Eric Luo: China will see just 20-25 GW of solar per year through 2025

The GCL System chief executive made comments that fly in the face of an expected solar gold rush in China that analysts predict will start this month. Though rising overseas demand will address overcapacity fears, according to Luo, the soundbite is sure to chill PV boardrooms across the world’s biggest solar market.

Thermal battery producer heats up storage market

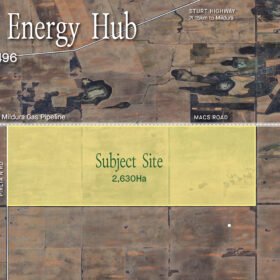

An Australian thermal energy storage company has reached in principle agreements to pilot thermal batteries in the telecommunication and eco-housing industries.

NAB stands behind Townsville battery gigafactory

Plans to develop a 18 GWh lithium-ion battery factory in northern Queensland have received a major boost with the appointment of National Australia Bank as financial adviser. With the feasibility study nearing completion, project proponents expect the development application to be submitted to Townsville City Council over the coming months.

ABB called out by UK Solar Trade Association over quality and customer support

The STA has warned Italian company Fimer, which is set to acquire Swiss company ABB’s inverter business, it will have to honor customer service commitments made to its British members, and voiced fears related to historic quality issues with ABB inverters.

Blue Mountains home to one of NSW’s first passive houses

“The Sapphire” is one of the first passive houses in New South Wales (NSW). Located in the Blue Mountains’ village of Foulconbridge, “The Sapphire” is a carbon zero house utilising an SMA Energy System consisting of a Sunny Boy solar inverter and a Sunny Boy Storage battery inverter providing clean solar power.

Distributed Energy Test Lab set to open in Canberra

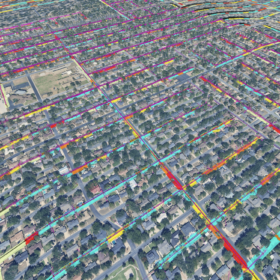

The Distributed Energy Resource (DER) laboratory “DER-Lab” will provide an environment for safe testing of new technologies including monitoring and communication devices, smart controllers, aggregation (e.g. Virtual Power Plant), market participation software and other innovative new products.

Space age solar solution moves toward production

A consortium of European research institutes has received €10.6 million in EU funding to establish pilot production of a high efficiency module concept developed by Swiss startup Insolight. The module combines high efficiency multijunction cells with a solar concentrator lens and has previously demonstrated 29% efficiency.

REC Group, Risen strengthen Australian distribution networks

Two major solar panel manufacturers are looking to expand their presence in Australia with new distributors on board.

Longi: ‘Our larger wafer must be industry standard’

The Chinese giant has argued its 166mm M6 product should be the new iteration used worldwide, even though larger products have been launched by rivals. Longi says the fact existing cell and module production lines can be adapted for the M6 means rising demand for solar worldwide can be swiftly satisfied.

Solar world pays tribute to founding father of SolarEdge

A tribute to Guy Sella has hailed ‘a brilliant man’ and ‘a revolutionary trailblazer’ who was ‘vibrant and energetic’ yet ‘down-to-earth and approachable’.