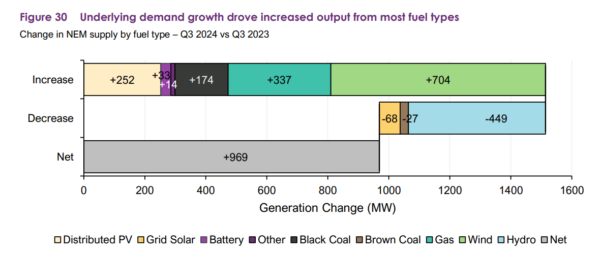

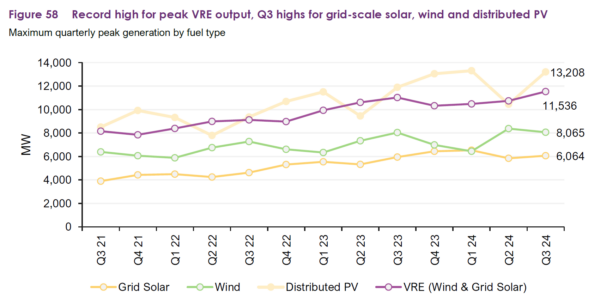

The latest Australian Energy Market Operator (AEMO) Quarterly Energy Dynamics report shows rooftop solar contributed 38.5% of total renewable generation to the National Electricity Market (NEM) in Q3 2024, followed by grid-scale solar, 18.3% and wind, 13.4%, achieving a combined renewables record of 72.2% on 9 September.

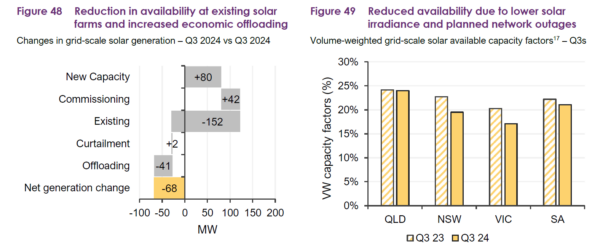

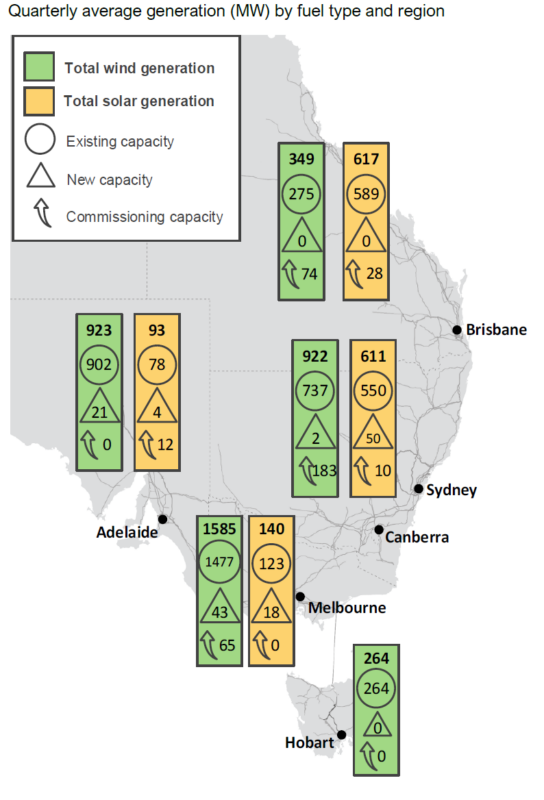

Compared to the same quarter 2023, distributed solar output increased 11% to average 2,539 MW due to growth in installed capacity, but lower solar irradiance and outages for network upgrades in New South Wales (NSW) combined with more economic offloading at grid-scale solar facilities saw a 4.5% or 68 MW (-4.5%) reduction in output to average 1,461 MW.

The monthly average grid-scale solar generation was 1,305 MW in July, before increasing to 1,503 MW in August and 1,578 MW in September.

The report finds, the majority of the increase in availability from new and commissioning solar farms occurred in NSW, with increases at Lighsource bp’s 425 MWdc Wellington North (+53 MW) and Metlin’s 75 MW Wyalong (+6 MW).

Vena Energy’s 125 MW Wandoan (+20 MW) in Queensland and 95 MW Tailem Bend 2 (+15 MW) in South Australia, and Pacific Partnerships Energy’s 130 MWdc Glenrowan (+20 MW) in Victoria also contributed to growth in this category.

Image: Australian Energy Market Operator

Wholesale Electricity Market (WEM)

In Western Australia’s (WAs) Wholesale Electricity Market (WEM), a 78 MW rise in rooftop solar offset higher underlying demand, which rose 88 MW for the quarter.

The report says, increased rooftop solar in WA, along with higher wind (+90 MW) and batteries (+9 MW) drove a new Q3 average renewable contribution record of 35.2% for the period – exceeding the previous record of 29.6% in Q3 2022.

Higher rooftop solar contributions observed during the quarter could have led to a new minimum demand record of 538 MW on 22 September 2024, but battery withdrawals helped push operational demand to 680 MW.

AEMO Reform Delivery Executive General Manager Violette Mouchaileh said this highlights the importance of batteries in maintaining system security and reliability during periods of low demand.

The increased battery contribution is linked to the state’s second big battery, Neoen’s Collie Battery, entering WA’s Wholesale Electricity Market (WEM), which once fully operational will have a capacity of around 200 MW.

Average electricity prices (excluding frequency controlled essential system service costs) fell 10% from $89.18 (USD 58.45) / MWh in Q3 2023 to $80.15 / MWh in Q3 2024.

New capacity

At the end of Q3 2024, 45.6 GW of new capacity were progressing through the connection process from application to commissioning, a 36% increase compared to the same time last year, and included 14.6 GW of battery projects, an 87% increase on Q3 2023.

A further 2.6 GW of new generation has reached application approval this quarter, with 3.5 GW registered and connected to the NEM and 1.3 GW progressing through commissioning to reach full output, the report says.

Mouchaileh said it was a promising sign to see Australia’s energy transition continue with more renewable generation capacity either coming online or progressing.

“AEMO is preparing the grid to run on 100% renewable generation at any one point in time, and this quarter saw total renewable generation available at over 100% of demand on two occasions,” Mouchaileh said.

Updated: 30 October, 2024

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.