Sydney-based Magnis Energy Technologies has become the latest Australian company to sign a binding offtake deal with Tesla, as the US giant scrambles to secure battery materials. Specifically, the deal is for what’s known as an anode active material or AAM, a graphite-based material crucial in lithium-ion batteries.

The conditional agreement will see Magnis supply Tesla with a minimum of 17,500 tonnes per annum of AAM for three years at a fixed price, though Tesla has the option to double its supply to potentially buy as much as 35,000 tonnes per annum.

The deal hinges on Magnis actually finding a site and bringing its envisioned AAM plant into commercial production no later than February 1, 2025.

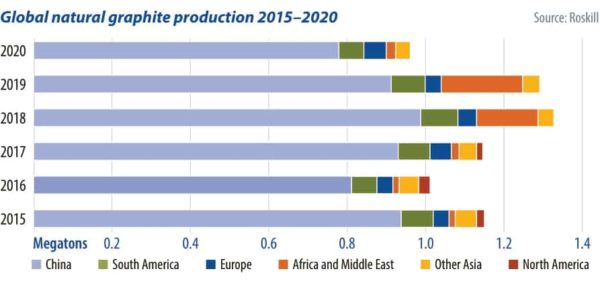

Although Magnis is an Australian, ASX-listed company, most of its ventures are abroad – including its proposed AAM plant, which is to be constructed in the US. Under Biden’s new Inflation Reduction Act (IRA), the country is offering strong incentives to source locally produced battery materials. Clearly looking to move into the lucrative new market, Magnis is seeking to be one of the first players offering AAM in North America, providing an alternate to China, which is the easily most dominant player today.

Renascor Resources

Townsville battery plant plan abandoned

Magnis’ offshore focus is now fairly solidified, with the company this month softly backing down from previously-hyped plans to build a lithium-ion battery gigafactory in Townsville, Queensland. The feasibility study for the 18 GWh Imperium3 Townsville (iM3TSV) Battery plant, as it was known, was funded by the Queensland government and proposed in the Lansdown Industrial Precinct.

In its half yearly report, published earlier this year, Magnis noted Townsville City Council had revoked its original land allocation, citing that the Lansdown precinct would now focus on hydrogen. The council gave the company the opportunity to apply for an alternate site – an offering Magnis turned down.

Image: Queensland government

Somewhat confusingly, the company then went on to say it would not be proceeding with the project, but included a footnote saying it is considering other potential options for its Australian gigafactory.

The way this news was embedded in the company’s half yearly results seems to have been queried by the ASX, with the company later putting out a statement downplaying the importance of the announcement.

“The company does not consider the [Townsville] project update to be information that a reasonable person would expect to have a material impact on the price or value of the company’s securities… The project, while remaining an important long-term strategic initiative for the company, constitutes a non-core (and thus immaterial) component of the company’s overall business.”

With its Townsville gigafactory seemingly out of the picture, Magnis is focussing on its Imperium3 lithium-ion battery plant in New York, of which it owns a 61% interest. The plant began production in August 2022, though Magnis in February told investors there will be a delay in gaining United Nations certification for the safe transportation of the lithium-ion batteries manufactured at the plant.

Image: Magnis Energy

“In one of the last tests performed, a cell reported an irregular result which has resulted in the process starting again with a new batch of cells,” Magnis said.

On top of its New York battery plant, Magnis owns the Nachu Graphite project in Tanzania.

Tesla turns to Australia

The Magnis deal follows on from a similar deal Tesla made with another ASX-listed graphite company, Syrah Resources, in late 2021.

Under that deal, Melbourne-based Syrah Resources will supply Tesla with 8,000 tonnes (the vast majority) of the Active Anode Material (AAM) it plans to produce at its facility in Vidalia, Louisiana. The plant is set to processes graphite mined in Mozambique into AAM.

At the time the Tesla deal was announced, Syrah Resources had not yet reached a final investment decision for the Vidalia plant, but construction on the facility is now nearing completion, with Syrah Resources saying production is set to start in the third quarter of 2023.

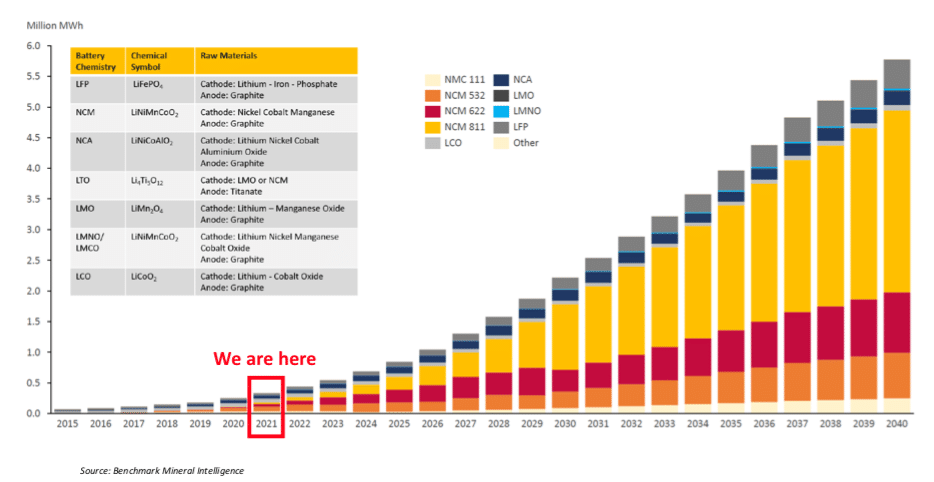

Currently, China dominates the global supply of graphite anode materials, accounting for an estimated 70% to 85%. With the US and Europe eager to diversify supply chains, Australian companies are competing to emerge as viable alternatives with several companies developing battery-ready graphite material facilities, as well as mines themselves, both in Australia and abroad.

Such players include Renascor Resources which is currently working towards realising its Siviour Battery Anode Material Project. Likewise, Western Australian startup International Graphite is also working on building a graphite battery anode material hub in Collie, WA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.