Elon Musk’s company Tesla has signed an offtake deal with Australian miner Syrah Resources which will see it supply graphite, used in the anode of lithium-ion batteries, to Tesla from its U.S production facility in Vidalia, Louisiana, for four years.

The Melbourne-based company said in an Australia stock exchange (ASX) announcement in late December that Tesla will take 8,000 tonnes of the 10,000 tonnes it plans to produce of natural graphite Active Anode Material (AAM) each year from the facility.

Following the news of the deal, Syrah Resources stock price rose sharply, increasing over 60%.

EV manufacturers on the hunt for raw materials

As sales continue to grow rapidly in China, the U.S. and Europe (though not Australia), electric vehicle (EV) manufacturers are urgently looking to secure raw materials needed to make batteries including graphite, nickel, lithium, and cobalt amid concerns global markets are deeply undersupplied.

International Graphite

Currently, China dominates the global supply of graphite anode materials, accounting for an estimated 70% to 85%. With the U.S. and Europe eager to diversify their supply chains, Australian companies are competing to emerge as viable alternatives with several companies developing battery-ready graphite material facilities, as well as mines themselves, both here and abroad.

Syrah Resources

Syrah Resources’s Vidalia facility, located in Louisiana, processes graphite mined in Mozambique into anode material. The deal with Tesla will underpin Syrah Resources’s plan to expand the facility to reach a scale of 10kt/pa. The expansion is still awaiting a final investment decision, expected sometime this month.

With Tesla agreement conditional on a series of benchmarks being met in the coming years as the Vidalia facility develops, Syrah Resources has said it will continue to engage other target customers for mass production and additional long-term purchase commitments.

Image: Daniel Oberhaus/Flickr

The company has told Fairfax media there’s no shortage of interest in this regard, suggesting additional expansion plans for both its Vidilia facility and Mozambique mine may be on the horizon.

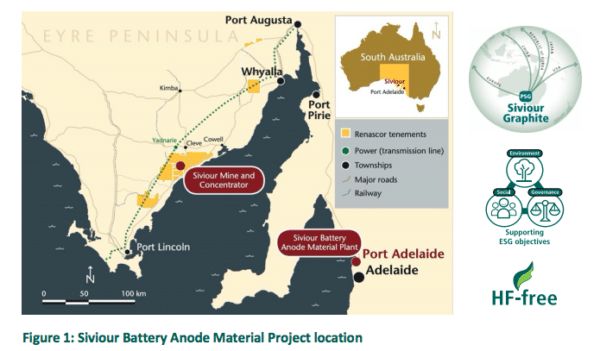

Renascor Resources

South Australian company Renascor Resources is also in the graphite game, having last year raised $15 million from institutional investors fund its Siviour Battery Anode Material Project up to the construction phase. The company says the project is on track to become the world’s first integrated mine and purified spherical graphite operation outside of China.

Renascor Resources

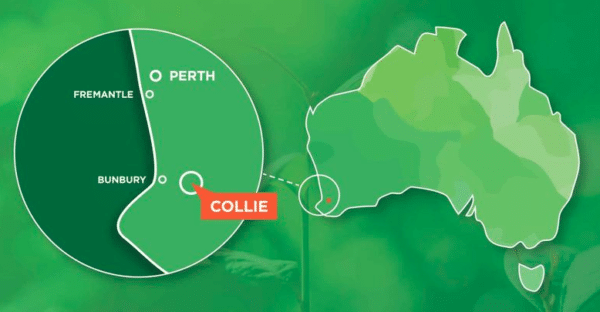

International Graphite

Western Australian startup International Graphite is also working on building a graphite battery anode material hub in Collie, WA.

In October 2021, the company announced it had struck a deal to acquire Comet Resources’s Springdale graphite resource. The arrangement, it says, will enable it to create the state’s first vertically integrated graphite production facility, from mine to customer.

Image: International Graphite

EV growth in Australia & abroad

While Tesla remains the preeminent EV manufacturer in the U.S. and Europe, China is set to lead the industry’s growth. Its EV market grew by a whopping 158% in 2021 alone.

Australia is yet to experience such enthusiasm. According to a recent poll from the Australian Electric Vehicle Council, 54% of Australians would consider purchasing an EV as their next car though. So what’s keeping EV sales rate in new cars down at only 2%? Money.

While state governments, notably in New South Wales and Victoria, are introducing EV incentives, there remains little to no federal support. Coming back to the survey, it found 40% of Australians would be encouraged to purchase an EV if government subsidies were available to help offset initial costs.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.