BayWa’s lessons from expanding into Southeast Asia

In recent years, global renewables developer BayWa re has been turning its attention to the Asia Pacific, expanding into Southeast Asia. Junrhey Castro, the company’s director of solar distribution in Southeast Asia, sat down with pv magazine Australia to discuss its experiences in the emerging markets of the Philippines, Thailand, Malaysia, and Vietnam.

Gentari seals deal for Wirsol’s Australian solar and storage assets

Malaysian oil and gas giant Petronas’ clean energy business Gentari has finalised its acquisition of Wirsol Energy’s Australian renewables assets, including 422 MW of operational capacity across solar and storage facilities, and 765 MW of potential capacity under development.

Malaysian oil giant reportedly set to buy Wirsol’s Australian portfolio

Malaysian oil giant Petronas is reportedly set to buy the Australian renewable assets of German developer Wirsol. With roughly 750 MW of solar and storage projects and nearly double that in development, the deal could be worth between $900 million (USD 625 million) to $1 billion, according to Reuters.

Malaysia to grant 4-year PPA extensions to bidders in large-scale solar tender

The Malaysian authorities have revealed that they will extend power purchase agreements from the fourth LSS4 tender for large-scale PV from 21 to 25 years.

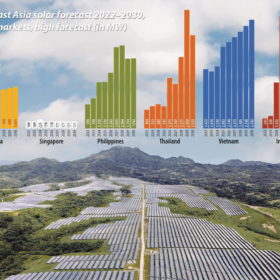

Weekend read: Southeast Asian interconnection

While near neighbours, the electricity generation of the countries of Southeast Asia couldn’t be further apart. Indonesia burns locally mined coal, Malaysia has reserves of oil and gas, while populous Singapore, Vietnam, and the Philippines, depend on fossil fuel imports. They could all benefit from increased solar imports, but higher grid capacities and interconnection are key for an opportunity to unlock the power of the sun.

IRENA highlights solar critical to ASEAN energy transition

Indonesia will have to get to work installing more than 24 GW of solar this year – and every year – if the region is to achieve the 2.1 TW to 2.4 TW of photovoltaics the International Renewable Energy Agency has estimated it will require to achieve a net zero carbon energy system by 2050.

Malaysia energy major targets early closure of coal plants

Malaysia’s largest electricity provider Tenaga Nasional Berhad has announced plans to fast track the closure of its coal-fired power plants to hasten the transition of its generation fleet from fossil fuels to renewable sources including large-scale solar PV and green hydrogen.

Singapore regulator issues fresh appeal for clean power

Singapore’s Energy Market Authority has already attracted proposals for 1.2 GW of renewable electricity, to be generated in four southeast Asian nations, and wants to raise that figure to 4 GW by 2035.

‘Clear winds of change’ in Southeast Asia

After a decade of under-delivering on its potential, there are changes afoot in Southeast Asia’s renewable energy development, says Assaad W. Razzouk, the CEO of Singapore-based developer Gurin Energy. Razzouk points to success stories in the region and notes that political will and clear regulations for developers are needed.

Malaysia’s water reservoir to host 150 MW floating solar plant

The floating facility will be built by Japan’s Shizen Energy and will sell power under unspecified conditions to local utility Syarikat Air Melaka Bhd (SAMB).