GIC, the key investment arm of the Singapore Government, has taken a stake in Hong Kong-based InterContinental Energy, which is part of the consortiums behind the proposed 50 GW Western Green Energy Hub planned for Western Australia’s (WA) southern coast and the 26 GW Asian Renewable Energy Hub being developed near Port Hedland in the state’s northwest.

InterContinental is also developing renewables-based green hydrogen projects in Oman and Saudi Arabia.

In total, InterContinental’s global renewables portfolio comprises 200 GW of onshore wind and solar capacity which would support the production of more than 14 million tonnes a year of green hydrogen or 80 million tonnes a year of green ammonia.

GIC, established by the government of Singapore in 1981 to manage the nation’s foreign reserves, announced on Thursday it had taken a “strategic equity investment” in InterContinental.

“This is a strategic investment to position GIC early for the emerging hydrogen economy,” said GIC’s chief investment officer of infrastructure, Ang Eng Seng.

“We believe that in time, hydrogen will play a crucial role in decarbonisation globally and that InterContinental Energy will be a key player in this transformation.”

InterContinental is one of the key players in some of Australia’s biggest green hydrogen projects, including the proposed $100 billion Western Green Energy Hub on the southern coast near the South Australian border.

The proposed mega-project would be the world’s largest renewable hub if realised, with a massive 50 GW of wind and solar farms to be spread across 15,000 square kilometres. The wind and solar would power electrolysers to produce either 3.5 million tonnes of green hydrogen or, alternatively, 20 million tonnes of green ammonia yearly.

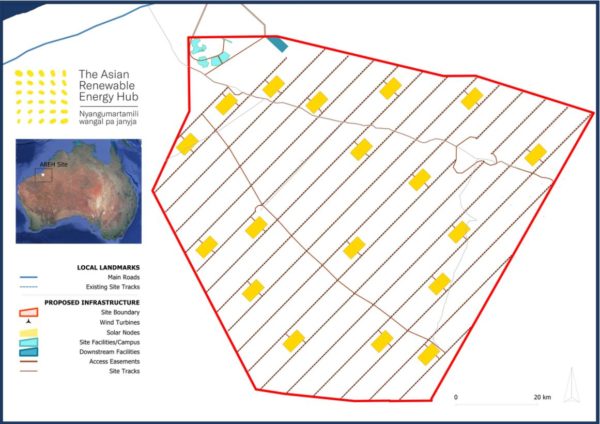

InterContinental is also part of the consortium behind the $50 billion Asian Renewable Energy Hub being developed in the east Pilbara region. The proposed 26 GW project will see wind turbines and solar modules installed across some 6,500 square kilometres. The facility would be used to power 14 GW of electrolysers to produce 10 million tonnes of green ammonia a year.

InterContinental chief executive Alexander Tancock said the firm “has an ambitious vision, together with our partners, customers, and stakeholders, to deliver green fuels at scale, and we are excited to have GIC on board as an investor, who share the same long-term commitment to global decarbonisation”.

The investment by GIC, which is estimated by the Sovereign Wealth Fund Institute (SWFI) to manage funds of more than $1 trillion, is seen as a major boost for the projects which are both currently in the process of gaining approvals and conducting feasibility studies.

Financial close for the Western Green Energy Hub is targeted for after 2028, with start-up in about 2030. A final investment decision on the Asian Renewable Energy Hub is expected in 2025 with the first exports tipped to commence in 2027/2028.

The size of the investment by GIC, which is estimated by the Sovereign Wealth Fund Institute (SWFI) to manage funds of more than $1 trillion, was not revealed.

The investment remains subject to approval by the Australian Foreign Investment Review Board

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.