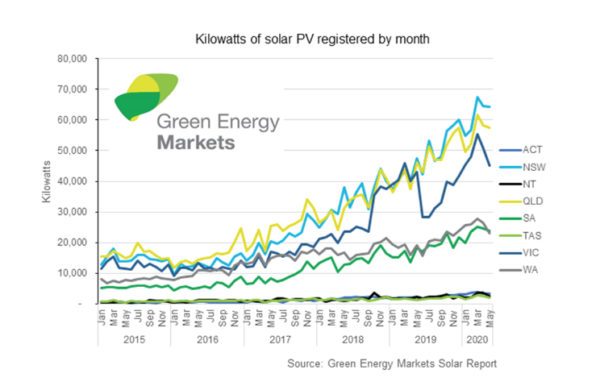

The Australian rooftop PV market continues to thrive with no clear sign yet of a Covid-19-induced slowdown. According to the small-scale technology certificate (STC) data, rooftop PV posted its eighth consecutive month above 200 MW, with 222MW registered in May.

The STC data compiled by Green Energy Markets (GEM) show that while kilowatts are down relative to March and April, they are 23% up on May last year. GEM’s Director, Analysis and Advisory, Tristan Edis says he has delved down into the data on system sizes to see if bigger commercial systems are dropping off but found they also show a pattern of strong growth.

There was 43 MW of commercial solar capacity registered in May, which is up 26% year-on-year. “What’s really interesting is the increasing popularity of the mega-household solar system greater than 10kW,” Edis tells pv magazine Australia. “These now represent the second largest segment of the Australian solar market after the 6-7kW system size category. They represent 15% of all residential capacity registered so far this year.”

Unperturbed by the Covid-19 outbreak, the Australian rooftop PV market was forecast to smash all previous records in 2020, approaching 3 GW of sub-100kW systems. Despite two consecutive monthly falls, the STC market has not revealed any significant slowdown as yet. However, an industry survey has found that the spread of rooftop PV is likely to slow down with confidence and many household incomes taking a hit.

The survey carried out in early April revealed that around 50% of respondents have seen customer inquiries decline by between 25-50%, with a further 20% reporting that new leads have dried up completely. Such a level of activity would represent a 50% contraction in the installation rate to around 100 MW per month.

Bad news

Despite the still strong STC figures and a trend toward larger system sizes, there are reasons to suggest that rooftop PV demand will not remain immune to the impact of Covid-19. The good results may actually come from the lags in the creation of the STC statistics, with weeks-long steps in-between – a customer expresses interest in purchasing a system, conversion to sale, installation and then STCs are ultimately registered.

A couple of months ago, the good news was that some installers and retailers reported having built up a considerable backlog of orders, which may provide a buffer of between six weeks to three months. The industry survey run in April also showed that installers were not reporting a rash of order cancellations, which suggested that April could record installs above the 200 MW mark as well.

However, GEM says that things have changed for installers since then. “The bad news however is that we have been hearing that the long installation backlogs that were in place prior to the implementation of the Covid-19 social restrictions have been whittled away,” Edis says.

While backlogs of six weeks were common prior to March 20 restrictions, Edis says that they are now much shorter for many retailers. “If you then add a four-week lag for STC registration onto six-week installation backlog then the impact of Covid-19 will only really be seen in June STC registration figures,” he says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.