The most recent version of Australia’s annual Identified Mineral Resources report has found that the country is growing its critical materials inventory, in some cases pretty massively.

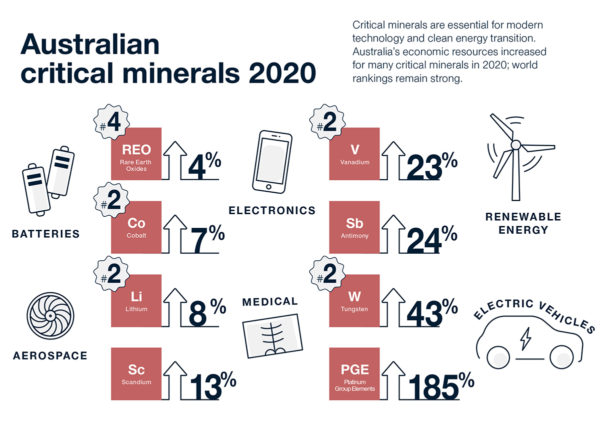

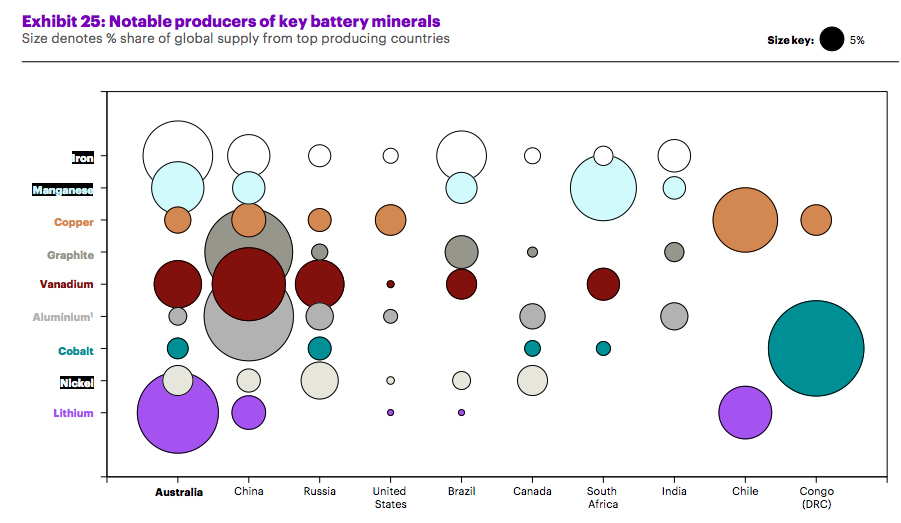

According to the report, released by Geosciences Australia, the country provided 49% of the global supply of lithium, essential for battery storage technologies and electric vehicles. It was also a top five producer of cobalt, ilmenite, manganese, rare earths and zircon, all of which are considered essential minerals for advanced and renewable technologies. Rare earths, for instance, being used in permanent magnets which are vital to both wind turbines and electric vehicles.

Image: Geosciences Australia

The report found in the year to December 2020, Australia’s economic inventories increased for rare earths (up 4%), lithium (up 8%), vanadium (up 23%) and platinum group elements, which increased an impressive 185%.

“We’re seeing demand for these minerals grow, particularly as the world transitions to low-emissions technologies,” Geoscience Australia’s Director of Mineral Resources Advice and Promotion, Allison Britt, said.

The report also noted that in 2020, mineral exports were valued at $231 billion and investment in mineral exploration reached $2.8 billion, an increase of 6% compared to the previous year. This is the highest spend on exploration since 2012.

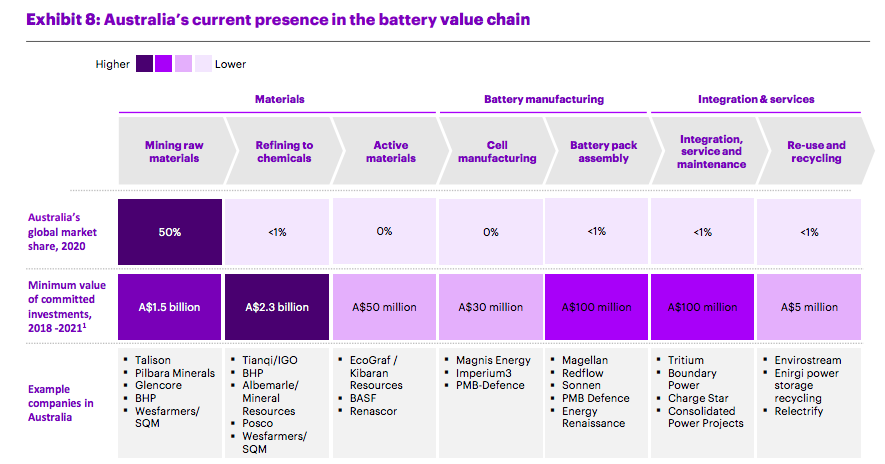

The increase, which is notably before some of the major supply shortages came into play last year, nonetheless marks Australia’s push in terms of both investment and rhetoric towards becoming a serious critical mineral supply alternative to China, which currently dominates the global role. Compared to Australia, China also exports refined and processed products rather than simply raw materials – a part of the supply chain Australia’s government and various companies are vying to change.

In March, the federal government allocated $240 million for critical minerals supplies. To a similar end, it also granted Western Australian miner Iluka Resources a $1.25 billion loan to build Australia’s first integrated rare earths refinery to supply electric vehicle and renewable energy industries earlier this month.

Private companies are also looking to expand Australia’s share, with Australian Vanadium Limited last week announcing that its plans for a vanadium mine and eventually vanadium electrolyte processing plant were found to be “bankable” and construction could begin as early as next year.

The markets for critical minerals have already expanded significantly in the last years and are set to grow far, far more before 2050.

“The International Energy Agency forecasts nickel and lithium use in batteries will increase sixfold and thirteenfold, respectively, by 2040. There is an urgency to discover new world-class resources to meet this projected demand and further develop the pipeline of mineral resources that will anchor secure supply chains for Australia and our partners,” Britt said.

The latest Identified Mineral Resources report here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.