Today Western Australia supplies the majority of the world’s lithium, but with demand soaring and a new cohesion around positioning Australia to become a global battery materials hub, projects have picked up a new sense of urgency.

This is certainly true of the Finniss Lithium Project in Darwin, owned by Core Lithium. It is Australia’s first lithium mine outside of Western Australia and its opening comes just one year after construction began.

The project is aiming to produce around 16 million tonnes of lithium-bearing ore over the mine’s 12-year life expectancy, primarily for overseas exports with a focus on Asia.

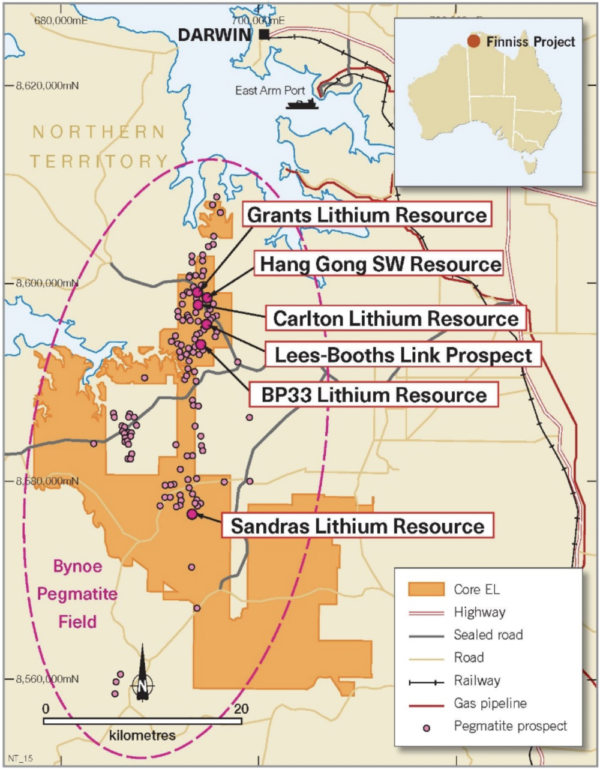

Image: Core Lithium

By early next year, 2023, Finniss Lithium Project’s concentrator facilities are expected to be operational, producing lithium concentrate that will be of “battery-grade” – a high enough quality to be used in electric vehicles (EVs) and the big batteries increasingly deployed to store renewable energy generated throughout the day.

In April 2021, the ASX-listed Core Lithium announced the Australian Nuclear Science and Technology Organisation (ANSTO) completed test work from a sample of its product from the Finniss site, successfully extracting over 95% of lithium on two kilogram samples of blended concentrate in two separate tests.

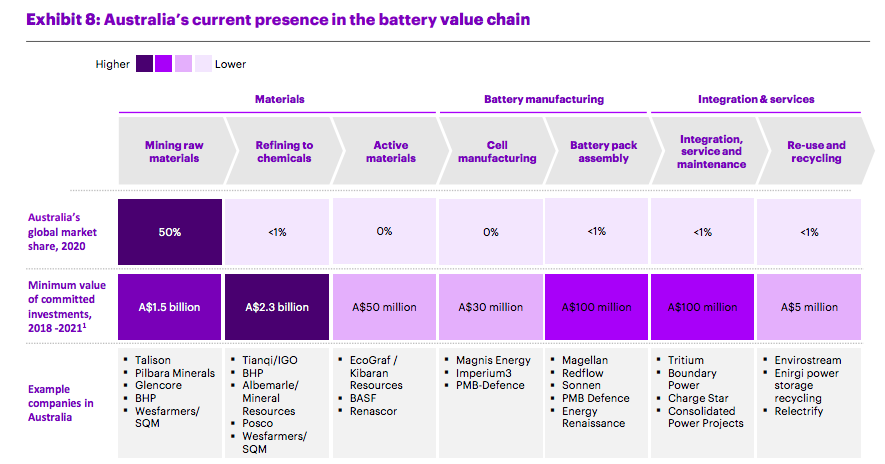

Australia is already the world’s largest lithium supplier, though both governments and industry appear to be putting increasing emphasis on moving beyond our global “quarry” status to establish more battery material processing facilities onshore to capture the full value chain of the expanding industry.

The demand for lithium has grown so rapidly the prospect of global shortages have already began to cause panic, leading companies scrambling to shore up supplies.

From day one of operations, the Darwin mine already had the vast majority of its output secured through binding offtake agreements with China’s Ganfeng Lithium and Sichuan Yahua to supply 75,000 tonnes per annum of lithium concentrate to each company over four years.

Image: Core Lithium

The flagship project is situated in what the company described as “one of the most prospective areas for lithium in the NT,” the Bynoe Pegmatite Field.

Core Lithium has been granted tenements – effectively a claim, lease or licence to the area – for massive tracts sitting in total at 500 square kilometres.

The company is actively continuing its exploration in the Bynoe Pegmatite Field, ultimately looking to grow the project’s scope, Core Lithium’s non-executive chairman, Greg English, told the ABC.

The scope of these granted tenements and the prospects of extension have caused alarm among some of the community.

Lithium mining and minerals processing has long been contentious, criticised for its hefty environmental impacts. Given Australia has among the world’s largest lithium deposits, and lithium batteries remain the primary storage chemistry used today, it seems fairly likely lithium projects in Australia will grow considerably.

Members of the Northern Territory government have described the Finniss Lithium Project as “just the beginning.”

“Our government has established the Mineral Development Taskforce to investigate and identify policies and strategies to accelerate private investment in mining projects just like this one,” Minister for Mining and Industry Nicole Manison said.

The global battery market is expected to grow nine to 10 times by 2030 and 40-fold by 2050, according to the Future Battery Cooperative. This would equate to roughly $23 trillion (USD 14.25 trillion) being spent on the technology before 2050.

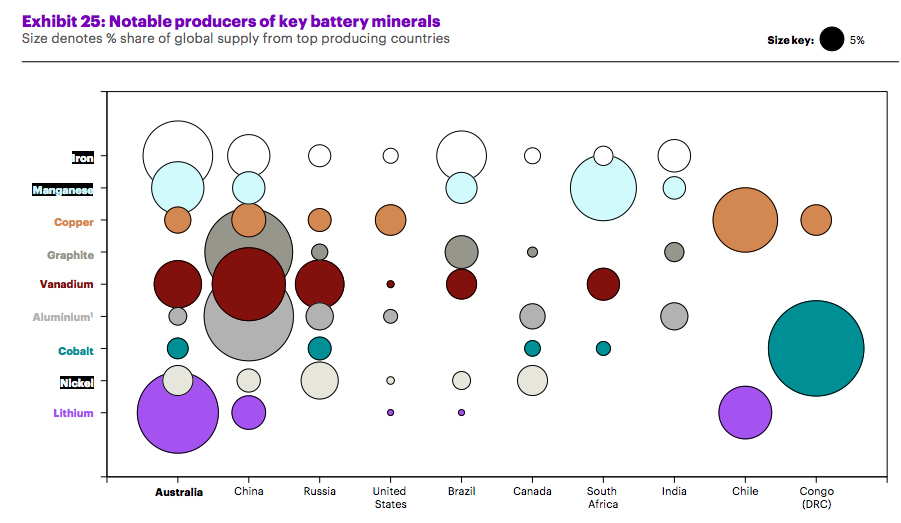

Image: IGO

Australia is home to all the raw materials required to make todays high performance batteries including lithium, cobalt, nickel, manganese and graphite. Until now, battery material refining and processing has tended to be done in developing countries, with China easily holding the lion’s share.

Western Australia is rapidly embracing downstream processing for batteries though. Earlier this year, Australian miner IGO and China’s Tianqi produced its first batch of battery grade lithium hydroxide at its Kwinana refinery in WA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.