Coal developers risk half a trillion dollars down nonrenewable drain

A new report from financial think-tank Carbon Tracker has found that coal developers risk wasting more than $600 billion due to stubborn resistance to the already cheaper electricity resources provided by renewable energies worldwide. The report finds, in short, that a new coal plant is about as prudent an investment today as a Clydesdale and cart.

Vietnam to stop licensing large-scale solar projects

In a newly published policy document, Hanoi has urged regional governments and the country’s state-run utility, EVN, to suspend authorizations for new solar parks until further notice. Around 8.93 GW of utility-scale solar capacity is already approved for development in Vietnam, according to the Ministry of Industry and Trade.

Vietnam introduces auction scheme for large-scale PV

With the publication of Notification No. 402/TB-VPCP on Nov. 22, the Vietnamese government has cemented its transition from feed-in tariffs to auctions, in a clear step away from earlier promises to revive the FIT scheme.

Vietnam may cut FITs for large scale solar 20%

The tariff for rooftop PV will be maintained at $0.0935/kWh but payments for ground-mounted and floating solar could be cut to $0.0709/kWh and $0.0769, respectively. The previous FIT scheme, according to government figures, has driven the deployment of around 5 GW of solar generation capacity.

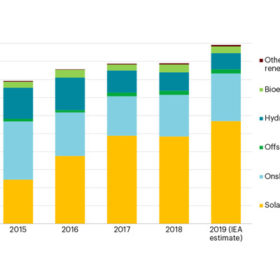

International Energy Agency forecasts 115 GW of new solar this year

The global expansion of PV, wind power and other clean energies will see double-digit growth this year as solar continues to lead the pack.

Shrimp and PV goes together like peas and carrots

With the benefits solar panels can bring to cropland being considered in Europe, PV and aquaculture are working in tandem in Vietnam. Shrimp and fish farming requires land and lots of water but solar panels are helping mitigate those demands.

Vietnam’s 2019 commissioning rush

Vietnam had already successfully commissioned 1.5 GW of utility-scale PV at the end of May this year, and there is no sign of this slowing down, with another 2 GW teed up for June 2019. The breakneck speed in development is making Vietnam a powerhouse in the region in installed capacity, even nipping at the heels of Australia. Rystad Energy’s Minh Koi Le looks at the state of play in the Vietnamese solar market.

Grid data transparency vital to making the case for renewables in Vietnam

With a glut of solar capacity having come online this year, cheaper financing would help keep some of that momentum but policymakers cannot be persuaded of the economic benefits of clean energy unless state-owned utility EVN opens up.

Vietnam overtakes Australia in commissioned utility PV following June FiT rush

Norwegian consultancy Rystad Energy has placed Australian and Vietnamese solar markets side by side and found the Southeast Asian country has left Australia behind in terms of commissioned utility-scale PV capacity. A staggering 4,460 MW of connected PV capacity in Vietnam at the end of June came as a surprise to many.

Jinko supplied 351 MW plant in Vietnam

The Chinese manufacturer revealed it had supplied the modules to one of the largest PV facilities in the APAC region outside its homeland.