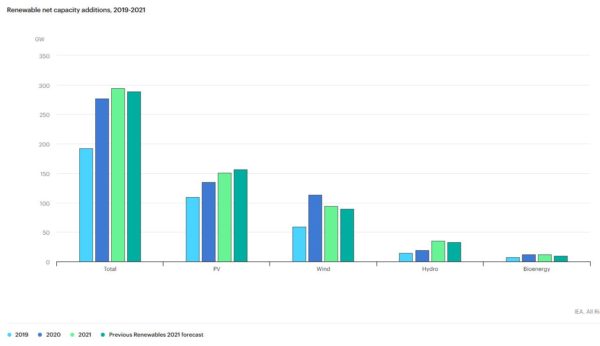

A new report published by the International Energy Agency (IEA) suggests new renewable energy capacity additions will exceed 300GW globally this year for the first time, with mounting concerns about climate change and energy security driving an 8% increase after new installations reached almost 295GW in 2021.

The IEA said this week that despite persistent pandemic-induced supply chain challenges, construction delays, and record-level raw material and commodity prices, renewable capacity additions increased by a record 6% globally in 2021.

In its latest Renewable Energy Market report, the IEA suggests new capacity for generating electricity from solar, wind and other renewables will grow to a record high in 2022, rising by more than 8% compared with last year, up by nearly 320GW with China, Latin America and the European Union (EU) leading the way.

IEA executive director Fatih Birol said the Russian invasion of Ukraine has added new urgency to accelerate clean energy transitions with governments increasingly looking to take advantage of renewables’ energy security and climate benefits.

“Energy market developments in recent months, especially in Europe, have proven once again the essential role of renewables in improving energy security, in addition to their well-established effectiveness at reducing emissions,” he said.

“Cutting red tape, accelerating permitting and providing the right incentives for faster deployment of renewables are some of the most important actions governments can take to address today’s energy security and market challenges, while keeping alive the possibility of reaching our international climate goals.”

Solar PV is forecast to account for 60% of the increase in global renewable capacity this year with the IEA predicting the commissioning of 190GW, a 25% gain from last year. The Paris-based body said utility-scale projects account for almost two-thirds of overall PV expansion in 2022, mostly driven by a strong policy environment in China and the EU driving faster deployment.

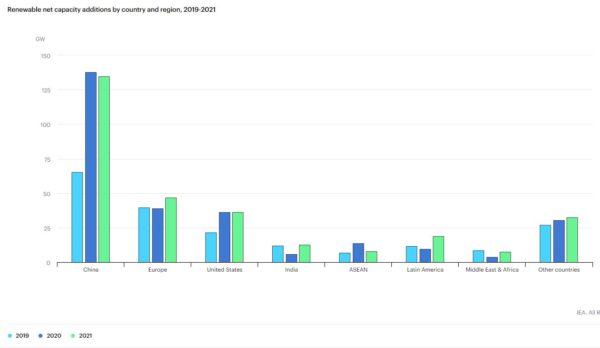

China accounted for 46% of worldwide renewable capacity additions in 2021 and is expected to largely maintain its market share of deployment in 2022-2023, with the commissioning of more than 140GW on average per year, driven mostly by large-scale solar PV deployment.

The growth in renewables comes despite elevated commodity and freight prices. The IEA said prices for many raw materials and freight costs have been on an increasing trend since the beginning of 2021. By March 2022, the price of PV-grade polysilicon more than quadrupled, steel increased by 50%, copper rose by 70%, aluminium doubled and freight costs rose almost five-fold.

“Compared with 2020, we estimate that the overall investment costs of new utility-scale PV and onshore wind plants are from 15% to 25% higher in 2022,” the IEA wrote.

“Surging freight costs are the biggest contributor to overall price increases for onshore wind. For solar PV, the impact is more evenly divided among elevated prices for freight, polysilicon and metals.”

While predicting solar PV costs will remain higher in 2022 and 2023 than pre-pandemic levels, the IEA said the technology’s price competitiveness had actually improved due to much sharper increases in natural gas and coal prices.

“Although costs for new solar PV and wind installations have increased, reversing a decade-long cost reduction trend, natural gas, oil, and coal prices have risen much faster, therefore actually further improving the competitiveness of renewable electricity,” it said.

While the outlook for new renewable energy capacity additions looks strong for 2022, the IEA cautioned that based on current policies “renewable power’s global growth is set to lose momentum next year”.

While solar PV is forecast to break another record in 2023, reaching almost 200GW, this is offset by an expected 40% decline in hydropower expansion and “little change” in wind additions.

“In the absence of stronger policies, the amount of renewable power capacity added worldwide is expected to plateau in 2023,” it said. “Ultimately, the forecast of renewable markets for 2023 and beyond will depend on whether new and stronger policies will be introduced and implemented in the next six months.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Wind has proved to be completely non-economical and the waste products of turbine blades is an ecological disaster. The extensive and environmentally destructive mining process needed to acquire component elements for solar and the use of diesel to move massive amounts of soil to access those elements makes it so that solar cannot offset the carbon footprint used to create the panels. Add on top of these huge hidden ecological and environmental negatives, the unpredictability of solar and wind as a consistent and grid balancing energy source has been demonstrated repeatedly as a non-value added consequence. Solar panels must be cleaned regularly and track the sun for a solid 2-4 hours of peak productivity that does not come near the advertised capacity of the field. Wind farms world wide have more turbines turned out of the wind than they have spinning in the wind. Adjacent turbines do not receive equal wind strength, and the ebb and flow of wind means that turbines are drawing from the grid to reestablish rotation after periods of no to low wind flow, this means that no turbine anywhere in the world is producing the advertised amount of electricity making them the most expensive form of power generation than any other on the market.

The technology sounds great the way the narrative is spun in the media to the uneducated masses, but without government subsidies, these technologies would never reach their ROI or be of net economic benefit to the region they supply. This is especially true if these industries were actually expected to clean up the the waste caused by non-renewable products and the toxic chemical processes used in their manufacture.