Rooftop PV continued its record-breaking streak in the first quarter of 2020 despite the spread of Covid-19, finds a new Clean Energy Regulator (CER) report finds, while large-scale renewables deployment slowed down but is generally on track. Although the economic slowdown may affect new projects looking to secure finance in the short to mid-term, the regulator says that such an effect has yet to emerge in new project announcements.

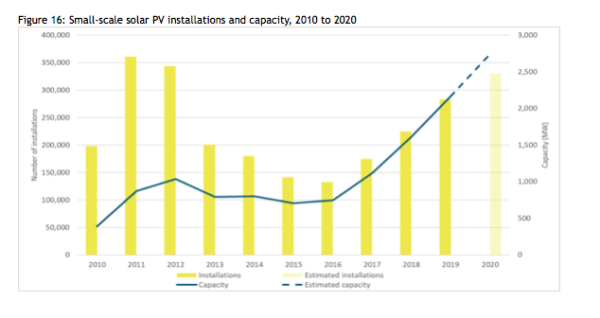

Small-scale PV capacity installed in the first quarter of 2020 was up by 33% year-on-year with no detected slowdown in the installation rate. In its Quarterly Carbon Market Report, the CER highlights the continued strong uptake of rooftop PV, with an additional 609 MW of sub-100kW systems added in the first three months of 2020. The average rooftop PV system size and installations increased by 9% and 22% respectively on Q1 2019 to 7.6kW and 75,000.

If not for the potential impacts of Covid-19, the CER finds that the total added capacity for 2020 would remain on a trajectory for 2.7 GW against the record 2.2 GW in 2019. However, it says that with current uncertainties, it is too early to say whether this goal will be achieved.

System orders have remained strong through to May, the CER says, in the face of fears that demand for new systems would decline owing to increasing unemployment and other uncertainties. But it is still unclear what lies further down the line, particularly in regard to the length of the order books.

Tristan Edis, Green Energy Markets Director, Analysis and Advisory, told pv magazine Australia earlier this week “the long installation backlogs that were in place prior to the implementation of the Covid-19 social restrictions have been whittled away.” While backlogs of six weeks were common prior to March 20 restrictions, Edis says that they are now much shorter for many retailers. “If you then add a four-week lag for STC registration onto six-week installation backlog then the impact of Covid-19 will only really be seen in June STC registration figures,” he says.

Despite the encouraging quarterly results, the CER acknowledges that most in the industry are expecting some moderation and the watchpoint is whether 2020 can still exceed the record set in 2019. In total, 10.6 GW of capacity has been installed under the SRES since its inception, with 99.9% of capacity coming from small-scale solar PV and the remaining from small-scale wind and hydro.

Large scale additions and pipeline

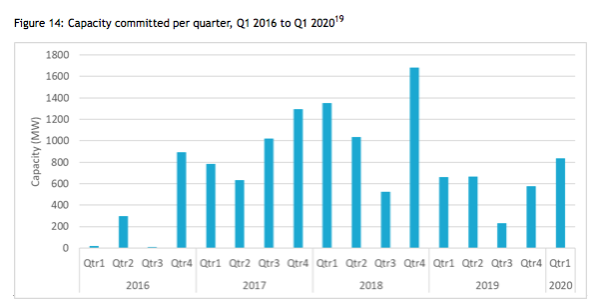

Q1 2020 saw 678 MW of large-scale renewables added to the grid, the CER reports, including the 121MW Bomen Solar farm in New South Wales. A total of 837 MW of newly committed large-scale renewable capacity reached financial close throughout the quarter, but the construction of large-scale projects has experienced delays.

The CER says that there are still good prospects that around 2 GW of new solar and wind projects will reach financial close this year. This is less than half the 4,400 MW worth of utility-scale projects reaching financial close in 2018, and around the level achieved in 2019.

However, Q1 was exceptionally strong posting the highest level of committed projects announced since Q4 2018. This included a large increase in projects associated with off-grid and resources regions, which have emerged as a new driver of large-scale renewables investment.

The CER reports that “there are currently 1.9 GW of projects with a Power Purchase Agreement (PPA) between strong counterparties”, but adds that “current circumstances may cause delays and renegotiations to get some of these projects to financial close”.

Supply

While the new supply of components was expected to face constraints owing to increased importation costs, timing for shipping slots, changing exchange rates, and supply chain disruptions, initial industry analysis suggests that Australian solar businesses have been relatively insulated from the shock to date. The CER notes that the reason behind this were long order books and solid inventory in Australia, and the fact that the production of key components from China was rapidly resuming.

“The extent to which these factors result in a material increase in the cost of components delivered to Australia, or issues in obtaining sufficient supply, depends on many factors including what happens world-wide with demand for such components and the details of any long-term supply contracts,” the CER adds.

Off-grid boom

The latest report also confirms that renewable electrification in the resources sector is a growing market in Australia, particularly at off-grid mining sites. Q1 saw major announcements by Shell, Fortescue Metals Group and Rio Tinto for new large-scale solar installations.

The CER is tracking 371 MW of renewable energy projects that are at various stages of completion. Of these, 270 MW were newly committed in Q1 2020, making up 33% of the total newly committed capacity for Q1.

Data collected by the CER indicates that across Australia, for 2018-19 there was 6,500 GWh of electricity being generated and consumed off-grid. Of this, approximately 477 GWh (7%) was generated by solar, wind and biomass. The CER estimates there is potential for additional renewables of up to 2.1 GW of utility-scale solar to replace this existing generation.

Currently tracked projects are predominantly solar PV. “This could be a result of the greater consistency and predictability of solar generation, which may make it preferable to wind in off-grid environments,” the report says, adding that “this is still an emerging market and it is unclear whether this trend will persist in the long run.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.