Originally intended for the processing of vanadium, the Queensland government has expanded its ambition for a critical minerals demonstration facility in Townsville, northern Queensland, broadening its scope to include processing for cobalt, high purity alumina, and rare earth elements.

Speaking from the Sun Metals green industrial precinct in Townsville, Premier Annastacia Palaszczuk said the $75 million facility – more than seven times the original investment – will be located at Cleveland Bay Industrial Park between the existing Sun Metals zinc refinery and Glencore Copper refinery.

“This facility will prove up the commerciality of critical minerals in Queensland,” she said. “The opportunities in North Queensland include mining and processing the minerals for vanadium, zinc bromine and iron flow batteries, cobalt and nickel used in lithium-ion batteries, high-purity alumina for LEDs, batteries and semiconductors, rare earth elements used in electronics and silicon for solar panels and semiconductors.”

The plant is expected to commence operations by the first half of 2025.

The move was welcomed by Queensland community group Solar Citizens, who have long advocated for Townsville to become a renewable manufacturing precinct. “Our research found that turning Townsville into a hub for renewable-powered manufacturing and renewable hydrogen production would create more than 5,350 ongoing jobs and 19,600 construction job years by 2030,” the group said.

To that end, Australia’s federal Albanese government last week unveiled a $70 million investment towards developing a green hydrogen hub in Townsville.

Coming back to the critical minerals processing facility, Queensland Minister for Resources Scott Stewart said materials like vanadium have the potential to be “the Eureka moment” for north Queensland.

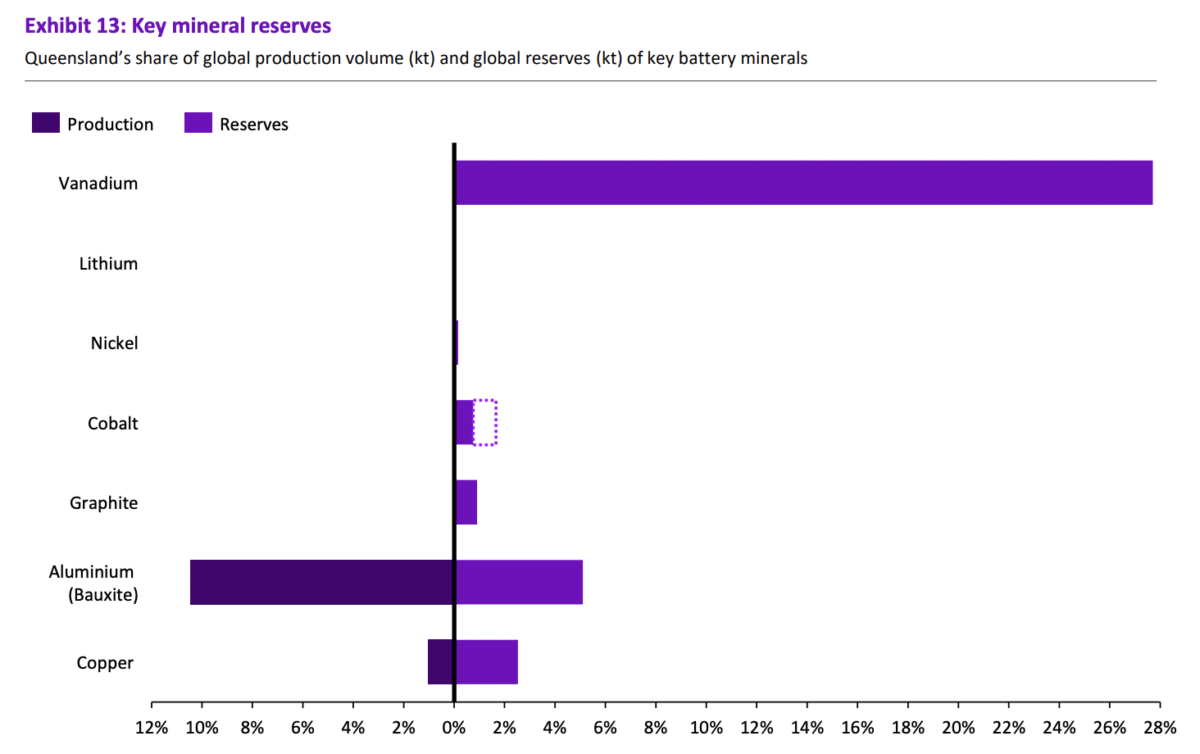

“Global demand for vanadium in batteries and high-quality steel is expected to outpace supply before the end of the decade,” Stewart said. “Queensland has world class, highly economic deposits of vanadium located in accessible marine shale.”

“There is already interest from companies in using the facility and once the market sees the quality of Queensland’s valuable resources for themselves, they will have confidence to invest in commercial scale facilities and downstream manufacturing infrastructure.”

Critical materials superpower vision

The announcement builds on a broader strategy by the Queensland government to become the a hub for battery-related industries (a position it will likely share with West Australia – home to massive lithium deposits).

Earlier this month, the Queensland government published its Battery Industry Opportunities for Queensland discussion paper, delivered by consultancy Accenture. It concluded Queensland’s battery industry has the potential to contribute $1.3 billion in gross value added (GVA) to the state.

Accenture also found Queensland has significant competitive advantages entering the battery materials industries, afforded through its natural resources, existing capabilities in mining, refining to chemicals and active materials and low future energy costs from renewable energy. Moreover, it has the ability to position itself as a “reliable participant” in global battery value chains.

This reliability is increasingly being understood as a serious drawcard in Australia, where momentum is growing across the country to develop battery industries.

There is some debate around whether Australia could take this as far as battery manufacturing itself, but there appears to be fairly uniform consensus that ‘value adding’ capacity for batteries, which includes things like refining, processing, and manufacturing materials onshore, would greatly add to the economy.

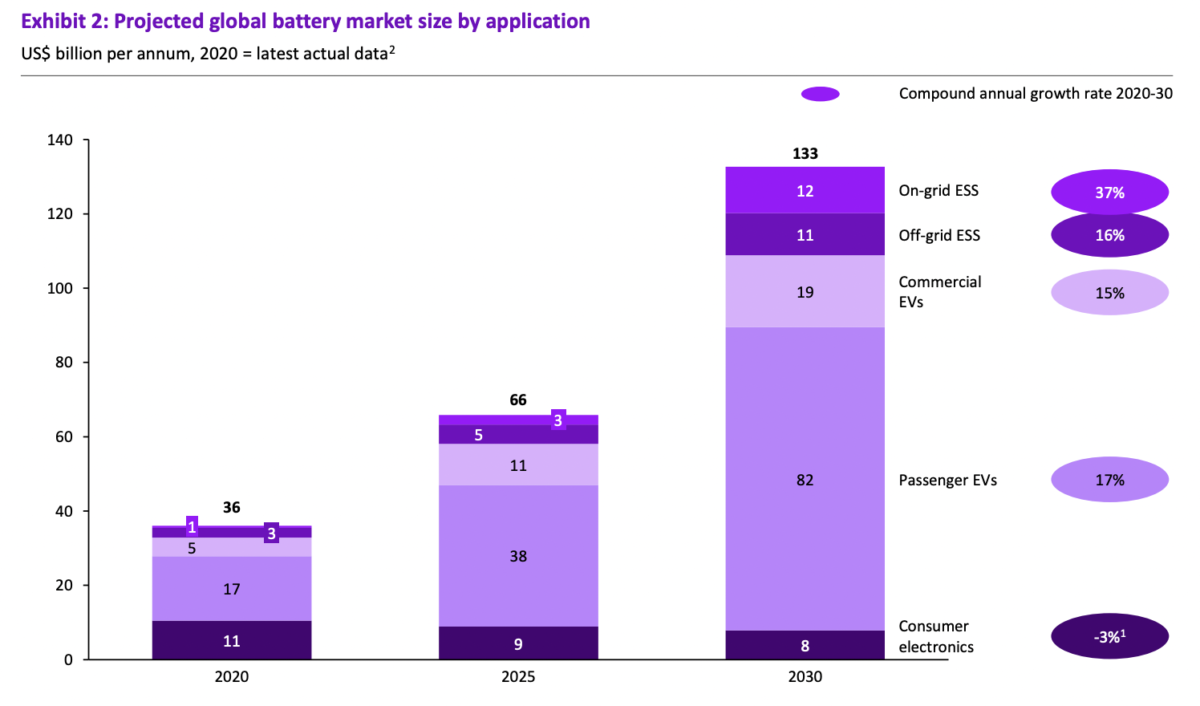

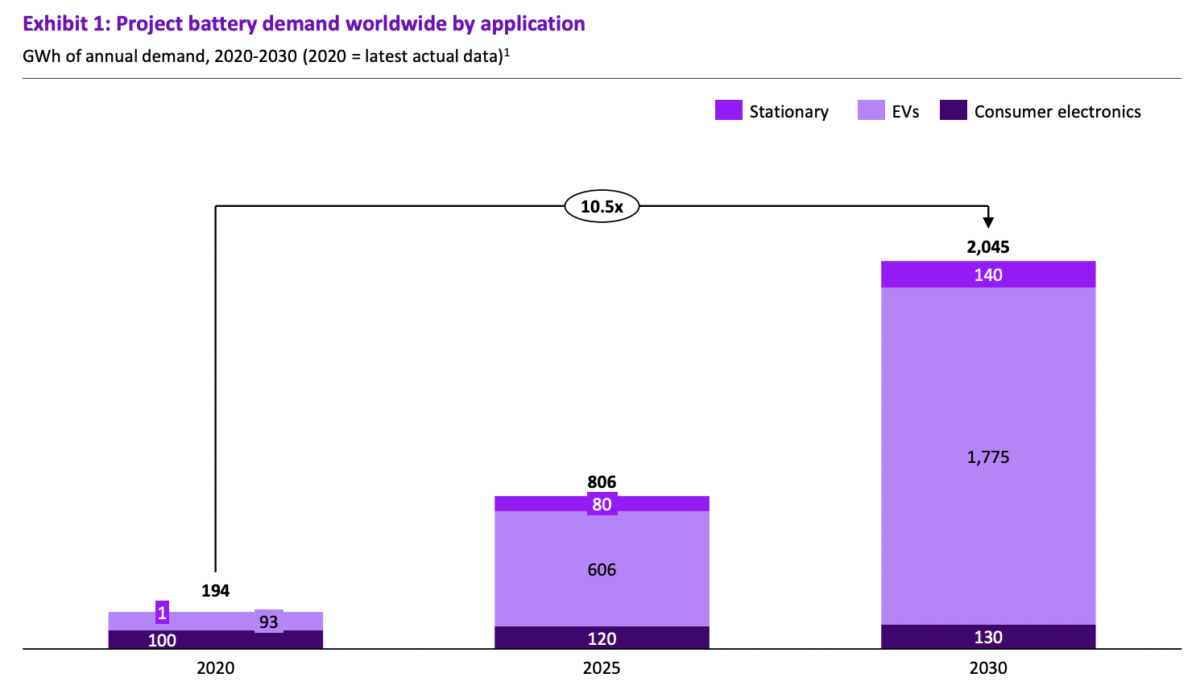

In the Queensland discussion paper, Accenture forecast domestic battery demand will total 90 GWh to 2030, while global battery demand is expected to reach 2,045 GWh by that time – an 11 fold growth rate from 2020.

While there is little doubt this would bring both huge revenues and jobs, such industries carry with them considerable environmental impacts.

Speaking at a media briefing last November, Quinbrook Infrastructure Partners co-founder and Managing Partner David Scaysbrook, noted President Biden’s recent Inflation Reduction Act has the potential to supercharge Australia’s critical mineral position. “The question is, do we have the stomach for that?”

For nearly 20 years from 1998 to 2017, China mined essentially all of the world's rare earth elements.

The U.S., Australia, and Myanmar have notably reduced this % since 2018. But China still overwhelmingly dominates refining and manufacturing.

From: https://t.co/VLaao2Ec3U pic.twitter.com/PiXFerwp8I

— Bismarck Analysis (@bismarckanlys) October 8, 2022

Until now, the vast majority of critical materials processing has been done in China, which has been willing to embrace some of the more impactful processes on the environment – processes Australia has historically baulked at.

Tim Buckley, director of Climate Energy Finance, agrees public opposition has the potential to seriously undercut the burgeoning critical materials industries.

He thinks unless governments, namely the federal government, enforce “sensible regulations” around the whole ecosystem early, including thinking about recycling, processing facility efficiency and carbon standards and pollution, the backlash could be a “constant battle.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.