BNEF lowers 2020 global PV outlook due to coronavirus concerns

Many solar factories in China are starting to resume production, suggesting that concerns about supplies of PV components could soon begin to ease. Nevertheless, the temporary standstill will have an impact on the global solar market, as the implementation of some projects will probably be postponed until next year.

Coal developers risk half a trillion dollars down nonrenewable drain

A new report from financial think-tank Carbon Tracker has found that coal developers risk wasting more than $600 billion due to stubborn resistance to the already cheaper electricity resources provided by renewable energies worldwide. The report finds, in short, that a new coal plant is about as prudent an investment today as a Clydesdale and cart.

Solar-powered trees for cool spots in urban hot spots

A Japanese consortium has started producing solar-powered ‘urban furniture’. The result is a solar-plus-battery bench with cooling elements and vaporizers.

Evaluating battery chemistries for grid-level storage

Researchers in China have ranked some of the most commonly used battery chemistries according to parameters deemed important for grid-level storage. The team gave a score in each category and determined a winner – and it wasn’t lithium-ion.

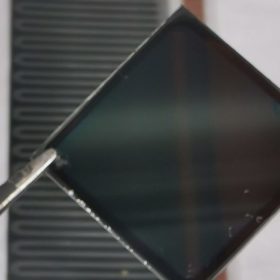

International consortium claims 25% efficiency for flexible CIGS solar cell

Researchers led by Belgian institute imec claim to have achieved the result with a 1cm² flexible thin-film cell intended for building-integrated PV application. The result tops the 24.6% efficiency the consortium announced in September 2018. The cell’s developers are now aiming for 30%.

Jinko Solar the world’s biggest module provider again in 2019

The solar giant shipped 14.2 GW of modules last year, up 33% on 2018 for the high-water mark of another year dominated by Chinese manufacturers.

Coronavirus could cost Chinese battery makers 26 GWh of output

WoodMac analysts say the amount of new battery manufacturing capacity added in the nation this year could fall by as much as 10% because of the outbreak. With Tesla’s Shanghai gigafactory affected by the extended new-year-holiday shutdown, the analyst warned of potential supply shortages for Australia and the U.S. and U.K.

Total to buy 50% stake in Adani Group’s 2.1 GW solar portfolio

The French oil and gas giant—which is already a partner in Adani’s natural gas business—will now invest US$ 510 million to buy 50% stake in 2,148 MWac operating solar power projects owned by Adani Green Energy Limited.

Coronavirus could cause solar panel price spike

The coronavirus outbreak in China could raise solar module prices in the near term as manufacturers have already begun experiencing wafer and solar glass shortages. Production rates are also being affected by an extended new year holiday introduced by the authorities as a measure to deal with the virus, and the requirement workers from infected areas quarantine themselves for two weeks.

A record-breaking quarter for Tesla energy storage and an improvement in solar

The internet’s favorite energy company installed 530 megawatt-hours of battery storage in Q4, beating out the previous record, set last quarter, as well as showing continued improvement in solar installations.