A new report from the Institute for Energy Economics and Financial Analysis (IEEFA) has found that the Macquarie Group has continued to invest heavily in fossil fuel projects after signing up to the international Net Zero Banking Alliance (NZBA) in October 2021.

The Sydney-based Macquarie Group is the world’s largest infrastructure asset manager with more than $871 billion (USD 580 billion) in assets under management, according to its latest annual report.

In 2019, Macquarie joined the RE100 intitiative, committing to power 100% of its operations with renewable energy by 2025.

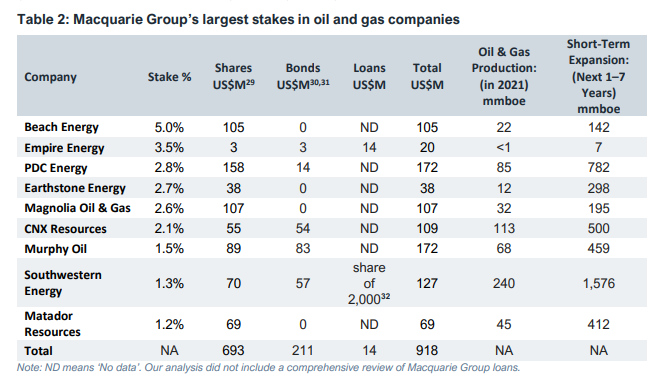

The IEEFA report however indicates that since making the NZBA commitment, the investment giant has issued loans and acquired stakes in oil and gas companies with “aggressive expansion plans.”

This included a $15 million loan to Empire Energy to support the development of the controversial Beetaloo Basin gas project, and a 5% stake in Beach Energy. The ASX-listed Beach Energy is targeting new developments in five different basins in Australia and New Zealand in the next two years.

Macquarie also made a contribution of an undisclosed amount to a $3 billion loan to Texas gas company Southwestern Energy, which has expansion plans that would create more CO2 than Australia’s total emissions in 2021.

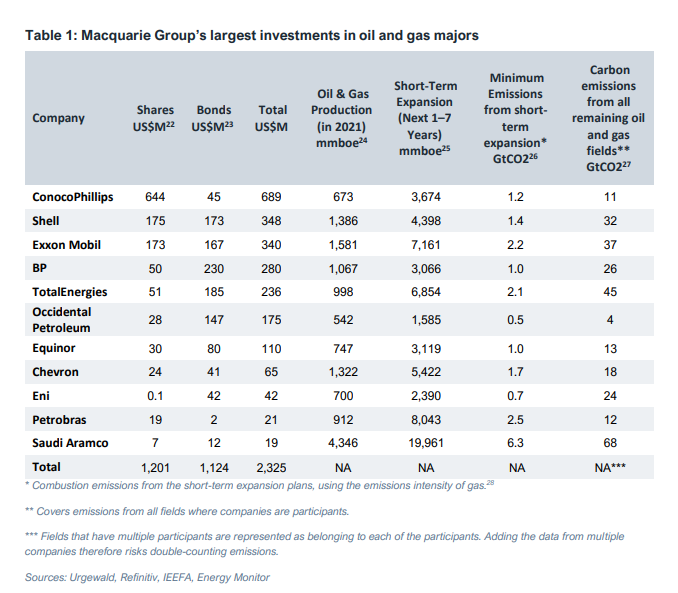

Overall, Macquarie has shares and bonds in 11 of the world’s largest oil and gas majors, worth about $3.5 billion, all of which are planning major short-term expansion in the next seven years.

In addition, the company has a further $1.4 billion in nine smaller oil and gas companies.

IEEFA Australia Chief Executive Officer Amandine Denis-Ryan, a co-author of the report, said the findings were out of step with Macquarie Group’s pledge to net zero.

“Our analysis finds that Macquarie Group’s actions directly contradict its climate commitments,” she said.

“The investments identified in this report add up to about $5 billion. A more comprehensive analysis of Macquarie Group’s exposure to upstream oil and gas companies through shares and bonds (excluding loans) found about $7.7 billion of exposure.”

The reported figure of $7.7 billion is in stark contrast to Macquarie’s disclosed $1.2 billion of financing exposure to the full oil and gas chain, which the company published in its 2022 Net Zero and Climate Risk Report.

Transparency needed

Denis-Ryan called on Macquarie to provide more transparency in its disclosures.

“The discrepancy between reported and actual exposure may be explained by the disclosures focusing only on on-balance sheet activities,” she said. “If so, Macquarie Group’s disclosure on financed emissions appears to be exploiting a loophole in the NZBA guidelines, which do not mandate member banks to establish targets for their fossil fuel exposure through off-balance sheet activities.”

Macquarie’s off-balance sheet activities include equity and bonds investments in the oil and gas sector, while the scope of the current NZBA guidelines covers lending and equity investments.

For its part, the NZBA has committed to updating its guidelines to include off-balance sheet activities once a common carbon accounting standard is built and tested.

The $7.7 billion figure also dwarfs the disclosed financing exposure to upstream oil and gas of three of Australia’s big four banks. CBA disclosed $2.1 billion, while NAB and Westpac each disclosed $1.9 billion, the report said.

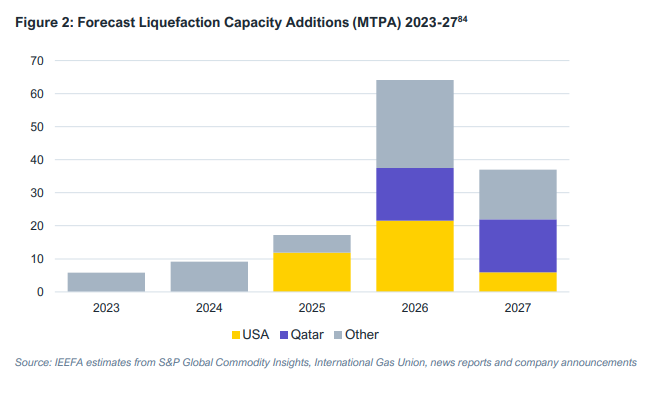

The IEEFA report also questioned the future financial performance of the gas sector and identified a “looming supply glut” in coming years that could affect prices and profits.

Alongside its oil and gas investment, Macquarie is investing in renewables, including solar. Macquarie Asset Management subsidiary the Green Energy Group has raised more than $2.5 billion for the development of large-scale solar and wind projects – including 8 GW of projects in Europe.

In March, the Green Energy Group announced that it was partnering with Shell to deliver the 200 MW/400 MWh Rangebank BESS, in Cranbourne, Victoria.

Author: Chad Bennett

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.