Global installed PV capacity could hit 260 GW in 2022

The International Energy Agency Photovoltaic Power Systems Programme (IEA PVPS) estimates that 173.5 GW of new solar capacity was installed in 2021, and that figure might rise to 260 GW in 2022. pv magazine spoke with the co-chair of the European Solar Manufacturing Council to look into the figures.

Victoria to target 95% renewable energy by 2035

The Victorian government has announced an ambitious target to reach 95% renewables by 2035, to end the state’s reliance on coal generation, and to establish a publicly owned corporation that will see the state hold a controlling stake in new renewable energy projects.

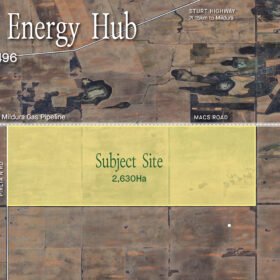

FFI, BP among six companies offered land by WA government to kickstart hydrogen precinct

The Western Australian government has allocated six companies land in the state’s mid-west to develop green hydrogen projects, including Fortescue Future Industries and BP.

Longi eyes green hydrogen market in India

Longi is entering the green hydrogen market in India with new alkaline electrolyser offerings. It also plans to roll out a next-generation Hi-MO solar module later this year.

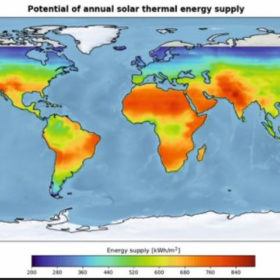

World has technical potential to host 47.6 PWh of photovoltaic-thermal panels

Scientists from the Central European University in Hungary have estimated the global technical potential of photovoltaic-thermal (PVT) energy production by using a high-resolution geospatial model.

Australian EV market share grows 65% in 2022

The demand for electric vehicles in Australia increased by 65% in 2022, reaching 3.39% market share of total new car sales, according to the Electric Vehicle Council’s latest report. Tesla continues to be the dominant brand, with New South Wales and Australia Capital Territory governments topping the charts on policy leadership.

PV production equipment sales soaring in Europe

According to VDMA, a German engineering association, there are now more orders coming in for German production equipment from Europe than from China. Nevertheless, shipments to Asia remain dominant.

Global polysilicon capacity could hit 536 GW by end of 2023

Clean Energy Associates said in a new report that it expects polysilicon production capacity to exceed PV installations next year.

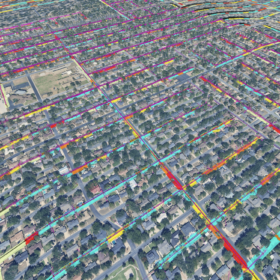

AEMO on track with ‘world-first’ grid connections simulator

The Australian Energy Market Operator plans to launch a world-first ‘connections simulator’ this year after completing pilot testing of the online tool that is designed to help fast-track the evaluation and approval process for new clean energy grid connections.

ClearVue moves into residential market with solar glass tech

West Australian smart solar glass developer ClearVue has made the move into the residential housing market, securing its first order to supply its power-generating solar PV windows for a luxury residence being constructed in the Australian Capital Territory.