Wollongong-headquartered green hydrogen electrolyser manufacturer Hysata has closed a $168.2 million (USD 111 million) funding round that it is describing as the largest Series B raise in Australian clean tech history.

The round was led by energy giant BP’s venture investing arm and Hong Kong-based alternative asset management firm Templewater, with each contributing $15.2 million (USD 10 million).

Hysata has earmarked the new funding to expand production capacity at its manufacturing facility near Wollongong on the New South Wales south coast, and further develop its technology as it focuses on reaching gigawatt scale manufacturing.

The company, a spinoff from the University of Wollongong, is developing new high-efficiency electrolysers that are designed to produce green hydrogen at scale with higher energy efficiency and lower costs than alternative technologies.

Image: Hysata

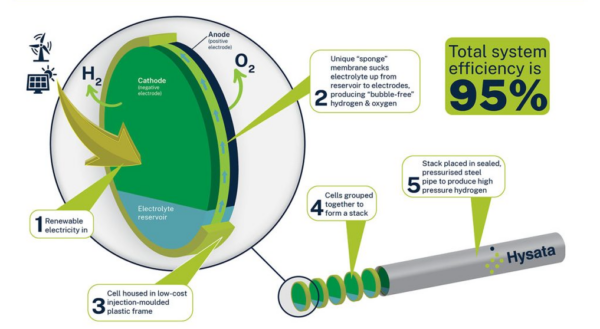

Hysata said its technology “combines engineering and science in a unique capillary-fed alkaline electrolyser that uses less energy to convert water to hydrogen.”

The electrolyser design is underpinned by an ultra-low resistance separator, and bubble-free operation, which collapse the resistance of the cell creating step-change efficiency that leads to lower cost green hydrogen.

Hysata Chief Executive Officer Paul Barrett said the company is aiming to accelerate the decarbonisation of hard-to-abate sectors such as steel, chemical manufacture, and heavy transport, by delivering the world’s most efficient, simple, and reliable electrolysers.

“With high-efficiency, intrinsically low capex and a mass-manufacturable design, Hysata aims to drive down the levelised cost of hydrogen,” he said.

“This funding round, backed by a world-class syndicate of investors, demonstrates the game-changing impact Hysata is having on the green hydrogen landscape. It will strengthen our team and enhance our capabilities, as we propel towards widespread commercial availability.”

Image: Hysata

Hysata claims that at scale its electrolysers could achieve energy efficiency well above International Renewable Energy Agency’s 2050 efficiency target, which calculates under the 1.5°C scenario, green hydrogen and its derivates may abate 12% of emissions and account for 14% of final energy consumption, which requires scaling up global electrolyser capacity to 5,722 GW by 2050.

BP Ventures Vice President Gareth Burns said green hydrogen is expected to play a big role in decarbonisation and is one of the oil and gas giant’s transition strategies with regional hydrogen energy hubs in development including, the H2Kwinana and Australian Renewable Energy Hub projects in Western Australian.

Burns said BP Ventures’ investment in Hysata is the company’s first in advanced alkaline electrolyser technology.

“Hysata’s electrolyser could provide optionality for our hydrogen business as BP aims to become a global leader in low carbon hydrogen production,” he said.

“Hysata’s technology could help save energy and reduce production costs, addressing two challenges of the green hydrogen market. We’re excited for Hysata’s next steps.”

The investment round was also backed by existing major strategic and financial investors IP Group Australia, Kiko Ventures, Virescent Ventures on behalf of Clean Energy Finance Corporation, Hostplus, Vestas Ventures and BlueScopeX.

New investors in the Series B round included Posco Holdings, IMM Investment Hong Kong, Shinhan Financial Group, Twin Towers Ventures, Oman Investment Authority’s venture capital arm IDO, and TelstraSuper.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.