First Solar’s big format brings big bookings

The PV maker’s quarterly results show not only the ramping of its Series 6 production at a third location, but also bookings that continuing to climb, with 11.3 GW of modules now under contract.

Bifacial PV and tracking: Q&A with JinkoSolar

On October 25, pv magazine will host a webinar, powered by JinkoSolar, in which the China-based manufacturer will present the case for using bifacial modules in large-scale solar plants, and discuss the influencing factors and their impact on bifacial PV tracking. In the following Q&A, JinkoSolar’s Andrea Viaro, Head of Technical Service Europe, JinkoSolar, and Colin Caufield, VP of Sales North America, Soltec provide a sneak peak into the technology and the advantages tracking can bring to bifacial technology.

2035: The renewable energy tipping point

The tipping point, where the world shifts from oil and gas to renewables, will be the year 2035, says Wood Mackenzie. This is when renewables and electric-based technologies converge, with around 20% of global power needs being met by solar or wind, and roughly 20% of miles traveled by cars, trucks, buses and bikes using electricity. Will the transition come soon enough, however?

Prices for monocrystalline solar modules are picking up

Analysts at Taiwan-based EnergyTrend and China’s PV Infolink have reported a further increase in demand for monocrystalline solar cells and modules in recent days. Their respective analyses on multi-crystalline products, however, do not match.

EVs could become key to renewables uptake and world’s largest source of battery storage

For renewables to claim a more sizable share of the global energy mix, the adoption of energy storage would need to pick up pace and the rapidly increasing size of the EV fleet will offer a scalable way to ramp up such access, says Fitch Solutions.

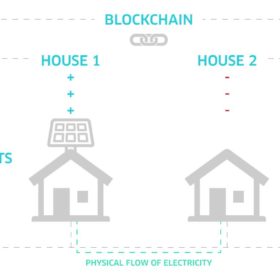

Blockchain: Regulation an impediment to adoption

The World Energy Council, in partnership with PwC, has interviewed 39 top level management energy leaders to find out if blockchain is driving an evolution or a revolution in the energy ecosystem.

Module prices have decreased by up to 25% so far this year, TrendForce says

According to the Gold Member Solar Report by EnergyTrend (Q3 2018), monocrystalline module prices have fallen almost 20% this year, while those for polycrystalline modules have dropped by more than 25%. Increased consolidation among manufacturers and developers is expected to occur in China and the global solar market, with more merger deals, plans for capacity reductions and even factory closures.

IEA low-balls solar growth (again)

The agency’s base case expects relatively flat growth in solar deployment over the next six years, but for solar to still dominate growth among renewable technologies. The agency’s estimates are again below those of major market analysts.

World reacts to IPCC report

A snapshot of how politicians, scientists, institutions, industry, and civil servants have reacted to the Intergovernmental Panel on Climate Change (IPCC) report, released yesterday.

Frost & Sullivan forecasts strong 2018 for solar, despite China’s policy setback

A new report published by business consultants Frost & Sullivan expects around 90 GW of new solar installations by the end of 2018, in line with the predictions of other leading analysts. It further notes that PV remains the world leader in renewable energy capacity, and that markets are moving away from feed-in tariffs to make increasing use of auction models and private PPAs.