“Australia is positioned to emerge in the new world economy as a value-added critical minerals superpower,” says a new report from Climate Energy Finance.

The report notes Australia’s pipeline of investment proposals “accelerated dramatically in 2022” to value of $10 billion (USD 6.7 billion). Among these proposals are key minerals for the energy transition, particularly when it comes to battery energy storage, such as lithium, nickel, cobalt, vanadium, and rare earths.

This massive push is driven by both Australian mining majors pivoting to future-facing commodities, as well as new entrants to the sector. Report authors Tim Buckley and Matt Pollard urge targeted, ambitious policy incentives and strategic co-investment to solidify Australia’s position in the growing market.

Global critical minerals demand is expected to grow five to 10 times this decade, the report notes. Such growth could also create approximately 35,000 jobs in the materials processing and manufacturing sectors by 2030.

It is crucial, the report says, that this opportunity is co-managed with First Nations and regional communities, and guided by a “nature positive” approach. Without a more inclusive and holistic approach, the industries spearheading this “reindustrialisation” risk repeating the mistakes of the past, which have greatly contributed to the crisis the world is now facing.

“Two global factors are combining to facilitate Australia becoming a value-adding superpower that refines its critical minerals into high-grade chemicals and metals before export,” writes Australia’s former chief scientist, Alan Finkel.

The first is that nations worldwide are urgently looking to “derisk” their energy supply chains by diversifying their sources away from China. The second is that these nations are also increasingly favouring materials refined and manufactured using clean energy, adds Finkel.

Combined, these two factors provide a massive opportunity for Australia, a country blessed with enviable natural resources and critical mineral deposits, coupled with a stable political and legal system.

Key findings

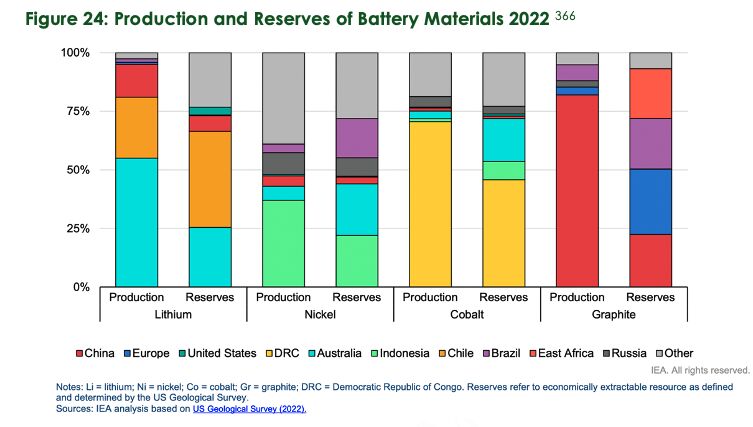

“Australia has the global competitive advantage of abundant geological reserves of critical minerals,” the report says. “We are the world’s leading producer of unprocessed lithium (46% in 2021), and we produce 79% of the world’s hard rock lithium, with exports forecast to reach $16 billion in 2023, up 15x in two years.” On top of that, Australia is the world’s third largest cobalt exporter and fourth largest exporter of mined copper, nickel and rare earths.

However, the report’s authors argue that Australia is wasting its geostrategic advantage as “almost 100% of Australia’s critical mineral exports are sent to China for refining to supply its dominant battery and EV manufacturing industries.”

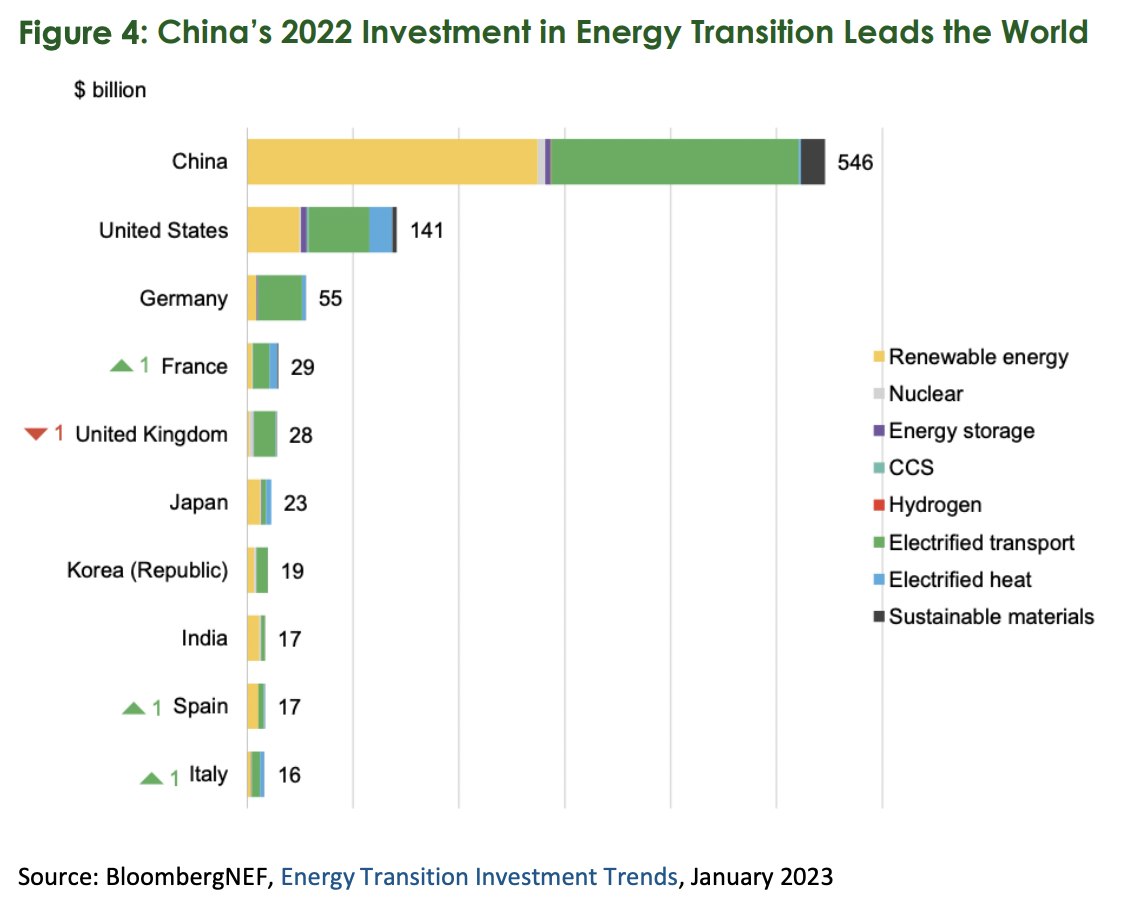

In 2022 alone, China invested $816 billion in the clean energy transition, and maintains global dominance in virtually all zero emissions industries, including the processing and manufacture of critical minerals, batteries, electric vehicles, aluminium, steel, nickel, polysilicon, graphite, solar modules and wind turbines. Indeed, the two Chinese leaders in battery manufacturing now produce over 50% of global supply.

China’s dominance, the authors say, presents both risks and opportunity for Australia. But the opportunity to onshore the processing and manufacture of Australia’s raw commodities is too lucrative to lose out on.

“Australia’s abundant wind and solar resources and extensive land area mean we have the potential to install [approximately] 25,000 GW of renewables capacity, sufficient to generate over 86,000 terawatt hours (TWh) of energy annually,” the report says. “This competitive advantage provides a critical opportunity to decarbonise value-adding onshore, and aid our key trade partners in abating value chain emissions by using low cost zero-emissions firmed renewables to power mining, refining and manufacture.”

To realise this potential, it is critical Australia’s federal government enhance its strategic public-private investment focus to maximise co-investment in energy transition, the authors say.

Such an undertaking would involve updating the mandates of the government’s Future Fund, Clean Energy Finance Corporation (CEFC) and Australian Renewable Energy Agency (ARENA), which all seek to support the energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.