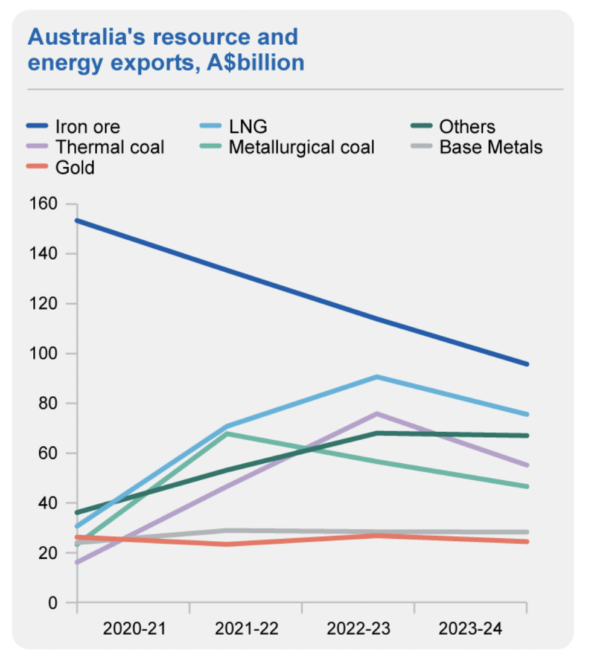

The Australian federal government has released two major reports on Australia’s energy and resources sector, forecasting exports will earn a record $459 billion (USD 307 billion) in 2022–23.

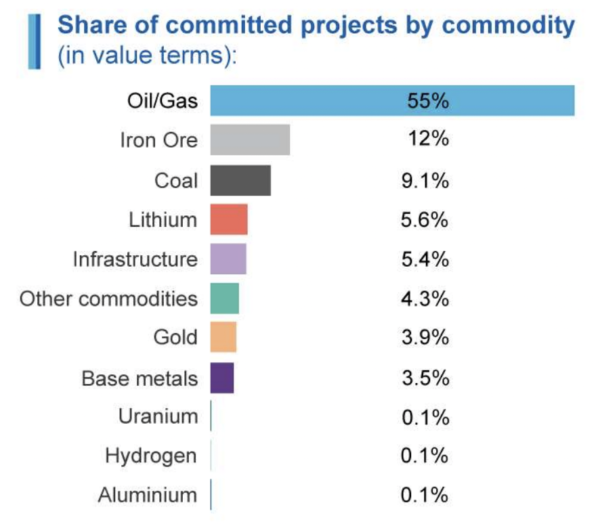

While a large portion of this value comes from the surging price of fossil fuels, the reports have, since 2021, begun to cover new energy industries like critical minerals used in batteries and renewable technologies, as well as hydrogen projects which dominate the development pipeline.

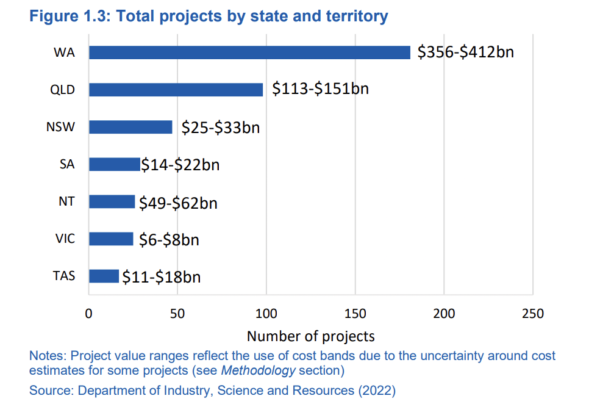

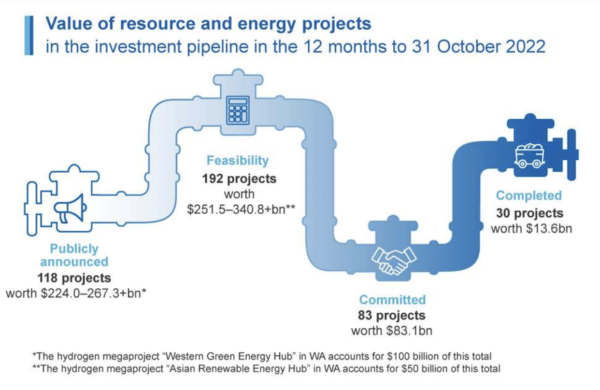

There appears to be vast differences in footings of these growing “new energy” categories. The forecast earnings from critical minerals pipelines have much lower dollar values compared to hydrogen, where the value of projects in the investment pipeline range to $705 billion. But the government points out just one hydrogen project has made it into the “committed” stage so far, with the majority falling off the radar following the feasibility stage.

Critical minerals and new energy metals

Demand for key battery materials is driving interest and investment in mine capacity and processing facilities in Australia, with the Resources and Energy Quarterly report, published by the Department of Industry, Science and Resources, forecasting export earnings from critical minerals like lithium, graphite, copper, nickel will reach almost $33 billion in 2022–23, compared with $22 billion in 2021–22, a 50% increase.

Image: Australian government, under International Licence

CC BY 4.0

The Resources and Energy Major Projects 2022 report from the Office of the Chief Economist in conjunction with the Commonwealth department, is even more optimistic, forecasting estimated value from new energy metals and minerals could reach $42 billion in 2022-23, which would amount to almost doubling value in one year.

Of the critical minerals, lithium understandably leads the pack with its export earnings forecast to increase more than ten-fold in two years, from $1.1 billion in 2020–21 to $16 billion in 2022–23 and $17 billion in 2023–24. This would make lithium Australia’s sixth largest “resources and energy” export commodity.

Such export chains are already well established in Australia, but there is also major growth in more emerging minerals like vanadium.

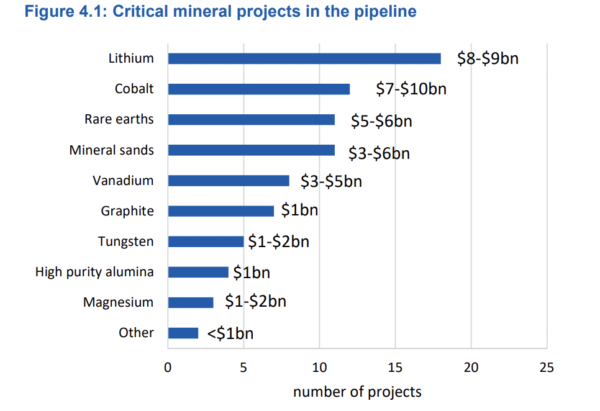

While Australia’s critical minerals list currently comprises 26 minerals or mineral groups, investment in major critical minerals projects is driven by five key commodities — lithium, cobalt, rare earths, heavy mineral sands and vanadium. Combined, these minerals accounted for over 80% of total investment, the report noted.

In total, Australia’s critical minerals major project pipeline sits at 81 projects, with around a quarter at the earliest “publicly announced” stage. Those are worth between $6.5 billion and $11.6 billion.

Projects at the feasibility stage account for more than half of all critical minerals’ projects — worth $16.3 billion to $22.9 billion. A total of 13 projects were at the committed stage ($6.7 billion), and 3 projects with a capital value of $800 million were completed during the year, according to the report.

Interestingly, the report notes an increasing diversity in the products these projects are developing, ranging from mineral concentrates to vanadium electrolyte for rechargeable vanadium redox flow batteries, instead of simply raw material export – though this form still dominates.

Image: Australian government, under International Licence

CC BY 4.0

Hydrogen

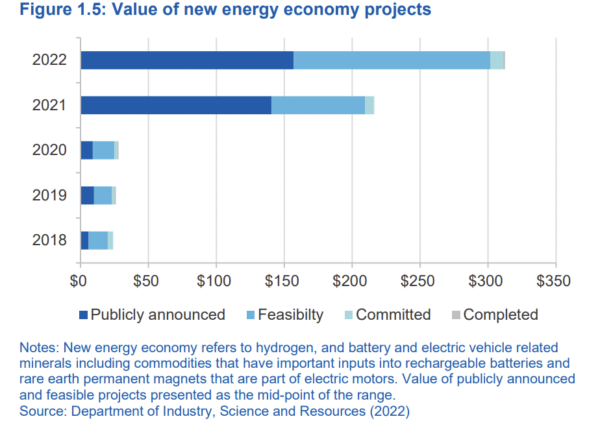

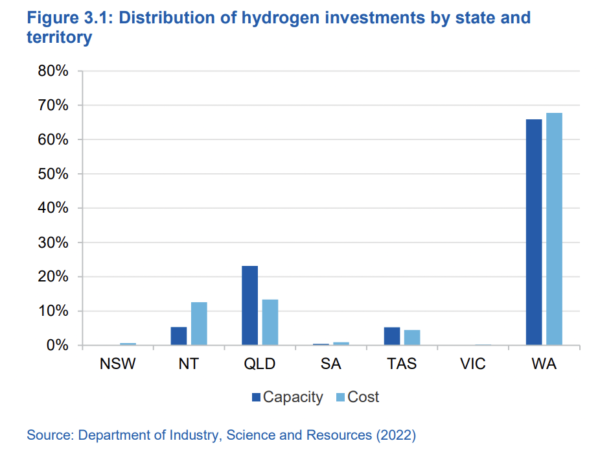

Hydrogen projects accounted for an estimated $266 billion worth of potential investment, according to the Resources report, lifting the estimated total value of projects in the investment pipeline to a range of $572 billion to $705 billion.

“Hydrogen projects make up the largest single component by value in this year’s report,” said its authors. “They have almost doubled from an estimated range of $133–185 billion in 2021 to $230–303 billion in 2022 — corresponding to some 48 projects, or 32 more than in the previous year. This does not include three regional ‘hubs’ with a combined estimated worth of nearly $1 billion, which have been classified as hydrogen-related infrastructure.”

Of the projects behind this lift, the major drivers are two Western Australian megaprojects worth $150 billion. Those are the Australian Renewable Energy Hub (which until recently was called the Asian Renewable Energy Hub) and the Western Green Energy Hub.

While the potential investment from hydrogen is staggering, the government also notes the industry has “high uncertainty for individual projects.” Only three out of 16 projects included in last year’s report progressed beyond the feasibility stage — of which one was a pilot program.

The availability of (public) seed funding has allowed many early feasibility studies to be conducted, the report says, but these have largely found that significant government support is still required for low-carbon hydrogen projects to be commercially viable.

“Hydrogen is a new field and, while progress can be expected for the industry as a whole, the landscape of projects is expected to change rapidly … These circumstances are not unusual in the resources sector, especially in a field where dominant technologies are not yet established,” the Resources and Energy Major Projects report adds.

Going green

The report also points out there has been “little follow up” on fossil fuel-based hydrogen generation, often named blue or grey hydrogen, following the shipment of blue hydrogen from Victoria to Japan as part of the Hydrogen Energy Supply Chain pilot.

“Wind and solar are expected to power over 95% of projects in the pipeline,” it says. “Apart from one project — which utilises waste or biomass — all the renewable energy projects rely on electrolysis.”

While the push for blue hydrogen has cooled, the focus of most projects remains on the export market, with the majority seeking to capitalise on Australia’s availability of land and isolation. “However, the best option for transporting hydrogen is currently unclear — particularly over long distances — both from an economic and a technological perspective,” the report says.

In terms of the form these hydrogen projects will take, the majority are aiming to produce either hydrogen (63%) or ammonia (27%). Methanol, while mentioned, remains fairly ignored.

Image: Australian government, under International Licence

CC BY 4.0

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.