While SolarEdge may have built much of its reputation and sales volumes in through the sales channels of the solar lease providers like Sunrun and Solar City, in Australia it has pursued direct sales and is working closely with utilities. The Israel-based company has had considerable success, and is now targeting C&I rooftops for further growth, a market segment it describes as “still waking up.”

“We see the Australian market is a mature market. We see very nice ecosystem in which companies can make money, and system owners understand the value,” SolarEdge Founder and VP, Market and Product Strategy told pv magazine. “Utilities are selling PV in Australia, at high volume, which is very indicative of the maturity level of the market.”

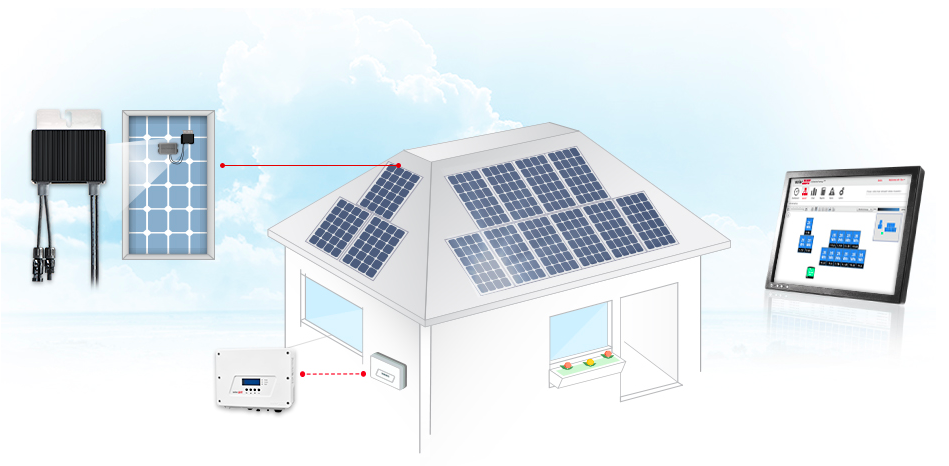

As with the solar leasers in the U.S., utilities in Australia would likely see additional value in the SolarEdge offering, in that its optimizer and inverter solution provides more granular data as to each PV arrays’ performance. Furthermore, SolarEdge’s monitoring platform provides information about not only the array’s performance, but also individual strings and modules.

“It’s a great market, mature and excellent – and it is still growing,” enthused Handlesman. “There is still many rooftop and the commercial market is still waking up.”

Handlesman continued that he believes SolarEdge is one of the leading inverter suppliers to the C&I market segment in Australia, based on the “SolarEdge benefits” of quicker installer, overal efficiency, reduced cabling, quality of service, monitoring and a reduction in the cost of ownership.

Optimizer competition

One of SolarEdge’s major competitors in recent years has been U.S. microinverter supplier Enphase, for which Australia remains one of its key markets. However, recent financial problems at Enphase has undermined its position in the marketplace, with questions as to the company’s bankability in the long term.

SolarEdge’s Handlesman says that his company has been picking up market share in Australia that is being ceded by Enphase – although he acknowledges that that kind of market info is not currently offered to the Australian marketplace.

“We hardly see them now,” said Handlesman, displaying more than a modicum of chutzpah. “Their [Emphases’] position in the Australian market isn’t as strong as it was – from what we see in terms of competition and competing bids.”

A clear point of difference between the two companies is their approaches to storage. While Enphase developed its modular AC battery solution, SolarEdge has been happy to work with a number of different battery system suppliers. A prominent early partner with Tesla, in September SolarEdge announced a partnership with LG for the North America market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.