The Clean Energy Regulator (CER) last week released its Carbon Market Report for the June Quarter and rooftop solar customers can once again be proud of their contribution to emissions-reduction — with 803 MW of PV installed — an 18% increase over the same quarter last year; while large scale solar and wind are showing an upturn in financial investment decisions (FID) in the second quarter of 2021 (725 MW) compared to the dismal first quarter (19 MW).

Given this quarter’s performance, the CER says “Australia’s carbon markets are on track to meet expectations estimated in the December 2020 Quarterly Carbon Market Report,” which forecast a total carbon emissions reduction of 57 million tonnes for 2021.

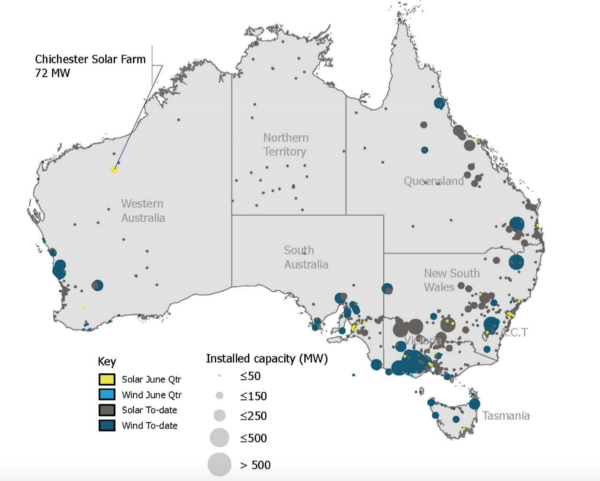

power station accredited in the June quarter.

Image: CER

Large-scale solar and wind have been the renewable sectors of most concern in the industry, with investors both keen but cautious, given the uncertainties caused by delayed grid connections, transmission infrastructure shortfalls, and fossil-fuel-favouring policies issued by the Australian Federal Government.

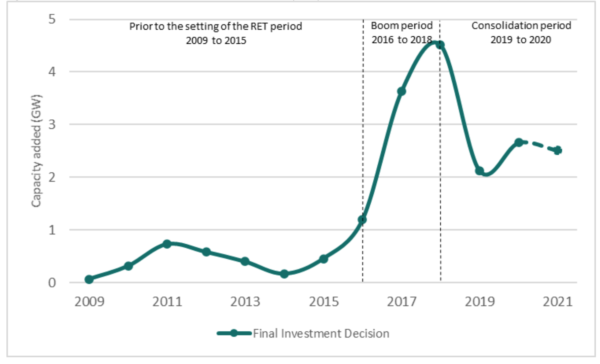

In this Quarterly Carbon Market Report, the CER says that based on the 744 MW of large-scale solar and wind projects reaching FID this year so far, plus 1.6 GW expected to reach FID in the second half of the year, plus the potential for some of 2022’s 1.6 GW expected to reach FID achieving that landmark a little ahead of schedule … it expects the total capacity achieving financial investment decision this year to equal last year’s 2.7 GW, and perhaps even exceed 3 GW.

The CER cautions that investment trends can only be accurately identified by considering multiple years rather than single quarters, but that based on current information, investment in large-scale renewables “seems to have settled at an average of approximately 2.5 GW per annum reaching FID and may be trending up”.

Image: CER

An extraordinary effort

In its report, the CER uncharacteristically editorialises, “This is quite an extraordinary effort by the renewables industry in the context of increasing difficulty, time and cost in grid connections” and the belief by some industry pundits that investment could fall to zero once it was clear that enough capacity would be built to meet the 2020 Renewable Energy Target.

It says that with a joint probable pipeline of 7.1 GW in committed projects, the outlook for the renewable energy industry over the coming few years is positive.

However, it adds, that, “At some point, investment in renewables may stall if delivery of transmission and interconnector upgrades are not sped up.”

Transmission of the abundance of clean electrons remains in doubt

The weekend saw a disturbing reported blowout in costs of new transmission in the National Electricity Market NEM, with HumeLink (the 500 kV connector from Snowy 2.0 massive pumped-hydro storage and renewable generation project to Wagga Wagga, Bannaby and Maragle) up from $1.35 billion to $3.317 billion; the VNI-West link from Ballarat to Wagga Wagga up from $2.4 billion to $4 billion.

Craig Stallan, an executive manager at transmission network operator TransGrid, which is building HumeLink, told the Sydney Morning Herald that the project is “a fundamental enabler” for new renewable energy supply to be added to the grid.

Simon Corbell, Chief Adviser at Energy Estate and CEO of the Clean Energy Investor Group agreed, saying, it is “critically important that we expedite transmission projects such as HumeLink” as part of Australia’s climate change action.

Transmission remains a contentious piece of the energy-transition puzzle, with its long timelines to approval and construction, and the constant reassessment in the light of potentially more flexible and lower-cost alternatives such as virtual transmission consisting of large-scale battery storage “relays”.

Bruce Mountain, director of the Victoria Energy Policy Centre, told the Herald on the weekend, for example, that many other transmission ventures are vying for funds as renewable energy projects seek to connect to the NEM, and that greater transparency was needed around how choices for investment are made, and the impacts on household energy tariffs.

The costs of HumeLink will ultimately be borne by customers of AusGrid and Mountain calculates the projected blowout will increase New South Wales residential electricity bills by 4%, raising annual average charges of about $1500 by $60.

If approved, the project would lift New South Wales household tariffs by about 4 per cent, raising average annual bills of $1500 by $60, he said.

Nothing beats self-generation and consumption of solar energy

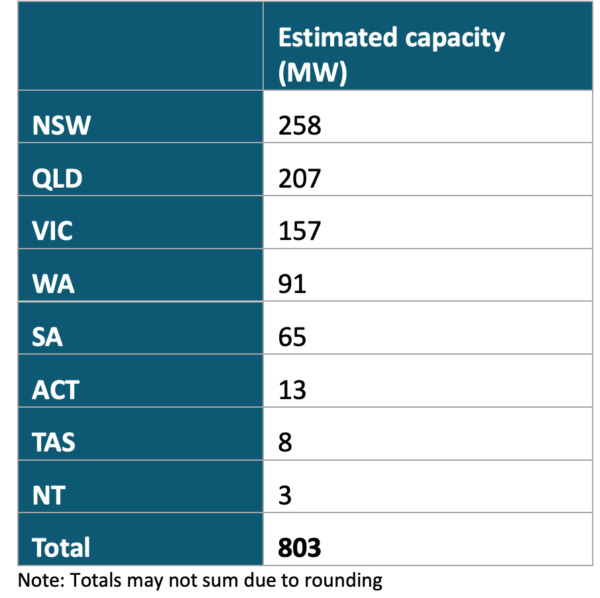

In the meantime, the CER shows New South Wales leading the rooftop solar installation board, with 258 MW of capacity added in the June quarter, more than 50 MW ahead of Queensland at 207 MW, and 100 MW ahead of Victoria which nonetheless laid on 157 MW.

Image: CER

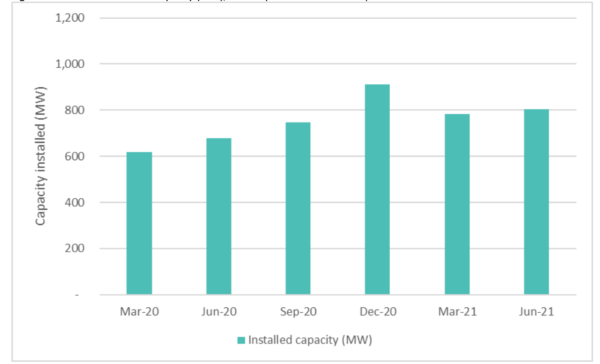

Although the CER says it’s too early to know the impact that Covid-induced lockdowns, most drawn out in Victoria and New South Wales this year, will have on final figures for rooftop solar in 2021, it says more rooftop solar is typically installed in the second half of any year, and there is still opportunity for the numbers to surge.

Based on installed rooftop capacity in the first half of 2021, “and assuming this seasonal pattern had held, the total capacity for the year could have exceeded 3.6 GW”, says the Quarterly Carbon Market Report, but the impacts of lockdowns are likely to dampen installations such that the country can merely expect to repeat last year’s stellar 3 GW of installed capacity, perhaps a smidge more.

The 18% growth in rooftop PV over the same period last year has been driven both by increasing numbers of installations (97,100 this year compared to 84,700 in last year’s June quarter) and an increase in average system size, from 7.5 kW to 8.3 kW.

Image: CER

Overall, in schemes administered by the CER, the Small Scale Renewable Energy Scheme — rooftop solar — is expected to this year deliver 15.5 million tonnes of the total forecast 57 million tonnes in emissions reduction; large-scale renewable energy projects are on track to contribute 24.3 million tonnes, which is 2.9 million tonnes in excess of the Renewable Energy Target-legislated demand for the year.

In addition to carbon emissions displaced by clean, renewable generation, projects under the Emissions Reduction Fund portfolio, which include gas captured from waste and carbon sequestration by revegetation, have increased 5% over the same period in 2020, and are on track to contribute 17 million tonnes of emissions abatement.

Australian Carbon Exchange is a goer

The Clean Energy Regulator says it is now close to founding an exchange for Australian carbon credits, with a call for expressions of interest for the Australian Carbon Exchange (ACX) having generated 27 responses by the deadline of 20 June 2021.

An exchange will reduce transaction costs and normalise the trading of carbon credits for individuals and companies.

Australian Carbon Credit Units have risen in price by 40% this year and are expected to continue to rise to 2030 as new emissions reductions targets declared by companies begin to generate action and carbon accounting improves.

On that topic, the Clean Energy Regulator is co-designing the Corporate Emissions Reduction Transparency (CERT) report initiative and pilot, and it says, “Consultation on the refined guidelines will occur later in 2021.”

Company emissions reduction targets are an important driver of large-scale renewable energy projects in that having corporate power purchase agreements (PPAs) in place is seen as a strong indicator of success for proposed large-scale solar projects.

The CER report says, “Prospects for renewables in 2022 and beyond are bright with the pipeline of projects that have a power purchase agreement and development approval growing [in the June quarter] by 60 MW to 511 MW.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.