms and IT are really the brains of the software system, which are in turn the brains of how any computer-driven system operates.

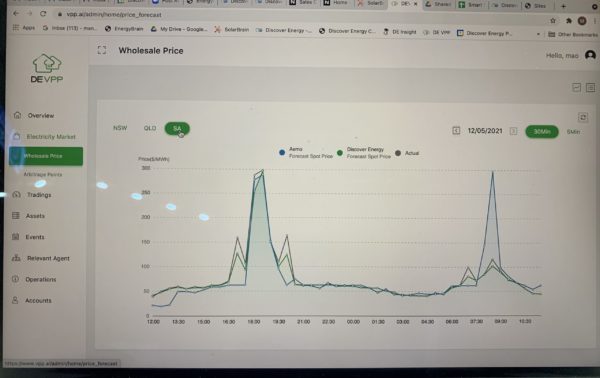

“Software as a service – that’s the key,” Zhang said. One of the key areas Discover is using its software is in its Virtual Power Plant.

Bella Peacock

As abstruse as the name sounds, Virtual Power Plants, or VPPs, are essentially software platforms that connect the capacity of home batteries distributed around the grid and join their forces so they have enough power to meaningfully engage in lucrative spot markets. Through a VPP, a home battery goes from being a solar shifting device to an electron trading platform that can generate a profit for its owners.

Disruption of virtual power plants

There are a number of VPPs operating today in Australia, with state governments backing numerous trials and energy giants like AGL and Origin also trying their hand.

Discover’s VPP, however, is the only platform in Australia that can integrate all battery brands, according to Zhang – giving it an important point of difference. “We are a truly hardware agnostic platform,” Chen added.

The pair frame Discover’s platform as the ‘android’ of the VPP world – able to integrate with any hardware. (Many of Australia’s other VPP operators rely on software provided by, for instance, Tesla, which naturally only pairs with its own battery hardware – a business strategy more akin to Apple.)

Slow and steady rollout

Discover’s strategy has been to slowly spread through Australia’s states with all their technical variations. It’s been operating its VPP in South Australia (the most lucrative market, given the world-leading solar penetration) for two years now, aggregating a capacity of 5 MWh. The company then moved into New South Wales and Queensland before launching in Victoria and the Australia Capital Territory (ACT) in April of this year. Zhang believes Discover’s is the first VPP to launch in the country’s capital.

Discover currently has 735 VPP customers across the nation. Its target is get to a total of 2000 by the end of this year. Given there were roughly 10,000 home battery installations in Australia last year, his target is characteristically ambitious, but he’s adamant that Discover’s capacity to integrate with any battery brand and hardware gives his company the upper hand.

Bella Peacock

Virtually invaluable lessons

Operating virtual power plants across the country has provided Discover with the data it craves and the revelations it impels.

For instance, it’s found that at any given time around 15% of batteries won’t be able to answer the VPP’s call to discharge their power at the most profitable moment because in reality it’s already being drawn by its ultimate overlords, the household’s owners.

On top of that, another 10% to 15% of household batteries won’t respond simply because they have bad internet connections, leading to roughly a 30% non-response rate overall.

Not only does such knowledge breed more accurate algorithms, it has also proved helpful for Zhang in other ways by granting him a powerful position of influence.

Discover Energy

Knowledge is power

Australia’s Clean Energy Regulator estimates that around 80% of solar panels installed in Australia are sourced from China. We also rely on China for much of our other solar equipment too – a fair portion of which travels through One Stop’s warehouses on its way to our rooftops.

Zhang is acutely aware, therefore, of his position as “middle man,” as he called it. That is, he is able to communicate with parties in China about what Australia actually needs to deal with its unique technical issues.

From the get go, Zhang’s business strategy has always been B2B (business-to-business) focussed, so it’s hardly surprising that he is bringing that practice to Discover, which is far more customer facing than One Stop.

Leveraging his position at Discover, Zhang said he’s able to influence the next generation of batteries entering Australia from the Chinese market. Why? Because he has useful information, information Chinese manufacturers need.

One example is the knowledge he’s gleaned about Australia’s wanting internet leaving home batteries unable to participate in spot markets through their VPPs. The revelation led Zhang to lobby Chinese manufacturers to integrate 4G internet dongles into the next generation of home batteries hopefully solving the issue.

This intimate knowledge of Australia, from its solar needs to the behaviour of its wifi, coupled with connections to Chinese manufacturers has put Zhang is a prime position of influence, a fact not lost on him.

Smoothing the grid

Zhang sees VPPs as one of the solutions to smoothing Australia’s increasingly unsteady grid. “New things always bring new problems, they just need new solutions,” he said. Ultimately, it’s about finding non-network solutions to solve the networks problems, he adds – like a VPP.

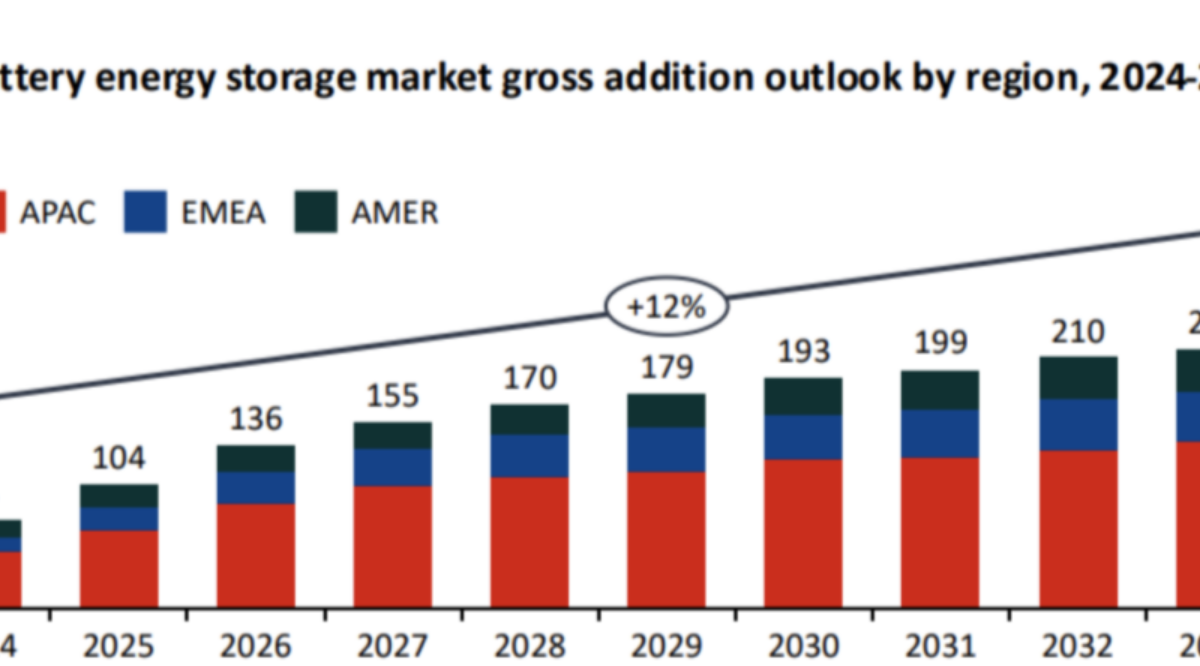

Naturally, the role of VPPs will grow as battery uptake grows – for which Zhang also has high hopes. He forecasts that in the next three years, the price of installing a solar + battery system at home will drop from the $13,000 to $10,000 it generally costs today, down to between $7,000 to $8,000.

To this end, Chen says its in government’s best interested to keep incentivising home battery uptake, as the more distributed storage assets are connected to the grid and aggregated in a VPP, the most firming capacity the grid will have at its disposal.

Community batteries, Zhang notes, also have an important role to play here. Importantly, these are often located on sites with far better internet connections than most households, allowing the larger batteries to trade on millisecond markets rather than the typical six second turn around of home batteries. Discover are currently working with Ausgrid to develop at algorithm for community batteries to trade on markets, Zhang adds.

The rise of VPPs is also, of course, beneficial for battery owners. Zhang said 90% of Discover’s VPP customers are on credit. That is, their bill is not so much a bill as an energy trading report (it’s also set out as such, a marketing feature Zhang loves). At the moment, the lion’s share of that profit is going to customers in South Australia, but as other states grow their battery penetration, there will be power in numbers.

While customers are the brawn, software is the brain – which is precisely where Zhang is focussing his attentions.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thank you for sharing these tools.

This is such an insightful article! I can wholeheartedly agree with the benefits you’ve outlined.

Insightful read on the role of SaaS in the solar industry! Data-driven solutions are definitely shaping the future of renewable energy. Thanks for sharing this perspective!