The Australian Workers Union is set to push for a “significant, punitive tax” on the export of unprocessed critical materials like lithium, cobalt and rare earths, saying the revenue could go towards subsidising more processing and manufacturing within our borders.

The proposal will be spelled out by the union’s secretary, Daniel Walton, during his speech at the Sydney Institute on Wednesday night. Beyond that, the Australian Workers Union (AWU) is reportedly planning to push for the proposal at the Labor Party’s National Conference in August.

As it stands, Australia is the globe’s leading supplier of many critical materials used in renewable energy technologies, including lithium, but most of the high value refining and processing is done offshore, largely in China. The AWU’s proposal plugs into a much bigger wave of momentum around keeping more of the value from Australia’s critical minerals onshore.

“If we continue to just ‘let the market rule’ it will mean only one thing: Australia’s raw materials will be shipped off to China and China will be the only player in our region with the sovereign capacity to turn them into anything useful,” Walton is set to say in his speech on Wednesday.

“Our primary concern should be where the products of those mines are going and how it is affecting the world.”

Image: TLEA

Calls for Australia to progress past its traditional ‘quarry’ status have come from numerous players, and seem to be gaining traction within the Albanese government. Since coming to power, Albanese has pledged to revive Australia’s domestic manufacturing industry to make the most of the country’s critical minerals deposits like lithium, zinc, nickel and rare earths.

Allies raise eyebrows

The proposal comes just as Ben Kim, the managing director for Posco Australia – a South Korean steel producer and major investor in Australia – discouraged the domestically focused movement.

South Korea is Australia’s third-biggest export destination and the country relies on Australian materials to produce its batteries, semiconductors and cars. If Australia were to begin doing more with our minerals onshore, it would put nations like South Korea in a position of competition rather than clear trade ally.

“The Australian government need to focus on what they are good at, that is the critical minerals mining side,” Posco’s Ben Kim told the Australian Financial Review. “For the manufacturing, maybe it is better to team up with a strong manufacturer like Korea and to have downstream ore processing plants in Korea,” he said.

“I think it is a sure fact that Australia is one of the highest labour cost countries in the world, so having many employees and [running] the factory with that manpower is not economical at all,” Kim added. “I am very doubtful about downstream or further processing plants built here in Australia.”

In December 2022, Posco Group announced it would invest $60 billion in Australia by 2040 across the green steel supply chain, including in renewable generation, electrolysis and steel making processes.

Unsurprisingly, Chinese officials have also rebuked Australia’s growing focus on critical mineral processing. China currently controls around 90% of the global production of refined rare earths, and the majority of critical minerals.

Where we place value

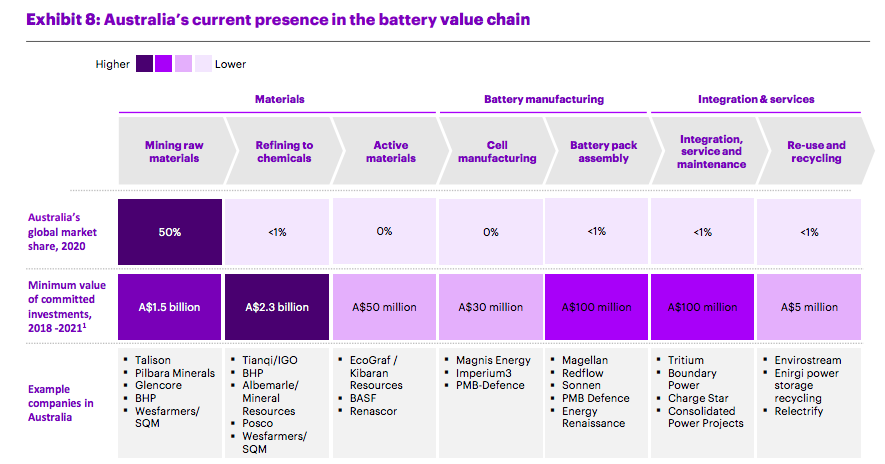

The McKinsey Global Institute’s Battery Insights team recently estimated the entire lithium-ion battery chain would grow from $127 billion (USD 85 billion) in 2022 to almost $600 billion by 2030. Indeed, Australia has already seen an enormous uptick in its revenues from lithium and other critical minerals.

But those figures would be much, much higher if the nation weren’t simply exporting raw spodumene, for instance. In fact, Dr Andrew Minnett, cofounder of Australian lithium battery company Sicona Battery Technologies, estimates Australia has 96% of the raw materials used in lithium batteries, but just 4% of that value was kept onshore.

In February, Australia’s federal government formally launched consultations on its National Battery Framework issues paper, which is seeking to strategise paths towards developing a globally competitive domestic battery manufacturing ecosystem in Australia.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.