Queensland Premier Annastacia Palaszczuk has launched the Queensland Critical Mineral Strategy at the World Mining Congress held in Brisbane this week.

In the strategy, the state government lays out a much clearer plan of action including abolishing exploration permit fees for the next five years, establishing critical mineral zones as well as a centralised oversight body, funding waste stream initiatives, instigating collaboration between research hubs, and running an international communications campaign.

The total investment in these initiatives is $245 million (USD 162 million), just shy of the half the amount currently being put forward by the federal government under its newly launched critical minerals strategy. While industry has pointed out both figures pale in comparison to the funding provided internationally, the Queensland government’s strategy is more precise and employs more policy levers than its Commonwealth counterpart.

Key policies of the strategy include:

- Establishing ‘critical mineral zones,’ initially at Julia Creek/Richmond and around Mount Isa, with $75 million of initial funding.

- Establishing government agency ‘Critical Minerals Queensland,’ a centralised point of contact overseeing the development of the sector.

- Reducing rent for new and existing exploration permits for minerals to $0 for the next five years, with the government claiming the scheme will see it forgo $55 million.

- $5 million to target mining waste and tailings for critical minerals, and $8 million towards scientific research on circular economy initiatives.

The strategy also pointed back to the government’s $100 million ‘Critical Minerals and Battery Technology Fund’ which was formerly announced to support new projects and investments.

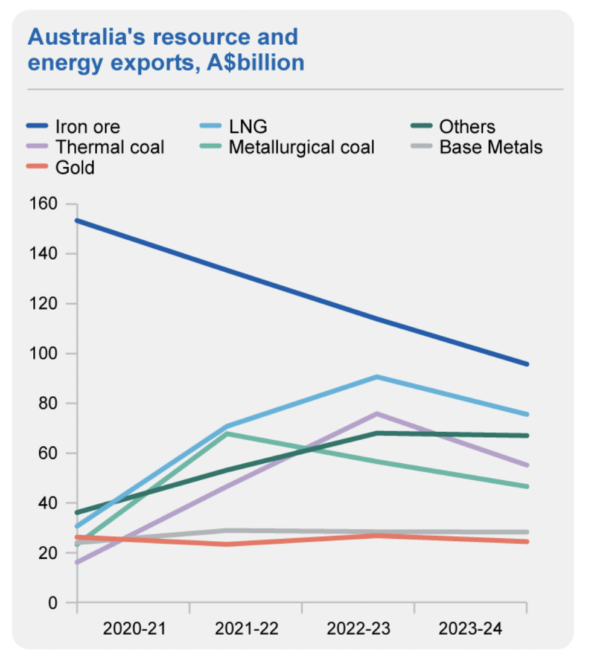

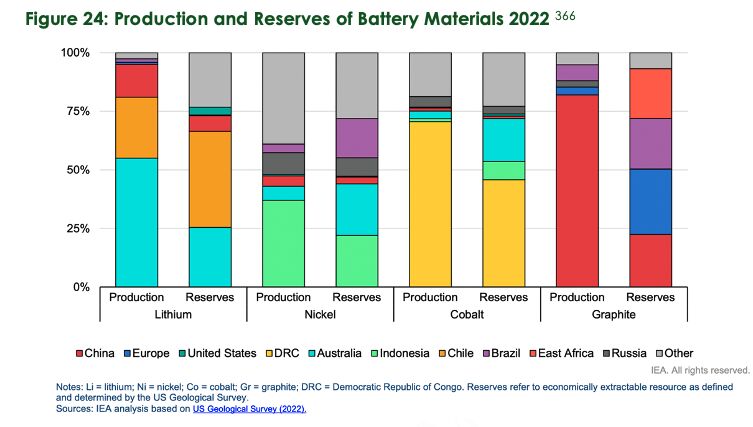

Like fellow mining state Western Australia, Queensland is eager to replace is waning export resources with the critical minerals needed for renewable technologies of the future. Given refining and processing these minerals onshore is forecast to double revenues, which can be further grown by manufacturing higher value products like electrolytes or battery precursor materials, the state has been actively working to recruit manufacturing into the region – successfully lobbying billionaire Andrew Forrest’s Fortescue Future Industries to manufacture there, among others like iron-flow battery maker Energy Storage Industries.

Image: Australian government, under International Licence

CC BY 4.0

“If we do not manufacture our future, someone else will, leaving Queensland to remain a low-end supplier of minerals and nothing more,” Queensland Resources Minister Scott Stewart rather bluntly said.

The details of Queensland’s strategy

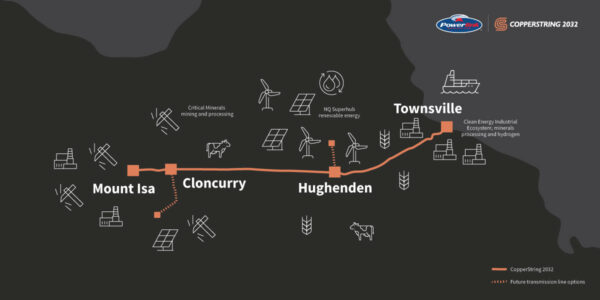

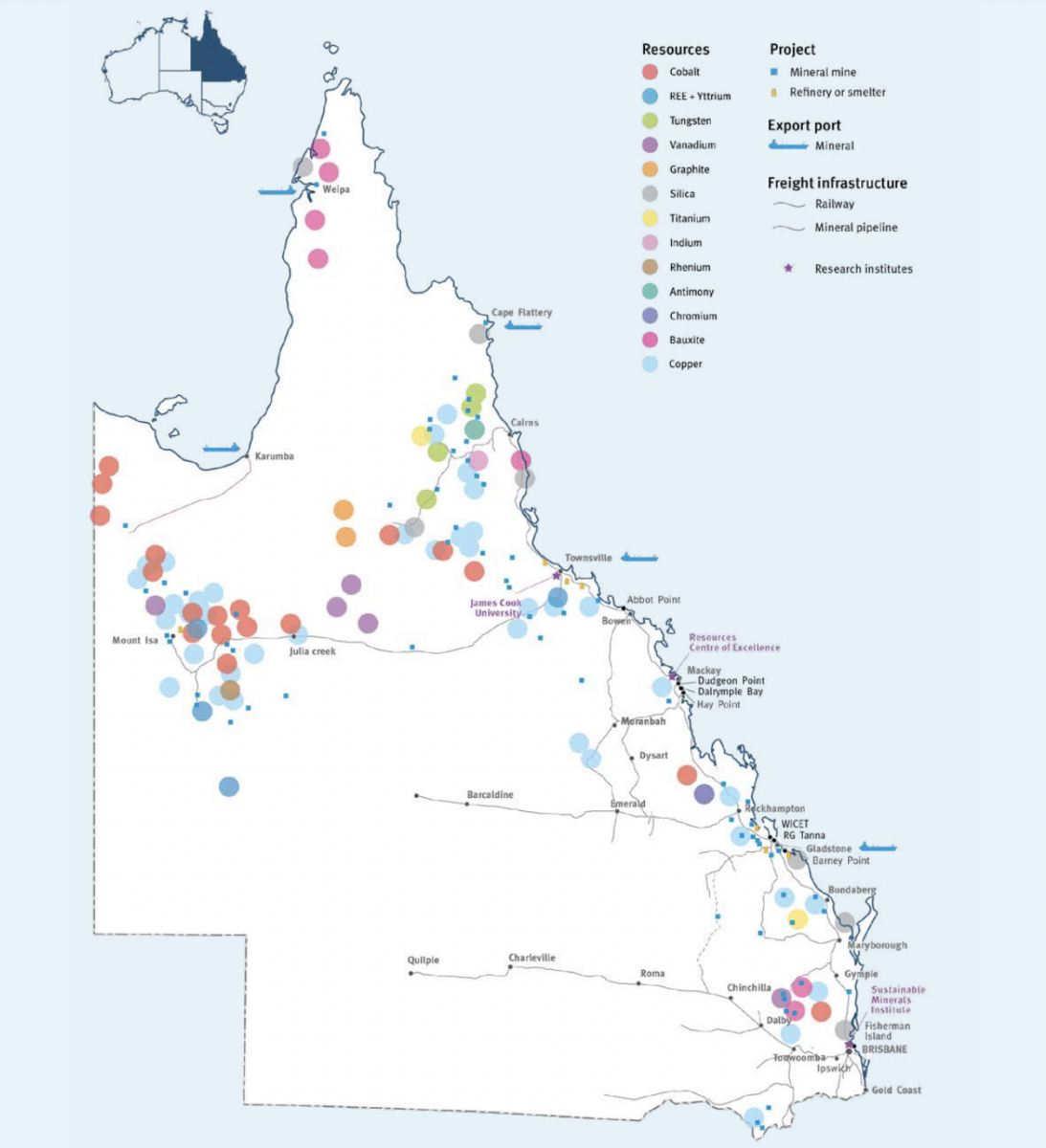

Queensland’s critical mineral ambitions hinge on the CopperString 2032 transmission line, which will connect the North West Minerals Province to the North Queensland Renewable Energy Zone. While minerals are not limited to this province, it is understood to have particularly rich deposits of things like copper, lead, zinc, nickel, cobalt, tungsten, graphite, vanadium and silica, as well as silver, phosphate and rare earths.

This transmission infrastructure will be vital since, as the Queensland government notes in its strategy, there is growing market demand for ‘clean’ materials – that is minerals and derivatives that don’t involve carbon emissions in their extraction. This push will prove beneficial for places like Queensland because its exports tend to be more expensive, but the importance of this fact is diminishing in a global market where Environmental Social Governance (ESG) credentials are more highly valued.

– Critical mineral zones

The government is kicking off this design initiative, which is widely seen as sensible by those in industry, with $75 million in funding.

The government is proposing two zones at the moment: one around Julia Creek and Richmond, and another just west of that in Mount Isa. Both these zones sit within the North West Minerals Province, with the Julia Creek zone set to focus on vanadium while the Mount Isa zone will focus on “secondary prospectively in mine waste.”

Consultation will be undertaken to investigate this approach at other locations, the strategy notes, pointing to the possibility of a further zone in Cape Flattery focusing on silica.

“A place-based approach will be undertaken where projects are co-located in one regional area,” the strategy reads. “This approach will leverage collaboration opportunities to achieve time, resource and capital efficiencies. Each zone will be unique, and government actions will be tailored according to geography, stakeholder priority and concerns, and the minerals targeted.”

This hub approach will allow coordinated development of common-user infrastructure, supporting economies of scale as well as providing opportunities to make use of mineralisation in mining wastes, it says. Finally, the zone design is expected to expedite community consultation – which will undoubtedly be a hurdle for the burgeoning industry.

“Establishing future zones will be in line with the aspirations of First Nations peoples, and other commitments from the government including future world heritage listings,” the strategy says.

Biodiversity and environmental protection which again will undoubtedly prove problematic for developing a critical minerals industry, given mineral deposits often sit under untouched vegetation in Australia, is addressed in the plan. “Baseline studies for the critical mineral zones may also inform a bioregional plan… The intent of bioregional plans is to provide improved protection of important areas of biodiversity while providing greater certainty about where development can and cannot go, and identify areas where further consideration of environmental values is required.”

– Mine waste and secondary prospectively for critical minerals

Another key action in the strategy, funded to the tune of $5 million, is looking at how to create more circular systems. That is, figuring out how minerals can be sourced through means other than virgin mining.

To that end, the strategy notes “the right regulatory framework” needs to be in place to facilitate this, with the government planning to review its frameworks, including consideration of a new ‘Residual Mineral Recovery Tenure’ and investigation into the current risk assessment criteria.

Image: Queensland government

The state has also allocated $8 million towards a research institute–government minerals alliance looking at circularity within mining. “The Queensland Government will also investigate establishing a collaborative model between the Sustainable Minerals Institute (University of Queensland) and other research institutions to focus on critical minerals.”

– Establishing a dedicated Critical Minerals Office

As mentioned, this dedicated Critical Minerals Office has been set up as a centralised point for industry, investors and community. It will coordinate pre-lodgement meetings with relevant stakeholders and government agencies as well as market Queensland internationally and work with the Australian Government to leverage bilateral free trade agreements.

Image: Geoscience Australia

– Attracting investment

Alongside removing exploration permit fees, the Queensland government plans to continue its active recruitment of projects and ultimately investment. There seems to be funds for international marketing, and the government says it will also create a (presumably online) portal to give investors access to up-to-date information about Queensland’s critical mineral opportunity, projects and other market intelligence.

– Fostering researching and “ESG excellence”

Likely a response to the public’s generally cool reception of the mining industry, which has a long history of misdeeds in Australia, the strategy notes the government “will work with industry to improve their ESG performance and reporting to ensure best practice and the ability to meet anticipated future requirements from consumers, investors, local communities and First Nations peoples.”

To jazz that up a little, it is considering handing out awards for ESG performance, and wants to ensure research and methods which improve ESG practices are shared within the industry.

– Critical Minerals and Battery Technology Fund

With a $100 million dollar investment, the fund seems to be a significant channel for the state, but how it works is more vague than the rest of the strategy.

“The Fund will provide support for local businesses and industry-led consortia to build industry capability in Queensland, providing greater access to national and global supply chains in metal refining, mineral processing and battery technology,” the strategy says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.