Sunday read: What to expect from China’s green power trading

On September 7, the country that consumes more power than any other nation introduced green energy trading. Two regions in China, Beijing and Guangzhou, were selected for the initial introduction of what will become the national green power trading market. Although it is still a pilot program, the market is expected to have far-reaching impacts on China’s energy transition away from coal. What do you need to know about it? Vincent Shaw in Shangahi sets out the details.

SolarEdge posts more record numbers, says good times are set to continue rolling

The inverter and battery manufacturer said it has been sitting on a record order backlog for the current three month window and the opening quarter of the new year, which may in part be down to a long Covid shutdown at its Vietnamese production base.

Module price hike impacting middle-sized PV projects in South Korea

The continuous rise in solar panel prices may affect PV projects of up to 1 MW tendered by the Korea Energy Agency and the domestic solar module industry may not be able to provide the necessary production capacity to respond to the recent supply bottleneck.

Patriot Hydrogen joins gasification outfit CAC-H2’s bulging partner list

Patriot Hydrogen has become the latest company to partner with the fast growing Singapore-based hydrogen-via-gasification outfit, CAC-H2.

IPO to finance first slice of planned 500 MW-plus solar field in the Philippines

Solar Philippines will tap stock market investors to back the first section of a solar project in Luzon it says will eventually be the largest in the region.

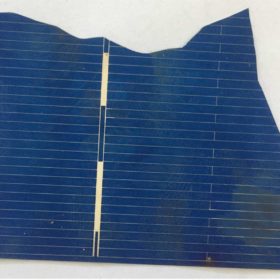

New tech to recover pure silicon from end-of-life solar cells

An Indian research group has used three different chemicals instead of commonly used hydrofluoric acid to separate silicon from the cell. The technique is claimed to be able to deliver recycled silicon with a purity of up to 99.9984%.

Sunman unveils 430 W glass free solar module

The new product has a power conversion efficiency of up to 19.3% and a weight of 11.2 kg. The module is produced with glass fibre reinforced plastic, which the manufacturer says reduces light reflection and opens up new assembly options.

Tesla orders 45 GWh of EV batteries from CATL

Reports calculated that the single order would be enough to support production of 800,000 vehicles.

Sunday read: What’s next for polysilicon?

The past 12 months have proved profitable for polysilicon manufacturers, as selling prices have soared to levels not seen since 2011. However, with major new capacity expansions on the horizon from most of the leading manufacturers, and new players planning to enter the scene, the market balance looks set to shift. Exawatt’s Alex Barrows rounds up where the industry stands and what might happen next.

Saturday read: ‘India presents a big market opportunity for us’

Sujoy Ghosh, First Solar’s vice president for India and the Asia-Pacific region, speaks to pv magazine India’s Uma Gupta about the company’s plans to set up a 3.3 GW module fab in India to service the local market.