Speaking at the Renewables and Critical Minerals Superpower webinar hosted by the Smart Energy Council on Tuesday, Tim Buckley, director of Climate Energy Finance, outlined the fierce competition flooding into the clean energy space, especially around manufacturing.

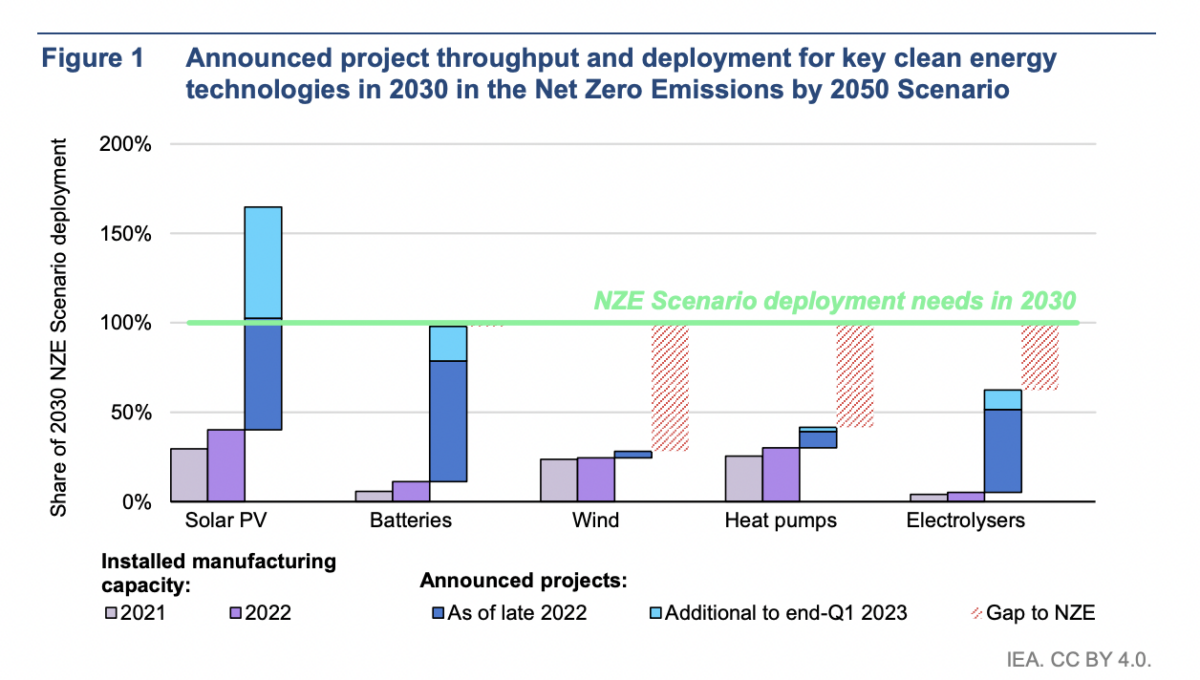

In the last year, there has been an onslaught of new clean energy manufacturing plants announced. “Literally 14 months ago, 16 months ago, the IEA [International Energy Agency] said there is only 40% globally of the [solar] module manufacturing capacity needed to deliver on their forecasts; 14 months later, we now have 65% more capacity than the IEA actually models,” Buckley said.

That is, in terms of solar module manufacturing, the last year has seen the globe move from a massive undersupply to an oversupply.

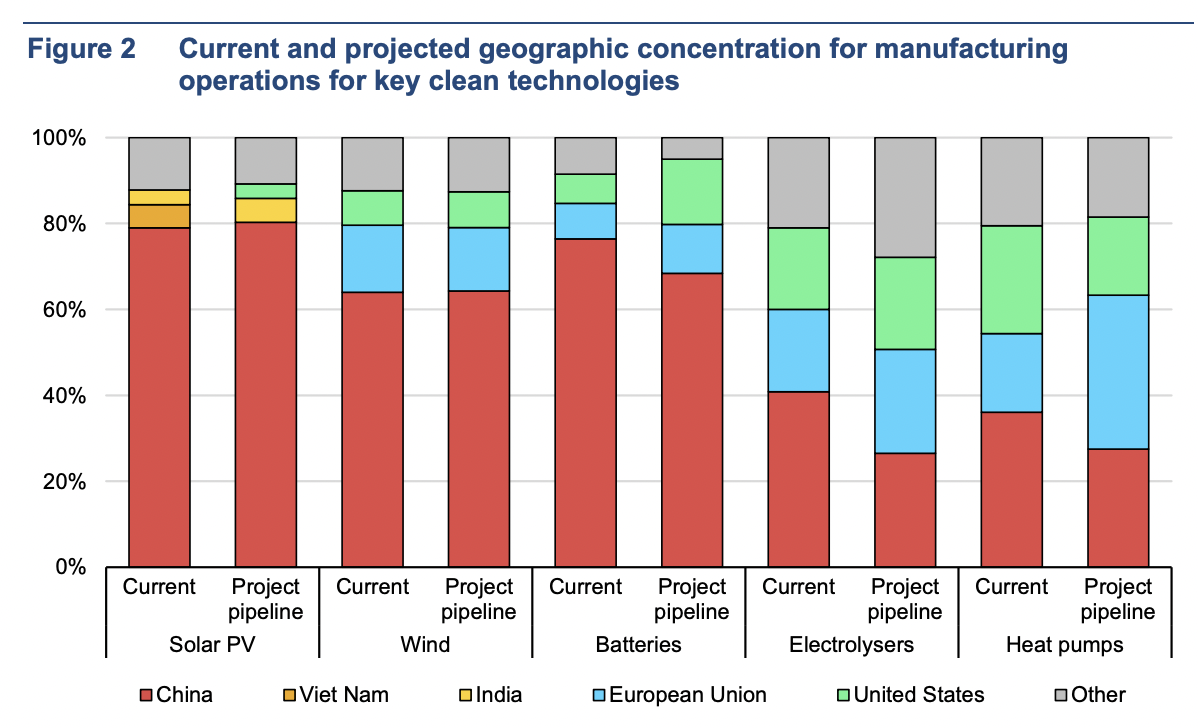

Much of the focus in Australia to date has rested on the Inflation Reduction Act (IRA), the US’ deceivingly named renewable energy manufacturing policy. While the IRA is set to bring a five fold increase in clean energy manufacturing to US, the projects it has inspired (and it has inspired a number), pale in comparison to what is happening in China.

“The biggest project announced in America in the last six months is 3 GW. China does 20 or 30 GW per factory. So just to put that in context, 10 times bigger than the biggest announcement in America for solar modules,” Buckley said.

Indeed, the SNEC conference held in Shanghai in May drove home China’s gargantuan capacity to scale up manufacturing – a skill it has finessed over decades. Representatives for pv magazine who attended the conference described the degree of vertical integration and technological diversity within companies as staggering.

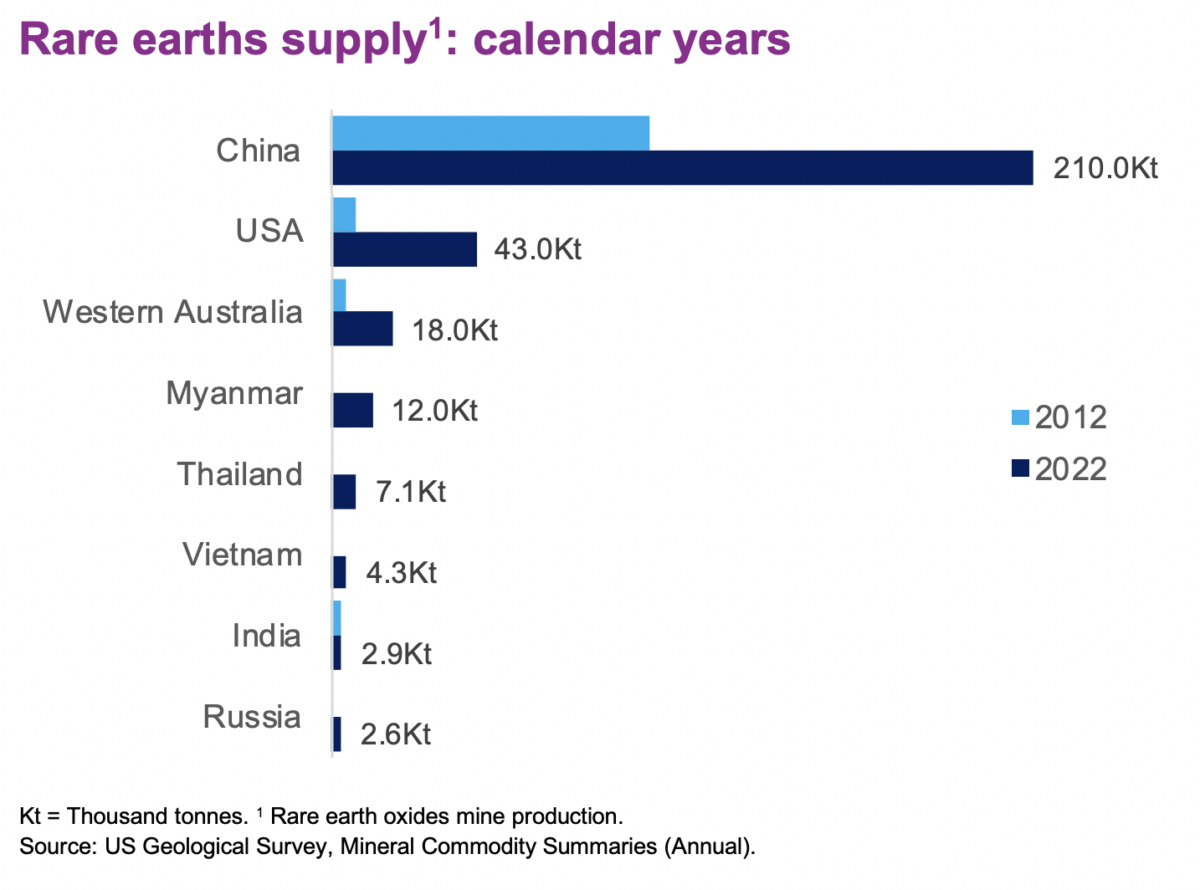

Far from standing by as the IRA diversifies global supply chains away from China, “they are racing even faster,” Buckley said. In its State of Clean Technology Manufacturing report, published in May, the IEA listed the globe’s major project announcements for solar PV and battery manufacturing in the first quarter of 2023. “294 GW of additional solar manufacturing capacity has been announced, and almost all of in China,” Buckley said.

He added that anyone yet to recognise clean energy manufacturing as a race, hasn’t been paying attention.

In that race, China is a decade ahead of Australia, Buckley said.

Australia’s capacity

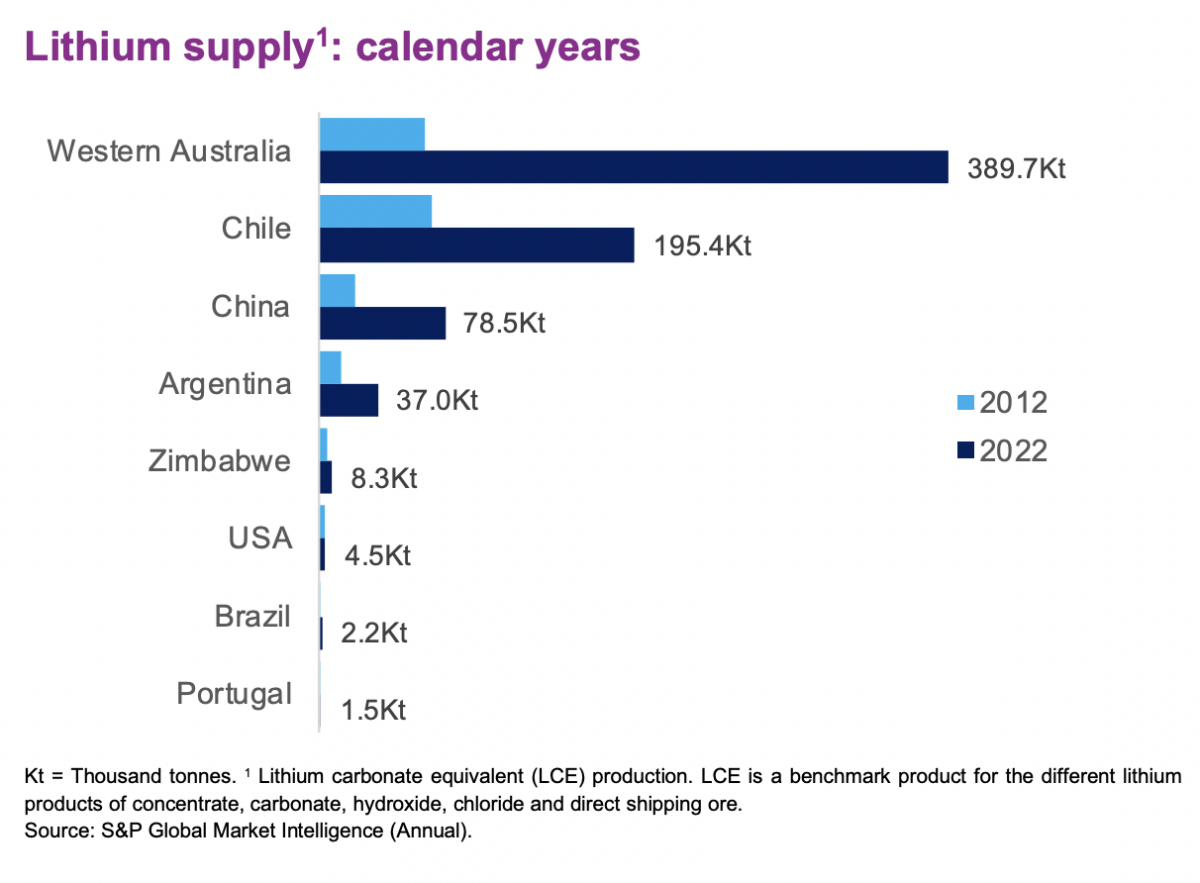

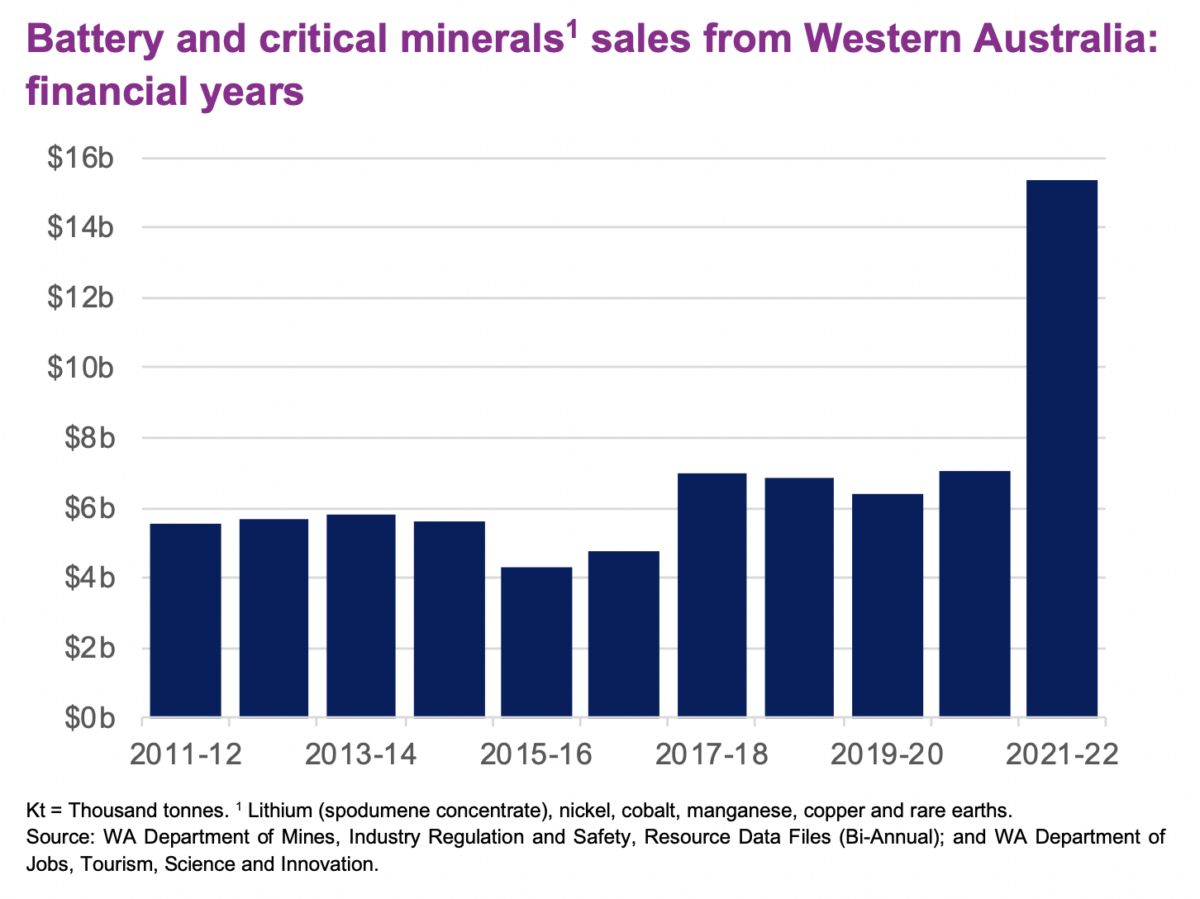

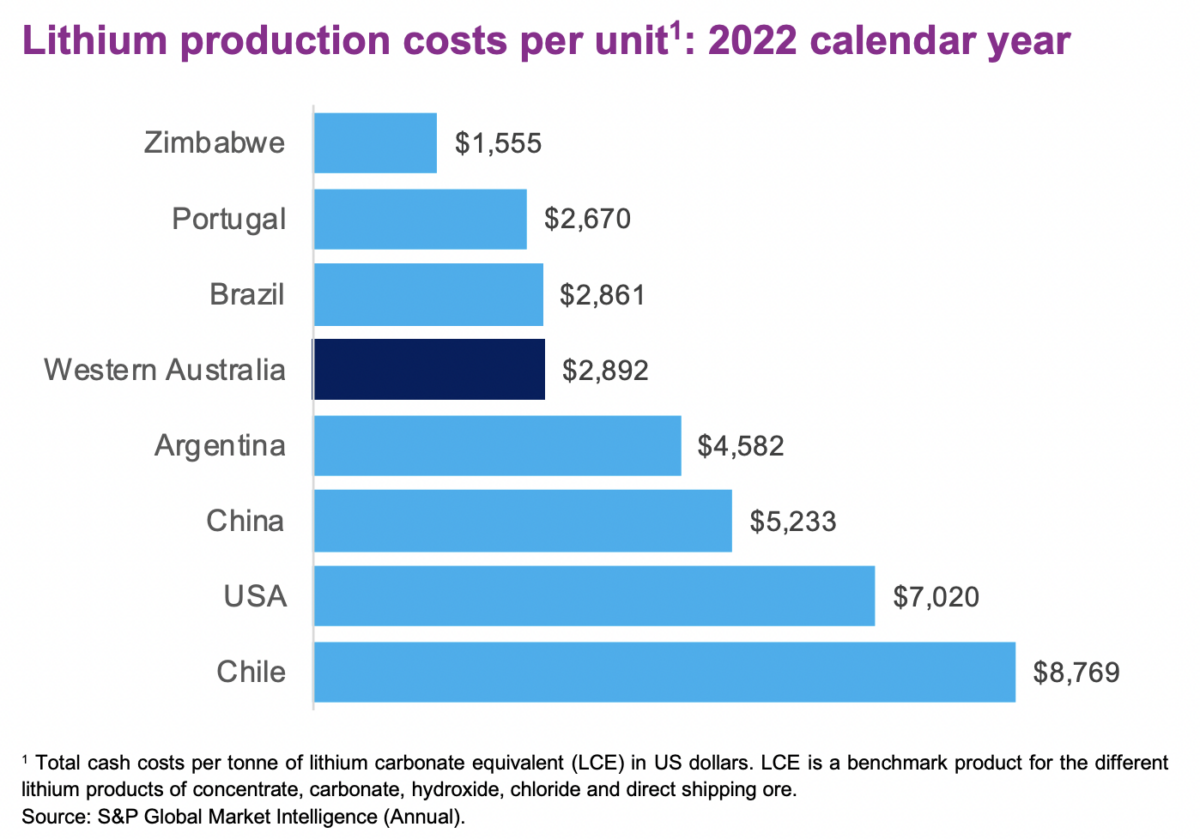

Australia is one of the few countries in the world with deposits of all the ingredients needed to make the future’s batteries. While it has a clear natural advantage and enjoys favourable terms under the US’ IRA, it is hardly well positioned to move into manufacturing.

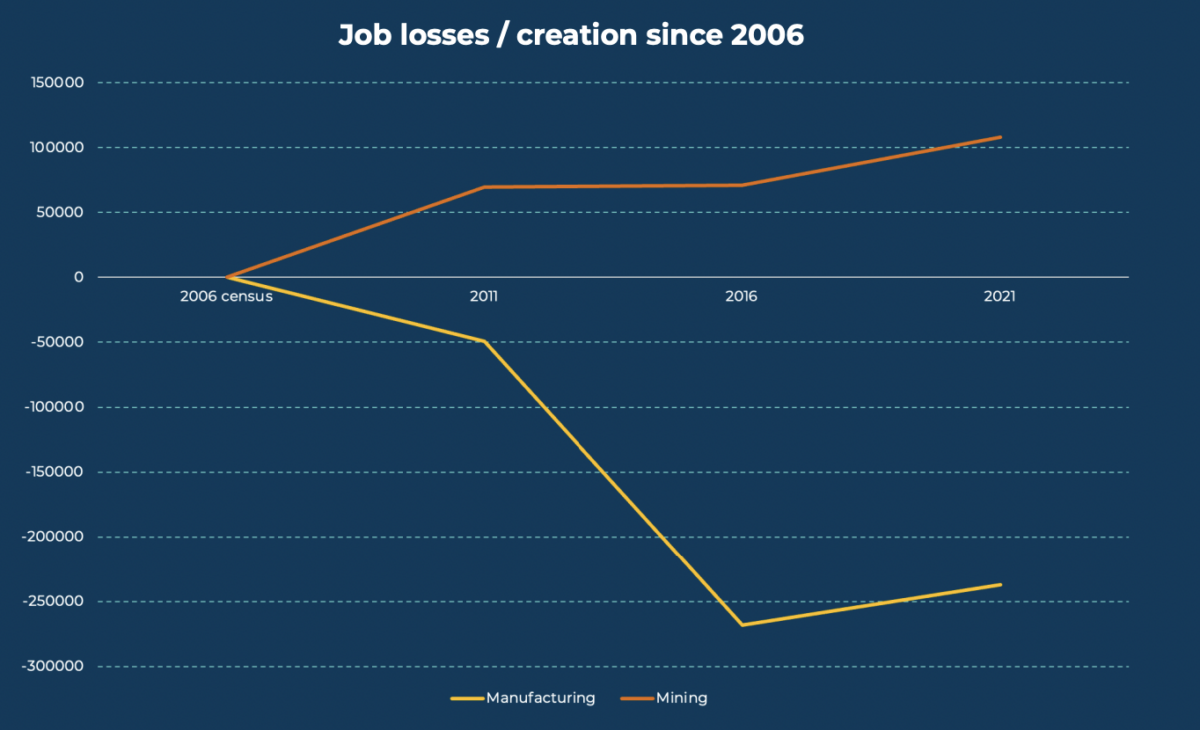

One quarter of Australian manufacturing jobs have disappeared since 2006, a new report from Australian climate tech startup, Conry Tech, has found. Entitled Australia’s Dig and Ship Obsession, the report noted mining jobs have doubled in that period. Which is to say, Australia is hardly turning around its global ‘quarry’ status.

Western Australia, unsurprisingly, saw the biggest increase in mining jobs, which grew 153% between 2006 and 2021, adding 40,000 jobs. This figure is set to grow substantially as the state’s mining ramps again to meet global critical minerals needs.

The question is not whether our mined materials are valuable though, but whether Australia will be able to keep more of the value chain onshore by processing, refining and manufacturing products from its raw critical materials.

The IRA

The Inflation Reduction Act will likely go some ways to realising this, since the policy is all about diversifying the US’ clean energy supply chains. While it is hoping to bring supplies onshore, the US is also looking to ‘friendshore’ – meaning it will source from allies like Australia.

“As a free tree trade agreement partner, Australia will have special access under the IRA,” Joanna Kay from the Smart Energy Council said.

The extent to which Australia will be seen as a ‘domestic’ supplier under the IRA remains a potential rather than guarantee, however. “That’s very promising, but I wouldn’t be holding my breath for the US taxpayer to send billions of dollars of subsidises for Australia,” Buckley says of Australian favouritism under the IRA.

Australia also recently signed a clean energy compact with the US. The compact outlines bilateral cooperation between the two nations and is seeking to create a framework to coordinate clean energy investments.

“It’s about positioning Australia as a partner of choice for the US,” Kay said. “It means that Australia, under the laws, will have additional tax credits as well,” she added.

This tax credit system a crucial aspect of the IRA’s design, as Rosie Oldfield, Sundrive’s government relations and corporate affairs manager, explained. “Within the Inflation Reduction Act, there is a particular piece of legislation and policy called the ‘Advanced Manufacturing Reduction Tax Credit.’”

“What this tax credit is, is the linking of tax credits to the production of a product. When you produce a product, for example a solar cell or solar module, what it means for that company is a tax credit goes back to the company, but it also goes back to every single company that had an input element in the supply chain of that product, as long as it happened onshore (in this case, the US). What this means is the tax payer is not on the hook for anything until is produced.”

Oldfield advocated for Australia to set up a similar policy based on this tax credit model.

In terms of how much Australia stands to gain from US policies and compacts, that remains to be seen. Buckley described the Australia US Climate, Critical Minerals and Clean Energy Transformation Compact as “very, very big on aspiration and targets and collaboration.”

“That’s great, but we do need to see a lot more details,” he added.

Buckley also importantly pointed out that in China, Europe and elsewhere, recycling is being recognised as an another key source of critical materials. In China’s most recent five year plan, the country is targeting a nine-fold increase to its recycling schemes.

“Obviously that is another source of critical mineral supply, so Australia’s got to be nimble, fast, and get onto it while the money is flowing,” Buckley said.

And flowing it is. Buckley pointed out the IRA is far from the only clean energy manufacturing subsidisation policy in town, with Europe, India, China and elsewhere all introducing their own schemes.

“It’s just a huge huge subsidy fest,” Buckley said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.