GreenSync has opened for business its much-anticipated marketplace where consumers will be paid for providing ancillary grid services, such as peak demand reduction and frequency regulation, and thus get more value out of their distributed energy assets – solar PV, storage and EVs.

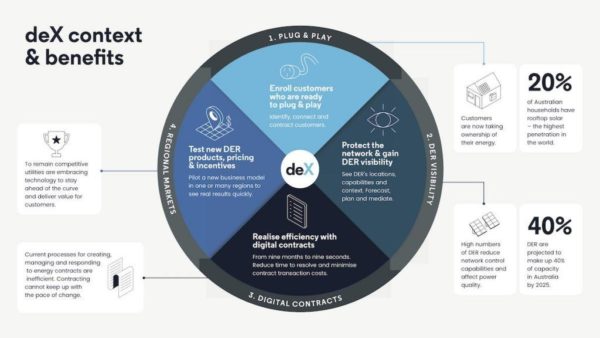

In addition to supporting the grid, the Decentralized Energy Exchange (deX) will aim to connect millions of distributed energy resources (DER) and virtual power plants (VPP) to existing markets, such as the wholesale market, for the purpose of energy trading.

DER will have access to open markets via a single (fleet-wide) integration completed by their technology provider using the deX API. The existing VPPs will, meanwhile, expand their reach in the market today.

The industry-backed project is looking to harness booming behind-the meter resources and ensure grid stabilization in markets with high renewable energy penetration.

Australia is the perfect starting point for that given its growing battery storage market and high rooftop solar uptake, which according to latest Australian PV Institute data hit a new record in September taking cumulative capacity to 10 GW.

“deX is open for business and this marks the dawn of a new era as Australia moves toward a responsive, dynamic and bi-directional grid that can predict and adjust to rapidly changing conditions to balance energy supply and demand,” GreenSync CEO and founder, Phil Blythe, said.

GreenSync also announced eight new partners on the project Wattwatchers, Enphase Energy, Sungrow, SwitchDin, Blue Pillar, Fronius, Goodwe and Solar Analytics, stressing that deX will thus represent more than 70% of Australia’s solar and storage inverter market.

The new partners joined Tesla who was the first technology vendor to be integrated with deX Connect.

GreenSync also unveiled deX Vision, a portal into the exchange which provides networks and system operators with visibility across the location, performance and operational status of DER, allowing them to understand the net impact of DER in the network.

The first integration partners for deX Vision are Schneider Electric and Indra, providing a bridge to distribution network management systems.

Australian households coupled with technology vendors on deX Connect will have the option to trade their energy on deX starting with customers connected to the National Electricity Market from Q1/2019 and customers with the Wholesale Electricity Market, Western Australia from Q2/2019.

Following the launch in Australia, the company will seek to progressively launch deX in the United Kingdom (Q3/2019), Japan (Q4/2019) and the United States (early 2020) in cooperation with its partners.

“There has been a lot of negative media coverage about the impending crisis posed by the proliferation of solar and other DER on the grid, but instead of launching into discussions about curtailment and the rollback of subsidies, we should be looking for ways to better manage its continued growth,“ Blythe said.

“deX ensures consumer benefit by growing the grid’s renewable hosting capacity whilst managing reliability, which is better for everyone.”

Residential, commercial and industrial customers can participate in deX and technology vendors can join deX Connect for free by simply registering online. Energy retailers and aggregators can participate in deX for an administrative fee. Distribution networks and market operators are able to access deX via a subscription license.

The $930,200 deX project has been backed by a $450,000 million funding from the Australia Renewable Energy Agency. deX was formed at ARENA’s accelerator A-Lab, which opened April 2016.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.