Climate Energy Finance (CEF) Green (Buildings) Wash report has found three of Australia’s big four banks have channeled the bulk of their sustainable finance target (SFT) funds to date, to green buildings, which CEF said meet minimum energy efficiency regulations and leave the banks open to accusations of green washing.

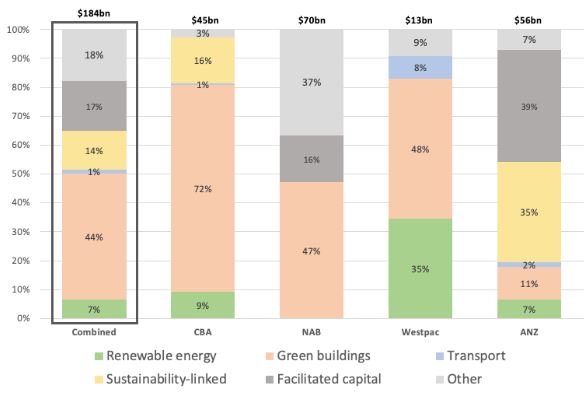

From the combined banks’ SFT allocations to date of $184 billion (USD 119 billion), just $12.4 billion, or 7%, has been assigned to the renewable energy or hard-to-abate sectors.

The National Australia Bank (NAB) has allocated nothing to renewables from its SFT, while Australia and New Zealand Banking Group Limited (ANZ) has assigned $3.9 billion, Commonwealth Bank of Australia (CBA), $4 billion, and Westpac, $4.5 billion.

“The banks should be using their firepower to advocate for more ambitious and coordinated policy, regulatory and investment settings that reflect and enable our national climate and sustainable economic growth goals, demonstrating leadership in Australia’s economic transformation to a zero-carbon economy,” CEF finance analyst Nishtha Aggarwal said.

Image: Climate Energy Finance

Alternatively, green buildings received $45 billion, $70 billion, and $13 billion from CBA, NAB and Westpac respectively, or 72%, 47% and 48% of their total allocations.

ANZ has assigned 11% of its $56 billion SFT allocation to date to green buildings but the bulk to facilitated capital (39%) and sustainability-linked activities (35%), which CEF analysts describe as an opaque allocation of funds.

CEF Director Tim Buckley said buildings are only truly green once they are fully electrified and thermally efficient, the grid is producing zero-emissions electricity, and building materials are decarbonised.

“That requires concerted action and investment to build firmed utility-scale renewable energy and reduce emissions in hard-to-abate sectors like steel, cement, and aluminium,” he said.

CBA’s efforts to encourage consumers toward financing electrification and solar was applauded by the report, but it noted the initiatives were not part of the bank’s SFT.

Westpac was a standout for its investment in renewables, which its March 2024 Green Bond Impact Report confirms, and which claims renewable energy projects and assets financed in part by Westpac Green Bonds have the potential to generate 12 million MWh of clean energy and avoid 7.4 million tonnes of GHG emissions.

Image: Spark Infrastructure

The Green Bond report said Westpac financed 10 solar farms and refinanced six last year, and from April 2023, sourced the equivalent of 100% of its Australian electricity demand from renewable sources.

It also committed a $1 million community fund under the Spark Infrastructure/Bomen Solar Farm (near Wagga Wagga, NSW) agreement and provides further funds in relation to the Berri Solar Farm and Battery energy project with Flow Power in South Australia.

The CEF analysis raises concerns over influence on all the Big 4 banks from fossil fuel industries, recommending more senior management with renewables and decarbonisation experience be appointed, who were not previously directors of oil, coal, and gas companies.

University of NSW noted in 2023 that institutions own about 23% of the shares of ANZ and Westpac, 18% of CBA, and 27.7% NAB with the largest institutional shareholder across all four being The Vanguard Group.

Energy Tracker Asia said the Group holds $460 billion in fossil fuel funds, with over $11 trillion in assets under management including $138 billion in coal.

In July 2023, the Australian Securities and Investments Commission (ASIC) commenced a new greenwashing case against previously fined Vanguard Investments over false claims investments did not have ties to fossil fuels, including links to oil or gas exploration.

“The banks should urgently remove the influence of these interests and recruit zero emissions expertise to drive credible net zero capital allocations to renewables and economy-wide decarbonisation,” Aggarwal said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.