In April, Vulcan Energy Resources, an Australian listed company backed by the country’s richest woman Gina Rinehart, announced it had signed a 20-year binding purchase agreement for at least 240 GWh of renewable heat per year with major German energy supplier MVV Energie AG.

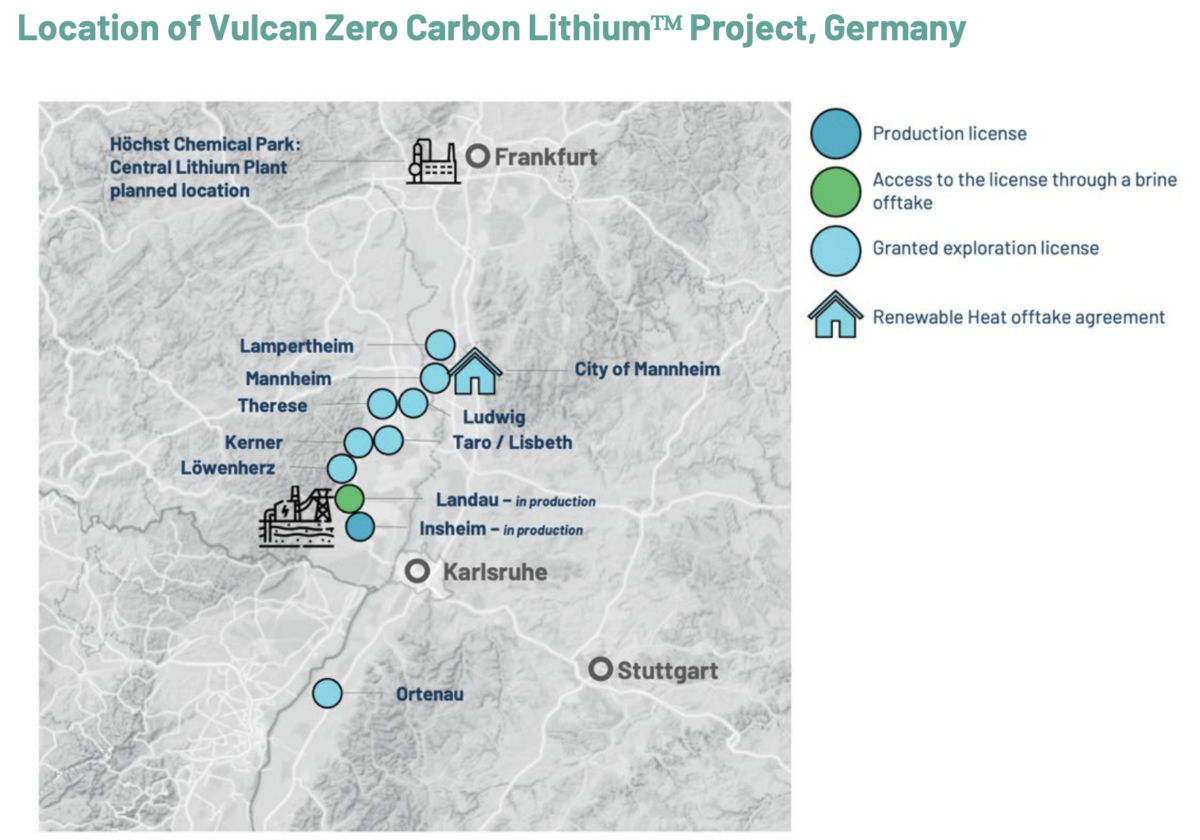

The agreement is set to commence in 2025 and is part of Germany’s push to move itself off a dependance on Russian gas. The agreement includes the supply of a minimum of 240 GWh per year to a maximum of 350 GWh per year and is set to supply households in Mannheim, south of Frankfurt, Germany.

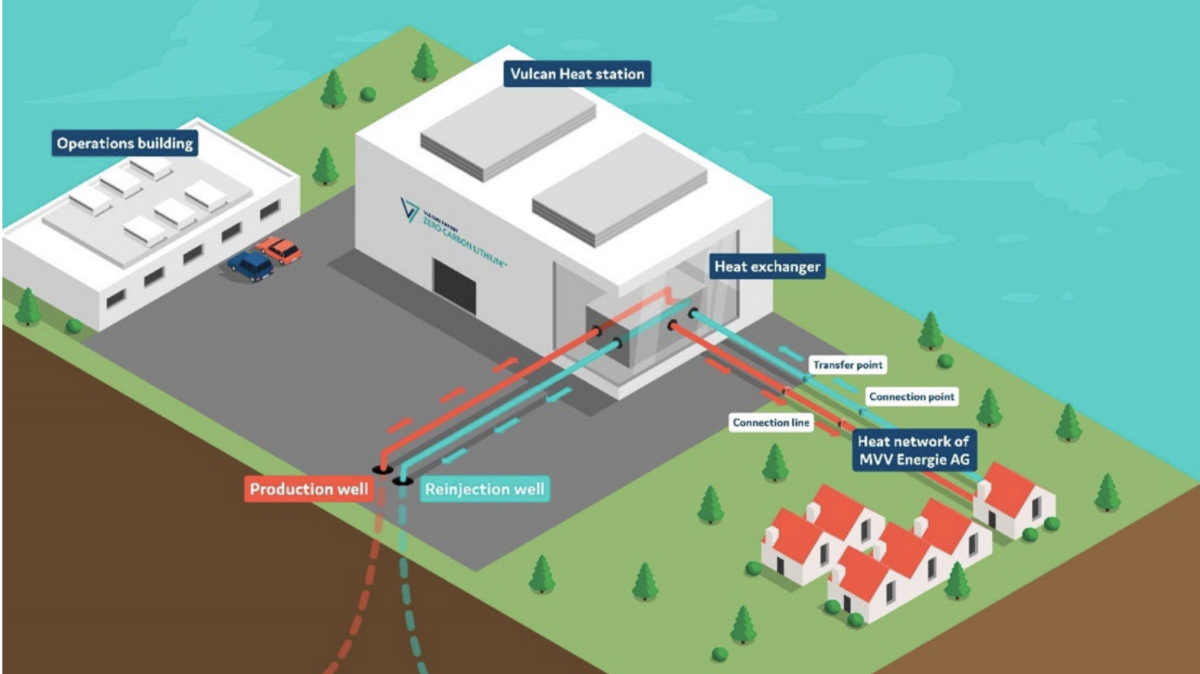

The Rhine Valley project involves Vulcan drilling several deep wells into an underground brine reservoir – essentially hot, salty water – outside Mannheim then pumping it to the surface where its heat will be transferred “via heating grids and a series of underground pipes that deliver hot water or steam to buildings in the local community.”

Eventually, Vulcan plans to extract lithium using this same geothermal wells using a method it claims has among the lowest footprints for lithium extraction.

Exactly what that process involves is a bit opaque, but the company’s website says: “through wells into the deep sub-surface, hot, lithium-rich brine from our project area is pumped to the surface… the spent brine then gets re-injected in a closed-loop cycle.”

Vulcan says the method “incur[s] virtually zero disruption to communities or the environment.”

“We believe that geothermal renewable energy on a mass scale, combined with lithium extraction from the same deep geothermal source, can and will play an important part in achieving Europe and Germany’s energy security and independence,” Vulcan’s Managing Director Francis Wedin said.

The company is targeting an annual lithium hydroxide output of 40,000 tonnes from 2024 – roughly enough to power one million electric vehicles (EVs). Its plans have already seen Vulcan ink deals with numerous European carmakers, all of whom are desperate to secure lithium supplies, including France’s Renault, Dutch company Stellantis and Germany’s Volkswagen.

It’s worth noting that lithium extraction has come under fairly fierce criticism in Europe, and getting the project across the line in terms of environmental and social licenses in such a rich and densely populated region in Europe may prove difficult.

Vulcan’s lithium plans are still in fairly early stages, and were probably somewhat shaken by the recent and very public end to Rio Tinto’s $3.3 billion Jadar lithium-borates project in Serbia – which came shortly after the country’s tennis star Novak Djokovic was deported from Australia.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

14 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.