In its new paper — Battery Storage — The New, Clean Peaker — released on the weekend, the Clean Energy Council (CEC) has amassed a battery of evidence that large-scale battery energy storage has become the superior solution to spreading energy generated by solar and wind throughout any day, and instantly responding to peak energy needs in the National Electricity Market (NEM) for long and short durations.

The paper compares the levelised cost of energy delivered by a new 250 MW gas peaker plant with 250 MW four-hour and two-hour grid-scale batteries, and finds that overall — when capital cost, cost of fixed operations and maintenance, and cost of variable operations and maintenance are calculated — the batteries are 17% (2-hour) and 30% (four-hour) cheaper.

Improvements in battery-operating technology mean storage now outperforms gas-fired peaking plants on speed and reliability of response, which was the basis of gas technology’s biggest claim to a place in the future renewable-energy-based electricity system.

Where gas plants can respond within 15 minutes, says the CEC report, battery solutions can discharge as “demand (and correspondingly prices) approach peak levels” and sustain output “to cover the typical daily peak duration”.

CEC Chief Executive, Kane Thornton, said in a statement released with the report, “Batteries can ramp up quickly, have zero start-up time and provide a better frequency response.”

He referred not only to the study as evidence, but to the experience of large-scale batteries such as the Hornsdale Power Reserve connected to the NEM over recent years, saying, “Over the past three years, batteries have been essential in keeping the grid stable and keeping power flowing to energy users.”

The paper draws on the Australian Electricity Market Operator’s calculation that by 2040 between 6.6 GW and 19 GW of new dispatchable resources will be required to help meet fluctuating demand, and to stabilise frequencies across a NEM that will be powered by 26-50 GW of new renewables.

CEC findings underscore that, “batteries are now the most prudent choice to meet this level of dispatchable capacity”, it says.

Image: Clean Energy Council

Commitment to battery projects is already phenomenal

Where capital cost was previously the biggest barrier to more widespread deployment of grid-scale batteries, product innovation and manufacturing at scale have already helped drive those costs down to the point where this year alone has seen developers announce 15 large-scale battery storage projects, with a total of 6.6 GW of capacity and $4.3 billion of investment.

These include AGL’s 200 MW four-hour duration battery storage facility to be built adjacent to its coal-fuelled Loy Yang Power Station; the ACT Government’s budgeting for a 250 MW battery energy storage system (BESS) to support the Territory’s grid; renewable developer Neoen’s plan for a 500 MW BESS west of Sydney in Wallerawang; and Edify Energy and Precinct Capital’s plan to build a 28 MW battery to stabilise the grid in Newcastle’s industrial precinct of Mayfield West.

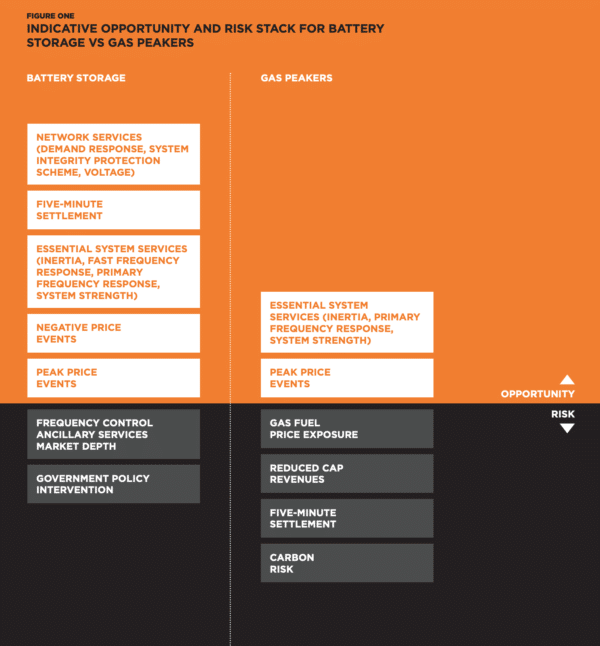

Delivering Frequency Control Ancillary Services (FCAS) is not the only source of revenue to reward investment in batteries, and although the markets for battery services are still emerging, batteries can offer a wider range than gas peaker plants of network services, such as digital inertia, voltage support and system strength — at lower cost.

“It is no longer economically rational (or necessary) for proponents, investors or governments to build gas peaking plants in Australia,” states the CEC report, seeking to shatter once and for all the preference that “some” in the government and industry hold “for new gas peakers as the firming support for variable renewable energy”.

The economic risks of operating gas peaker plants

In fact, the report finds that risks to shareholders, tax payers and electricity customers, posed by investing in gas peaking technology are growing. They include:

- The NEM’s move to five-minute settlement from October this year, which will challenge the ability for peaking plants to defend their traditional cap contracts and respond to price spikes.

- The volatility of gas fuel prices

- The uncertainty of gas supply volumes and

- The risk of premiums being imposed on such carbon emitting technologies

Batteries of course not only emit no carbon during the discharge of their energy, but they facilitate greater uptake of renewable technologies while providing stability and security services to the grid.

Greater reliability, longer life, and cheaper by the day

The CEC also argues that the responsiveness — the necessary ramping up and down of peaking service providers — does not favour gas plants which will, says the CEC have a shorter lifespan when operated in a grid increasingly powered by renewables; and also require more regular downtime for maintenance.

“In contrast,” writes the CEC, “batteries have higher availability (given less maintenance work is required) and can offer guaranteed fixed power and energy for over 20 years to effectively maintain capacity over their entire useful life.”

Over time, batteries will become even more economical as a source of peak energy, as the costs of battery production fall, and the price of energy from proliferating renewable generation also becomes cheaper.

“The commercial case for batteries will continue to improve as battery technology advances and new markets are established to reward the services they provide,” says Thornton.

His one caveat in the undeniable, researched outcome of this BESS-vs-gas peaker comparison, is that long-term certainty for investment in batteries, “remains reliant on appropriate market reforms and forward-looking policy that incentivise new, flexible technologies that are needed to complement renewables”.

The methodology and modelling assumptions behind the CEC report are explained in its appendix.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

But with BESS, we need base load power generation capacity, when we have very low power generation due to cloudy/rainy days or low wind days to meet demand. With large BESS systems incentive for Solar & wind generators to install BESS will be uneconomical , So they may tailor the generation capacity to suit available grid capacity only. Hence, we cannot eliminate Base load generation using more efficient fossil fuels, which is Gas & Renewable Hydrogen (using Solar/wind/Hydro), to eliminate coal power generation.