Even with gold stocks trending up strongly on historical charts, the ballooning demand for critical minerals has seen the value of Australian stock exchange (ASX) listed companies in the sector power past their golden counterparts.

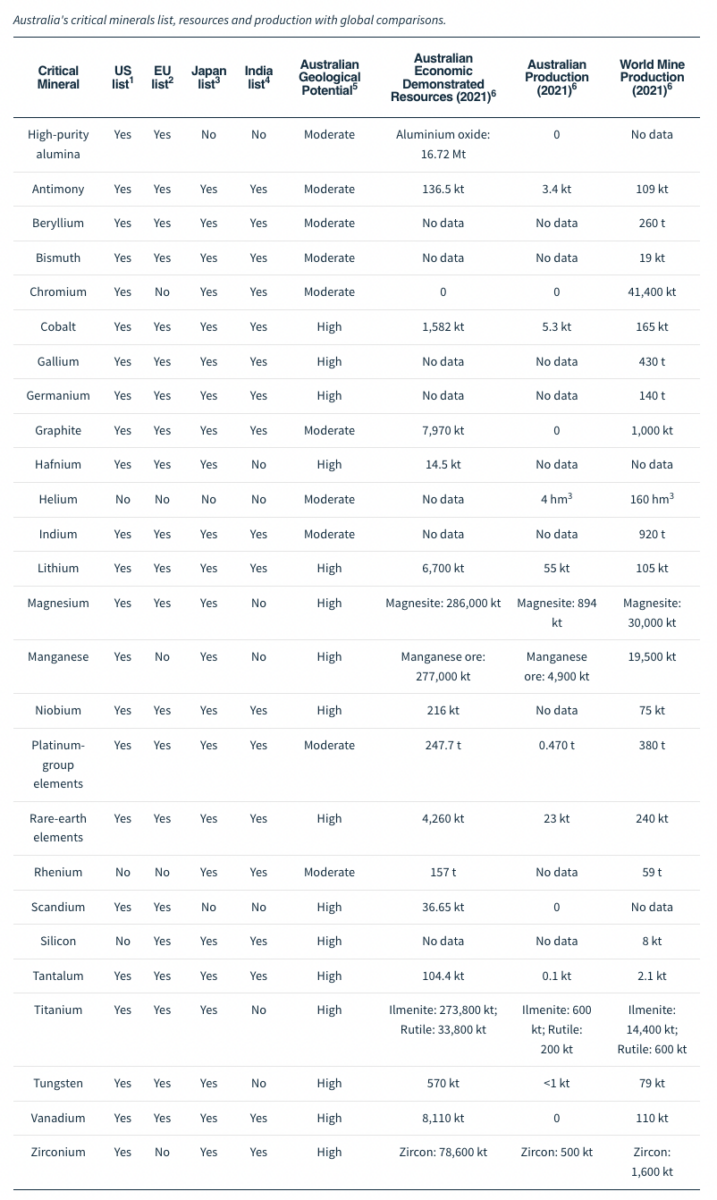

The Australian government classes 26 resource commodities as critical minerals, defining them as metallic or non-metallic elements essential for the functioning of modern technologies and economies. They include lithium, rare earths, graphite, vanadium and others, and are used in technologies like electric vehicles, wind turbines, solar panels, and big batteries.

As of Tuesday, June 13, 33 major ASX-listed critical mineral stocks came to be worth more than the 25 companies within the ASX All Ordinaries Gold Index, which were valued at $86.1 billion.

Home to historic mining booms in the past, Australia’s mining industry is highly developed and has managed to rapidly move into the burgeoning sector. Various politicians and lobby groups have pointed to critical minerals as Australia’s ace card in the global race to become a renewables superpower as it is home to both bountiful deposits and industry know-how.

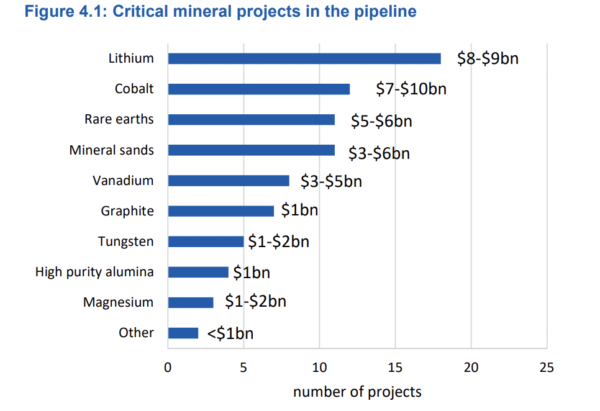

In a recent report, consultancy Climate Energy Finance noted Australia’s pipeline of investment proposals in the critical minerals sector “accelerated dramatically in 2022” to value of $10 billion.

Image: Australian government, under International Licence

CC BY 4.0

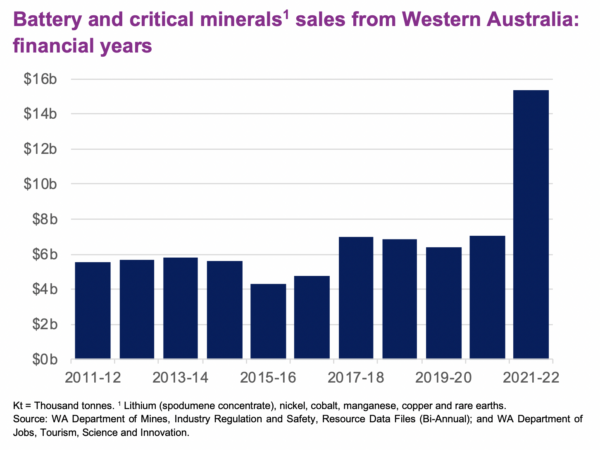

Meanwhile, Commonwealth agency Geoscience Australia found Australia’s economic inventories for many critical minerals soared in 2021, including platinum group elements, up 131%; scandium, up 21%; vanadium, up 10%; and cobalt, up 6%. Australia is already the world’s top lithium producer, with nearly all of it coming from Western Australia.

Image: Western Australian government

While the market growth holds vast economic promise, the industry has significant environmental impacts – a fact often brushed over by clean energy industries which enjoy touting themselves as ‘planet savers.’

A recent report from the Jubilee Australia Research Centre warned the race to capitalise on “staggering” demand could see Australia dig up more critical minerals than necessary.

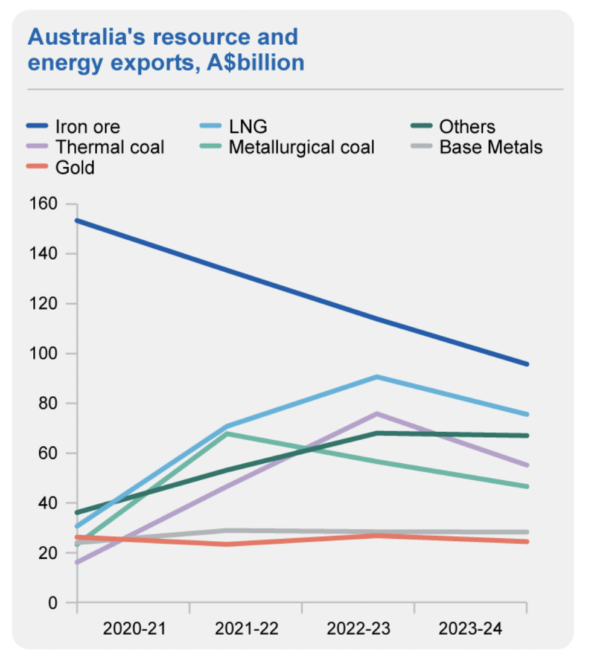

Image: Australian government, under International Licence

CC BY 4.0

Jubilee Australia Research Centre Executive Director, Dr Luke Fletcher, urged government to pause and reflect to ensure the new mining push does not repeat the mistakes and damage of past mining booms. The report also questioned global mineral demand projections, suggesting they may be inflated since most fail to factor in supply from future recycling.

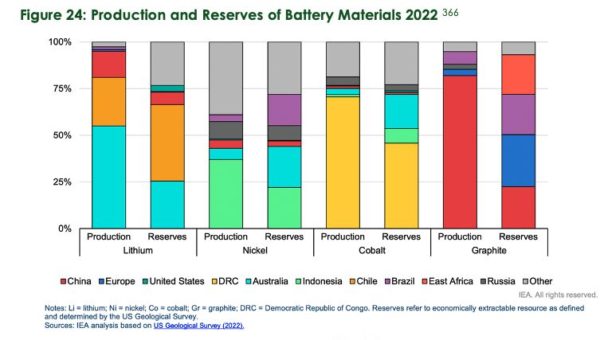

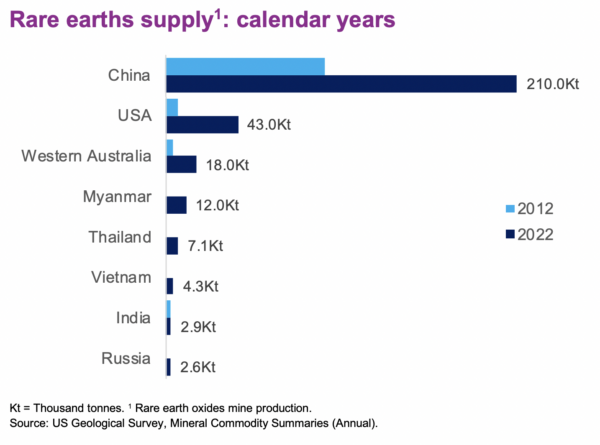

The Australian government is currently preparing a revised critical minerals strategy, and appears to be planning to rapidly accelerate the growth of the sector with a broader view of breaking China’s domination– a role Australia’s allies are eager for it to step into, given energy security is front of mind.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.