Initiated last year, the $15 billion National Reconstruction Fund is a government-supported finance corporation similar to the Clean Energy Finance Corporation, although it has a wider investment scope.

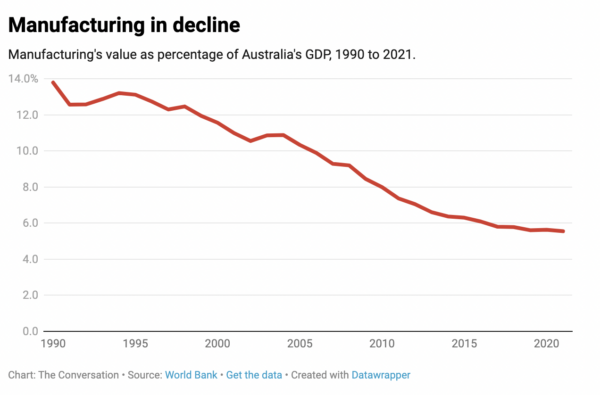

The intention of the National Reconstruction Fund (NRF) scheme is to boost investment in onshore manufacturing, including in clean energy technologies like batteries, solar panels, hydrogen electrolysers, and components for wind turbines.

On Tuesday, Federal Industry and Science Minister Ed Husic posted: “the National Reconstruction Fund Corporation is officially up and running – with the board meeting for the first time yesterday.”

The government has transferred the fund’s first $5 billion, with another $10 billion expected to be provided in instalments over the rest of the decade.

Following the launch, where Minister Husic attended the first board meeting as a guest, he gave an interview to the Sydney Morning Herald where it was reported that the NRF fund had already received around 100 proposals, mostly for advanced technology within renewable energy industries.

The priority areas for the fund include agriculture, medical science, energy, advanced technology manufacturing, defence and transport.

The government previously said up to $3 billion of the NRF’s $15 billion would be earmarked to support renewables and low-emission technologies.

How the National Reconstruction Fund works

The NRF is administered by an independent board, operating under a government mandate. It will provide multiple investment avenues including loans, guarantees and equity and it is expected to operate commercially, delivering returns on its investments.

The NRF board is chaired by Martijn Wilder, who also headed up the Clean Energy Finance Corporation when it started in 2012. Also on the board is former national secretary of the Australian Workers’ Union, Daniel Walton. Before departing his role at the union, Walton pushed for a “significant, punitive tax” on the export of unprocessed critical materials like lithium, cobalt and rare earths, saying the revenue could go towards subsidising more processing and manufacturing within our borders.

Other members include the Australian Energy Market Operator’s (AEMO) Non-Executive Independent Director of its Board of Directors, Kathryn Presser; venture capitalist and Airtree cofounder, Daniel Petre; Brandon Capital Partners’ venture partner and CEO of medical device company OncoRes Medica, Katharine Giles; former Liberal Minister for Industrial Relations of Australia, Kelly O’Dwyer; former Australia Post chief; Ahmed Fahour; and company director Karen Smith-Pomeroy.

Like the Clean Energy Finance Corporation, the NRF will work on a ‘co-investment’ model, seeking to partner with businesses and superannuation funds to unlock additional private investment.

In April, shortly after the NRF passed through parliament, the University of Sydney’s published an article saying the fund would be improved by greater transparency standards, including the public sharing of the board’s investment decisions; retaining flexibility with its investment areas; and making investments that support the entire manufacturing ecosystem rather than solely individual projects.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.