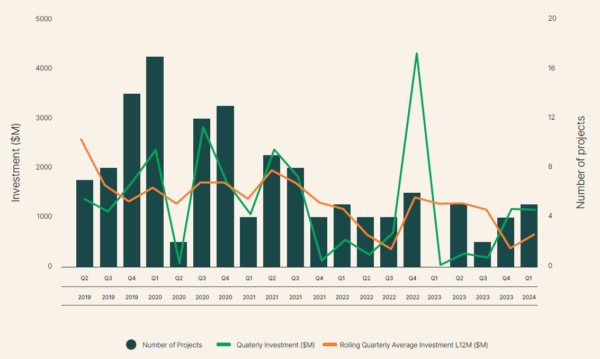

The Clean Energy Council (CEC) Renewable Projects Quarterly Report Q1 2024 says it’s been the best quarter for large-scale renewable energy generation financial commitments since the end of 2022 and the fourth consecutive quarter energy storage projects secured commitments over $1 billion (USD 670 million).

After falls in large-scale renewable generation projects reaching financial commitment in 2023 and none in the same quarter last year, the report shows a rise in commitments for a second quarter in a row, recording $1.1 billion from five projects with a combined capacity of 895 MW.

As a result, the rolling-12 month quarterly average for investment of generation projects increased by 79% to $659 million.

Total investment for storage projects in Q1 passed $1 billion for the fourth quarter in a row at $1.1 billion, and for the first time the quarterly energy storage average passed 3,000 MWh, at 3,084 MWh. The CEC says the average has increased by 308% compared to Q1 2023.

Image: Clean Energy Council

CEC Chief Executive Kane Thornton said the results are an encouraging sign that Australia’s clean energy transformation is moving in a positive direction and on the road to recovery.

“Landmark commitments made by the Federal Government in recent months have been designed to build certainty for renewable energy investors, which we expect will drive a resurgence for the large-scale generation we need,” he said.

“Investment in large-scale storage continues to be very strong, following a record year in 2023. It is abundantly clear that renewables firmed by storage are the future of Australia’s energy system and investors have a strong appetite for new energy storage projects.”

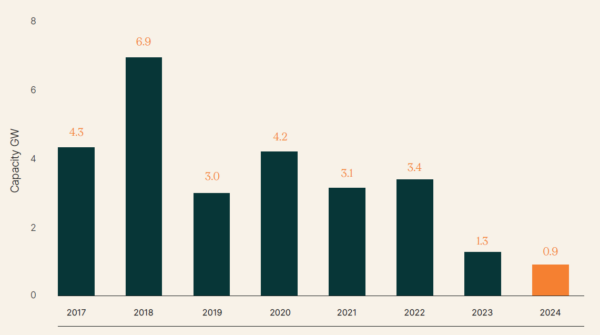

However, the report says that while capacity generation projects improved for a second quarter in a row, and the average for those financially committed increasing to 539 MW, it is the fourth-lowest average since the CEC began tracking project capacity in 2017.

It is also a drop of 22% compared to the rolling average of Q1 2023, remaining well below investment levels needed to meet 82% renewables by 2030 target.

“Investment levels in generation projects will need to increase further with financial commitments of at least 6 – 7 GW of new large-scale generation projects needed in 2024 (and successive years) to meet the Federal Government’s target of 82% renewables by 2030,” the report says.

Downloaded by EF 7/6/24

The CEC identifies barriers to investment as higher financing and supply chain costs, drawn-out planning and environmental assessment processes in some areas and the legacies of a decade of underinvestment in our transmission network, the CEC says.

Construction of generation project figures are also down 40% lower than the generation capacity commenced in Q1 2023.

However, European Energy’s 56 MW Mokoan Solar Farm, Victoria, Squadron Energy Group’s 414 MW Ungula Wind Farm, New South Wales, CleanCo’s 250 MW / 500 MWh Swanbank Battery, Queensland and Synergy’s 500 MW / 2,000 MWh Collie battery energy storage system (BESS) in WA, did all begin construction.

Financially committed projects in Q1 include two solar projects, Metis Energy’s 94 MW Gunsynd Solar Farm, Queensland and the Gold Fields’ hybrid wind and solar 77 MW St Ives Renewables Project in Western Australia (WA).

Large-scale energy storage projects financially committed include Origin Energy’s 300 MW / 650 MWh Mortlake Power Station Battery, Victoria and Epic Energy’s 100 MW / 200 MWh Mannum BESS.

Two solar farms and one BESS reached commission, representing 255 MW of new installed capacity in the grid, and $800 million worth of investment.

In Queensland, these were Vena Energy’s 125 MW Amazon Solar Project – Wandoan and Genex Power’s $30 million, 50 MW / 100 MWh Bouldercombe Battery Project, and in Victoria, CIMIC Group’s Glenrowan Solar Farm.

There are currently 121 generation and storage projects which have either reached financial commitment or are under construction, equating to 12.3 GW of electricity generation project capacity, as well as 8.4 GW / 18.8 GWh of energy storage projects.

Overall, 212 generation and storage projects have now been commissioned since 2017, representing 16.2 GW in new electricity generation capacity and 1.8 GW / 2.4 GWh of storage projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.