Not every participant in Australia’s renewable energy industry will look back on 2020 with fondness, but German inverter manufacturer SMA had a year of highlights in Australia, represented most solidly in record sales of some 1.6 GW of SMA Sunny Central inverters connected to 15 major solar projects around Australia by December 23.

The biggest share of Sunny Central inverters — the current SMA model of choice, soon to be usurped by the Sunny Central UP line — went to Neoen’s 460 MW Western Downs Green Power Hub, which will be the largest solar farm in Australia to date when it reaches scheduled completion in 2022.

“Being part of that is huge for us,” says Joshua Birmingham, Director of Project Sales for SMA Australia.

He names Gold Fields’ Agnew Gold Mine project that integrates solar, wind, gas and diesel generation in a 56 MW microgrid as another proud achievement, telling pv magazine, “We see enormous growth in the offgrid market and in the north-west of Western Australia, so being involved in Agnew is also a big win.”

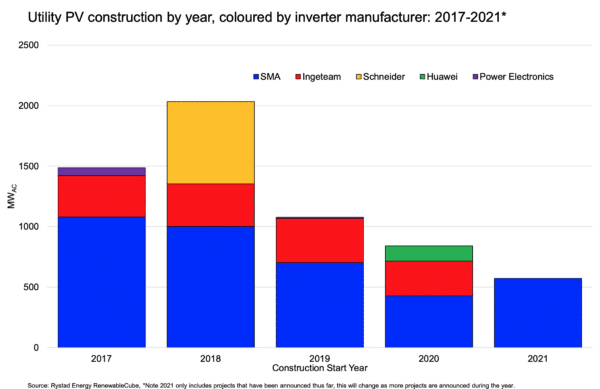

Image: Rystad Energy RenewableCube

Boots on the ground, and hands on!

Getting down and hands-on dirty, whether in mining or the morass that was the West Murray disaster zone, is a hallmark of SMA’s commitment to the Australian renewables industry, which Birmingham says is part of the key to maintaining the lion’s share — 65%, says SMA — of the local utility-scale market.

In April 2020 when SMA engineers collaborating across the globe came up with an inverter-based solution to the seven-month severe curtailment of five West Murray solar farms found to be causing voltage oscillations in the West Murray region of the grid such that stability of electricity supply was threatened, the cheer that went up must have been audible on the moon.

Not only did the fix stop the combined million-dollar-a-day loss in revenue to those solar farms, but the successful, hard-won resolution meant that the Australian Energy Market Operator (AEMO) could again begin processing applications from other projects in the region queuing to connect, and it strengthened confidence in the ability of projects in more remote parts of the grid to deliver their renewable riches to the National Electricity Market (NEM).

The solution involved tuning SMA’s inverters — which were deployed by all five affected West Murray generators —to play in time with one other, reducing the “chaotic noise” of each potentially beating their own drum, Scott Partlin, Head of Service, and previously Head of Engineering for SMA Australia, explained to pv magazine back in April.

And therein lie two other secrets of SMA’s deserved success in Australia: its in-country team of some 60 skilled employees, many of whom have long experience with the idiosyncrasies of the NEM; working with “the technical superiority of our equipment to deal with weaker grid connections”, says Birmingham.

SMA executives are typically modest and forbearing in speaking out against the shortcomings of others, but Birmingham says that, “If those five West Murray plants had been Schneider plants, well, Schneider has walked away from the utility PV market, so it wouldn’t have been helping.”

As it was, the five plants, and other West Murray renewable projects waiting to connect to the grid, which did have SMA inverters either installed or on order, had more than a snowflake’s chance of getting up and running — if a little later than expected due to the long cold freeze on project connections prior to SMA’s nutting out of a tuneful solution.

SMA thinking on 2021

SMA’s sales continue, and Birmingham anticipates 500 MW of new capacity joining the SMA family during the first quarter of 2021. Plus the repowering market — replacing the inverters of other manufacturers that are unable to perform to AEMO’s satisfaction — is just getting started.

Although he says that, “To this point in time,” SMA is “very happy” with where it sits in terms of market share, and the esteem in which it is held in the Australian market, it isn’t complacent.

“We’re seeing increasing competition from Chinese inverter manufacturers,” specifically Sungrow and Huawei, says Birmingham.

“They both achieved their first connection approvals last year,” and FRV’s 85 MWac Winton Solar Farm is currently being tested in Victoria with Huawei inverters.

And of course, Spanish inverter company Ingeteam has been consistently performing in the Australian market; in the New Year it announced a 2 GW total power base of solar across this wide sunny land, including the 160 MW Maryvale Solar Farm, which lies within New South Wales Central-West Renewable Energy Zone.

Juan Miguel Gutiérrez, the director of Ingeteam Australia, said in the company’s January announcement that although 2 GW is “a nice, round number, the important thing is that it reaffirms the confidence that our customers are placing in our solutions, in a market in which the technical requirements demanded by the power companies and grid operator are probably the toughest in the world”.

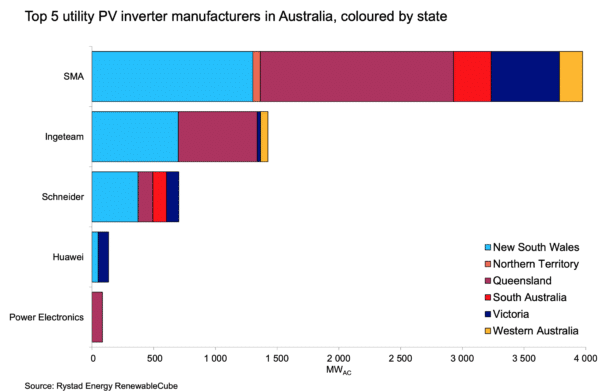

According to Rystad Energy’s Senior Analyst in Renewables Research, David Dixon, SMA has 62.6% of the Australian utility-scale market share, and Ingeteam is its closest rival with 22.5%.

Grid-forming capability will redefine the inverter landscape

The next defining factor in Australia’s inverter market will be the successful deployment of grid-forming technology, as opposed to the currently used grid-following technology. SMA and GE are among the companies testing new systems at the dangling edge.

Where grid-following inverters rely on the spinning reserve of large fossil-fuel-driven turbines — or their non-productive yet still spinning stand ins, synchronous condensers — to set the tempo of voltage waveforms, grid-forming inverters can set their own pace without the inertia generated by large spinning pieces of hardware.

So when your solar farm is hanging out at the end of the line, where land is cheap and the sun is all but uninterrupted, a long way from spinning machinery, voltage patterns can become weak or inconsistent. Without an inverter that can create a steady wave pattern, your output is likely to threaten grid stability and be disallowed.

Birmingham says SMA is “commencing modelling of grid-forming plants, both solar and storage”, and that he expects the first grid-connected, grid-forming plants to be commissioned in 2022.

“Grid-forming inverters vastly improve the ability of solar plants to connect in low-system-strength conditions,” he explains, adding that in Germany SMA inverters have been used to “form” grids for whole towns such as the Bordesholm project, allowing them to run completely independently, even if just for an hour, of any kind of traditional generation or spinning reserve. Birmingham says, “It’s the future.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.