The Future Battery Industries Cooperative Research Centre’s flagship project, the new pilot plant will, as the name suggests, establish the technology and capabilities for Australia to design and build cathode precursor manufacturing facilities on a commercial and industrial scale.

Cathode precursors are engineered materials which tend to be one of the highest cost components of a battery cell.

The pilot plant is the “culmination of several years of hard work,” Future Battery Cooperative CEO Shannon O’Rourke said, and it seeks to capitalise on the fact Australia, particularly Western Australia, produces all the elements needed for modern batteries.

The Cathode Precursor Production Pilot Plant

Located at Curtin University in Bentley, just south of Perth, the pilot plant has been supported by 19 industry, research and government groups.

Over 18 months, the plant will run a series of test campaigns through four fully integrated and automated precursor cathode active material (P-CAM) production units, provided by German chemical giant BASF.

The four units will enable the plant to run different compositions and ratios of chemistries simultaneously, or to run the same chemistries under four different conditions, changing variables such as temperature, pH or stirring rate, the Future Battery Cooperative said.

The produced precursor cathode active materials will then be lithiated, calcined and electrochemically tested at the Queensland University of Technology’s Electrochemical Testing Facility.

Capturing the booming battery market

The global battery market is expected to grow nine to 10 times by 2030 and 40-fold by 2050, the Future Battery Cooperative and WA government both note in their releases on the news. This would equate to roughly $23 trillion being spent on the technology before 2050.

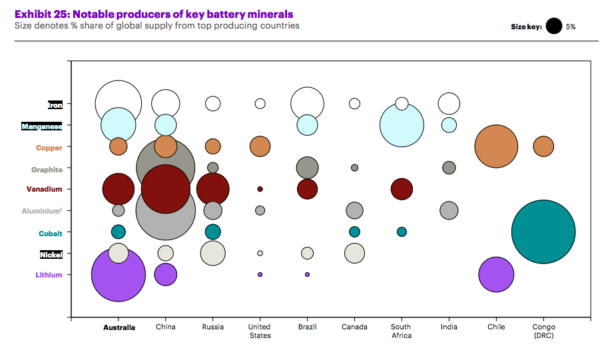

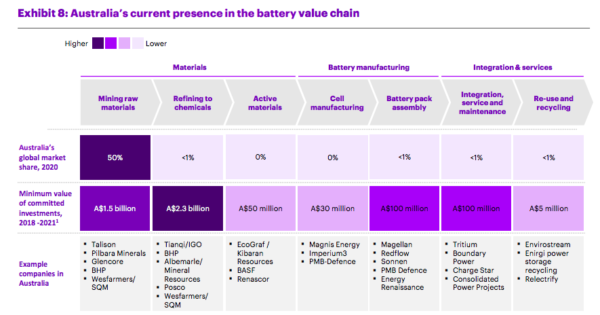

Australia is unique in that it is home to all the raw materials required to make high performance batteries including lithium, cobalt, nickel, manganese and graphite, so it makes sense for the country amass more of the battery value chain in the form of processing and manufacturing.

While the economic case is self evident, it’s worth noting battery material refineries have been criticised for their environmental impacts – which may be why most of the chemicals processing has tended to be done in developing countries, with China easily holding the lion’s share.

Western Australia is rapidly embracing downstream processing for batteries though. Earlier this year, Australian miner IGO and China’s Tianqi produced its first batch of battery grade lithium hydroxide at its Kwinana refinery in WA. (IGO is also listed among this pilot plant’s project participants).

Mineral sands miner Iluka Resources also reached a final investment decision to proceed with the construction of its first rare earth oxide refinery, the Eneabba Rare Earths Refinery, this year.

The Future Battery Cooperative believes establishing an active materials manufacturing capability in Australia could deliver $1 billion to the economy and support 4,800 jobs by 2030, according to its report Future Charge — Building Australia’s Battery Industries.

Project participants

The pilot has been supported by BASF, BHP Nickel West, the CSIRO, Queensland University of Technology, Curtin University, and the University of Technology Sydney among others.

The WA government has also committed $13.2 million to facilitate global investment in precursor cathode manufacturing, it noted.

“Australia has the potential to develop into a competitive player in the international batteries industry. The Pilot Plant launch is a significant step in developing the onshore capabilities and industry knowledge to create thousands of jobs and add billions of dollars to our economy,” Shannon O’Rourke, CEO of the Future Battery Industries Cooperative Research Centre said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

hello my name is Gaven Scott

I am very interested in finding out more about battery advancement and where the industry is moving to in terms of new products, advancement and new technology.

Kind Regards

Gaven Scott