After recent booms in utility-scale PV installations in Australia and Vietnam, project momentum may stall a little said Rystad Renewable Energy analysts in their Solar-rush aftermath webinar last week, but transmission relief and coal-fired retirements in Australia, and sustained generous feed-in tariffs (FiTs) in Vietnam, will continue to energise investment.

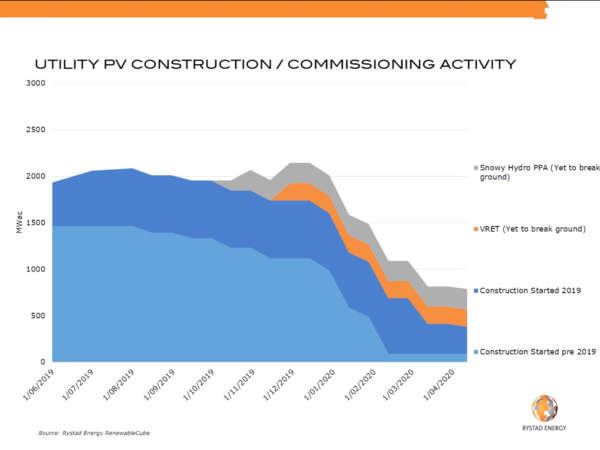

Australia’s utility-scale rush to solar will see 2 GW of commissioned utility-scale PV added to its generation capacity in 2019, to reach an end-of-year total of 3.5 GW, says Rystad’s Dave Dixon, Senior Analyst for Renewables Research at Rystad Energy, and 2020 will see a further 2 GW of utility PV find place in the landscape.

But in terms of new project proposals entering the Rystad database, Dixon says that if weren’t for the 10 GW Sun Cable solar farm mooted for the Northern Territory, “Solar would be the only renewable technology in which we’re behind year on year.”

In Australia, he predicts a dramatic decline in construction activity when the current crop of large projects achieves scheduled completion in the first quarter of 2020, and a resulting fall in energised projects in 2021.

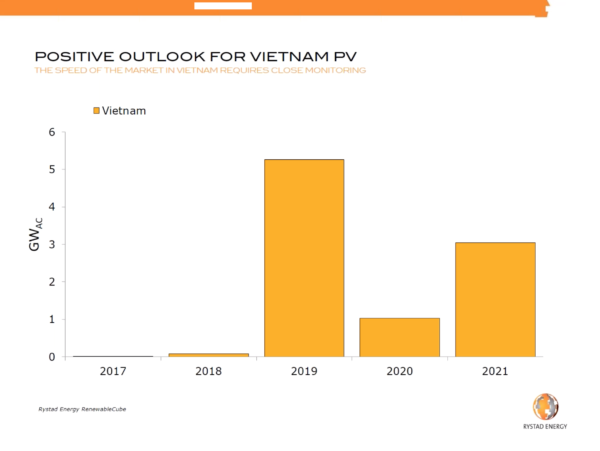

In Southeast Asia, Vietnam’s astronomical uptake of utility-scale PV — 4.46 GW commissioned in the 12 months to end of June 2019, and around 5.3 GW expected to be generating by year end — has been driven by one of the world’s most generous feed-in tariffs of around US 9.35 cents per kilowatt hour (KWh), an offer commenced in 2017, and which drew to a close as of July 1 this year.

MLFs, inadequate transmission networks and 64% curtailment!

The rush to connect in each country has overloaded significant portions of the national grids, both of which are long and strung out from north to south.

In Vietnam, solar development has been concentrated in provinces of best resource — 50% of the connection rush has been in Ninh Thuan and Binh Thuan in the south of the country — where there has traditionally been low demand and the grid is weaker than in regions of higher industrial concentration. As a result solar plants in these areas now experience up to 64% curtailment of their output.

Minh Khoi Le, leader of Southeast Asia analysis for Rystad Energy, forecasts a significant drop in utility-scale solar PV activity in Vietnam in 2020, to around a quarter of the country’s current install rate, as new FiTs are set and the market settles.

Graph: Rystad Energy RenewableCube

In Australia, developers have been challenged by three main factors (excluding the overarching lack of a Federal Government energy transition policy):

- The by now infamous marginal loss factors (MLFs), which penalise generators for calculated electrons lost on their often long and wobbly transmission journey from the point of generation to areas of peak demand

- Network capacity inadequate for the volume of renewable projects seeking to connect in certain areas

- The pace of commissioning, which typically requires coordination between engineering and procurement companies, the Australian Energy Market Operator (AEMO) and network service providers (NSPs)

As Dixon points out, “In the second half of 2018, we had 14 utility PV assets energised, and eight of these were in Queensland, so you can imagine the strain that must have placed on services in the State.”

The experience gained by developers in guiding their projects toward commissioning has, however, led to improved timeframes: “The majority of assets scheduled to be energised in 2019,” says Dixon, “have been commissioned faster than the historical median of 100 days. That’s a really positive sign for the industry.”

Graph: Rystad Energy RenewableCube

At the same time, there are signs that some investors may temporarily retreat from Australian renewables, with John Laing Group having put further investment in Australian projects on hold due to risks posed by transmission.

But rushing right along …

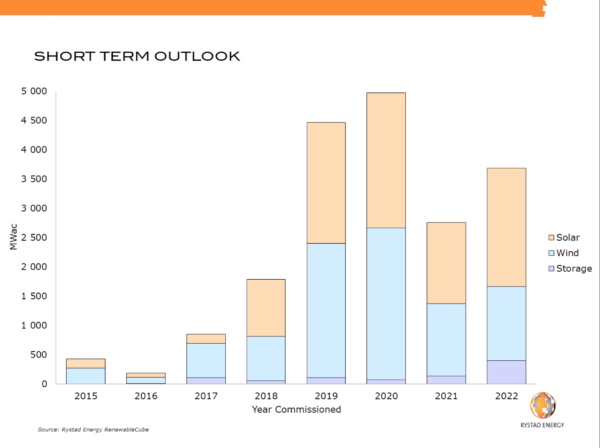

Ultimately, Rystad’s analysts have a few reasons to forecast that the Australian market will pick up again in 2022, and that Vietnam will resume its charge in 2021.

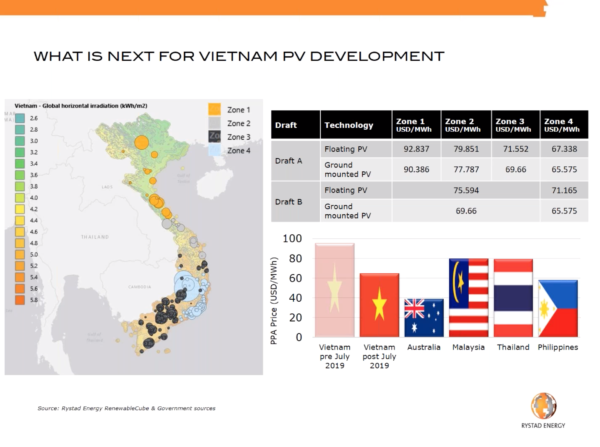

Despite its initial generous FiT offer having come to a close, the Vietnamese Government’s draft plans for future incentives to drive renewables investment look almost as enticing. Indications are, says Le, that the next round of FiTs will be variously set to drive more renewables into areas of lower resource, and into floating PV; where higher FiTs will help compensate for lower generation, and higher development costs, respectively.

But even Vietnam’s lowest likely next-round FiTs will still be “at a level higher than in Australia”, says Le.

Graph: Rystad Energy RenewableCube

The expectation is also that transmission in Vietnam will be progressively and aggressively upgraded to meet the country’s anticipated doubling or even tripling of demand for electricity over the coming 10 to 15 years. As a result, renewable plant will see curtailment levels reduced.

This is one of the key factors encouraging foreign investment in Vietnam’s renewable push, says Le: “These players are willing to take the risk of curtailment, take the high FiT price and bank on grid upgrades to be able to release the rest of the capacity in future.”

In Australia, Rystad’s forecasts show grid-scale solar picking up again in 2022, to another 2 GW of installed capacity, which Dixon puts down to increased demand for renewable generation “as Liddell starts to exit from the grid”, and completion of some of AEMO’s Group 1 transmission upgrades as proposed in its Integrated System Plan.

This “debottlenecking” says Dixon will open up new opportunities.

It will also likely coincide with a predicted fall in manufacturing costs of battery storage systems.

Graph: Rystad Energy RenewableCube

Analysts and industry pundits have earmarked 2022 as the year of the battery, and Rystad forecasts an almost tripling in the capacity of batteries associated with renewables installed year to year, from around 150 MW commissioned in 2021 to around 450 MW commissioned in 2022.

Although there are still regulatory and market hurdles to overcome in integrating batteries to help manage utility-PV exports of electricity to the grid, lower battery prices are likely to drive innovation in harnessing storage to support both system strength and fast frequency response as Australia transitions away from coal-fired power.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.