From: The Conversation

Plug-in electric vehicles (EVs) accounted for 16% of new light-duty vehicle sales in California in the first half of 2022. In Australia, EV sales are only 2% of the market, and mostly from one carmaker, Tesla.

Australia, a country with no vehicle fuel economy or CO₂ emissions regulations, is debating how to move forward. The local auto industry suggests Australia needs a slow transition to EVs and should lag the United States, Europe, China and neighbouring New Zealand. Compared to proposed European vehicle emission standards of 43 grams of carbon dioxide per kilometre in 2030, the local industry proposes 98-143g CO₂/km (for light cars and SUVs).

The proposed Australian target would result in a slow transition, which new research suggests will have little or no effect on the transport sector’s CO₂ emissions.

The rationale for a slow transition is the same as was heard for decades in California: EV prices are too high, there isn’t enough infrastructure to support these vehicles, their driving ranges are too short, and certain models aren’t available (electric utes, for example).

We fact checked Sussan Ley on electric utes. Here's what we found https://t.co/IN1xeaG6bD

— ABC News (@abcnews) August 30, 2022

These concerns have some validity, but are largely out of date. Australia in 2022 faces a very different situation from California when it started down the electric vehicle path.

Let’s deal with why each of these four concerns might now be overstated.

1. Limited range

Drivers in both Australia and California travel similar distances per year. In both regions, most trips are well within EV range.

Further, in both regions most households own two vehicles. This means buyers can, if needed, use another vehicle for longer trips.

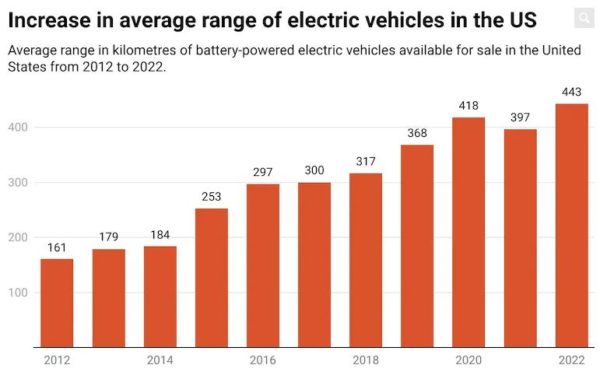

Electric vehicle range has also improved: the average range of available electric vehicles in 2013 when electric vehicle sales in California reached Australia’s current level of 2% was 179 kilometres (111 miles). Now, it’s 443 kilometres.

2. Lack of charging infrastructure

In California and other markets like Norway, most early electric vehicle buyers charge at home on their driveway or in a garage. In Australia even more people live in a detached house than in California. Drivers in these households could charge their vehicle at home, which reduces the need for public charging stations.

Public charging may be needed to support occasional charging, to enable longer journeys and to support the smaller proportion of households without home charging. But public infrastructure is not a prerequisite for early market growth.

Australia already has as many charging stations per person as California had in 2016. In fact, Australia might be only a few years behind.

Is Ampol Missing the Point with Electric Vehicles?: Starting in six months, Ampol Australia is building out 121 ultra-fast charging stations across its service network. These are being built on the east coast in metropolitan centres… https://t.co/Tntm2EYbPT #Renewable #Energy pic.twitter.com/o8tLkLIsGs

— Tom DeRosa (@RenewableSearch) October 13, 2021

3. High prices

In Australia the average new car is $40,729 (US$28,000). EVs with ranges of around 400km could be made available at that price.

For example, the 2023 Chevrolet Bolt starts at US$25,600 ($37,000) in the US. And until 2020 the Renault ZOE was sold in Australia for $37,400. Both models have a range of about 400km.

Consumers have also been shown to be willing to pay more for an EV compared to a conventional vehicle. This might be partly due to the savings on fuel and maintenance costs.

4. Lack of models

In 2022, 316 electric and 162 plug-in hybrid models are on sale globally. These models include SUVs, utes and pick-up trucks.

The lack of choice and of lower-cost EVs in Australia is because carmakers prefer to send these models to markets with supportive electric vehicle policies . Making these models available in Australia may be as simple as giving carmakers the motivation to sell them there.

Australia may be well positioned for a rapid transition to EVs if it adopts more supportive policies. If Australia brings in policies such as ambitious fuel-economy standards or a zero-emission-vehicle sales mandate, the country could benefit in the same ways as California did.

All that’s needed now is supportive policy

Supportive policies like these help set the stage for the early electric vehicle market to grow. They do this by:

- giving carmakers the confidence to develop and supply electric vehicles at multiple price points, in multiple body styles and with long driving ranges

- giving providers confidence to roll out charging infrastructure

- giving consumers the supply of EVs they are waiting for.

An EV mandate can also protect consumers from supply ebbs and flows that are common in import-only markets.

Other nations have been down this road

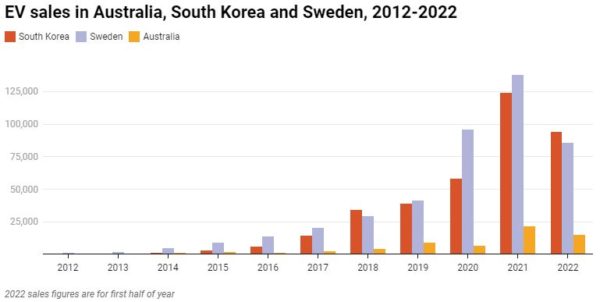

Australia is not the first nation to grapple with these challenges. South Korea, despite being a global producer of EVs, was experiencing slow domestic market growth. Many Korean EVs were exported to regions with policies more friendly to the technology.

The government responded with policies to support EVs. Since then, domestic sales have tripled. South Korea is now the seventh-largest EV market in the world, up from 11th in 2019.

And as federal Energy Minister Chris Bowen noted at the EV Summit last month, with the right policy settings, Sweden increased its proportion of electric vehicle sales from 18% to 62% in just two years.

Similar approaches could yield similar results for Australia. While some nations may need a slower transition for a variety of reasons, Australia need not be one of them. Concerns about range, infrastructure and model availability can be readily overcome.

The country is well placed for early market growth. All states already offer incentives for EV buyers, including rebates, registration discounts and road tax exemptions.

All that may be needed is for the federal government to adopt policies that support electric vehicles. Based on the remarkable improvements in the technology and what has been learned in California and elsewhere, Australia is well placed for rapid market growth.

Authors: Scott Hardman, professional researcher, Electric Vehicle Research Center, University of California; Daniel Sperling, Professor of Civil and Environmental Engineering and founding director, Institute of Transportation Studies, University of California; Gil Tal, director, Plug-in Hybrid & Electric Vehicle (PH&EV) Research Center, University of California

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.