Australian-owned renewables player Quinbrook Infrastructure Partners will adopt the new energy-tracing software, dubbed Quintrace, across its portfolio companies and customers in Australia, the US, and the UK, it says.

The Quintrace digital platform enables customers to trace the source of every kilowatt-hour consumed at their operational facilities, matching it back to their nominated renewable supply projects located within the grid on a 24/7 basis. The software also includes information about the carbon-intensity of electricity supplied by the grid at any given time, allowing for granular monitoring of emissions.

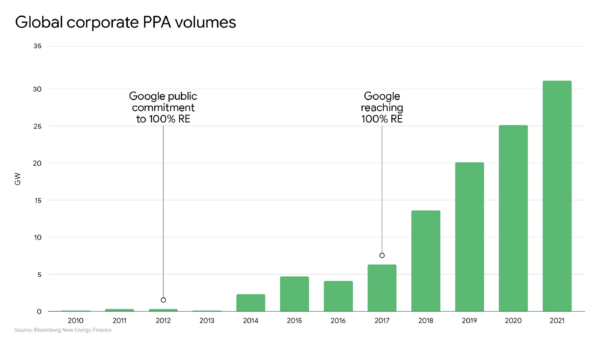

In other words, platform is about time matching renewables – something which looks like it will soon be legislated in the US and Europe, but is only just starting to crack Australia’s cognisance. The importance of energy tracing most prominently came to light after Google’s own engineers called the company out for claiming to run on 100% renewable energy, when in fact it was matching 100% of the electricity its operations consumed with renewable purchases, much like Australia’s Capital Territory (ACT).

In fact, when Google audited its energy use, it found it had only used ‘carbon free energy’ 66% of 2021 – meaning renewables actually powered its data centres two thirds of the time, while coal and other fossil generation was still consumed for the nighttime difference.

This publicised example spurred a more nuanced examination of the difference between actually using renewable energy and claiming to have used renewable energy via a certificate scheme. Currently in Australia and much of the rest of the world, renewable energy certificates like Large-scale Generation Certificates (LGCs) do not account for when or where electricity is used.

Australia’s federal government agency the Clean Energy Regulator is currently working on introducing a new renewable energy certificate scheme, which will be known as the REGO, or Renewable Electricity Guarantee of Origin. This scheme is expected to come into effect around 2025, and will coexist with Large-scale Generation Certifications before replacing them and Small-Scale Technology Certificates (STCs) after 2030.

Despite the fact that Europe is structuring its own Guarantee of Origin certificates down to 1 watt hour of granularity, including time stamping, and President Biden committed the US to having a ‘carbon pollution-free electricity sector’ (that is, with 24/7 time matching) by 2035, Australia’s scheme does not appear to be pursuing this standard, and is still working on a much larger megawatt hour window.

During consultation period for the REGO scheme earlier this year, a number of different industry groups including the Clean Energy Investor Group, the RACE for 2030 group, Google Australia, UNSW, Enosi and more, called on government to include time-stamping and carbon intensity information in the REGO certificate scheme. So far, the Clean Energy Regulator appears hesitant to consider this due to the added complexity.

Industry argues that moving forward with a scheme misaligned with standards being adopted by the world’s biggest markets will undercut Australia’s ability to export green energy and green manufactured materials.

Coming back to Quinbrook, cofounder and managing partner David Scaysbrook said: “Knowing what your real and auditable footprint is to defend greenwashing claims and track genuine carbon impact is now an acute business need. This urgent customer need is exactly why we created Quintrace.”

Image: Quinbrook Infrastructure Partners

The company says the platform will also integrate with emerging global standards like EnergyTag and can access hourly carbon calculations in accordance with the Greenhouse Gas Protocol. The platform also facilitates the recording of annual and hourly energy flows under Power Purchase Agreements (PPAs), including custom PPAs, Quinbrook says.

The company pointed to the software’s particular role given the rise of battery storage – a technology embraced as renewable, even though batteries are entirely agnostic about the source of the electricity they store. “It’s now critical to know the carbon intensity of the grid power being used to charge batteries before that stored energy is supplied to a customer,” Scaysbrook said.

For customers with battery storage, Quintrace provides advanced tracking and real-time monitoring of battery carbon intensity “with the ability to support optimisation of both commercial and carbon impact objectives in real-time,” Quinbrook says.

While energy traceability and 24/7 time matching is undoubtedly necessary to reach a zero-emissions grid, these types of technologies raise the bar on renewable claims significantly. This, in turn, entails far more nuanced work from both companies and governments. It is inevitable that should such standards be widely employed, many renewable hydrogen and battery projects would have their green credibility undercut, as would the long list of RE100 companies.

Quinbrook argues: “Companies must be able to prove and audit their carbon footprint reductions along with the need to meet increasingly stringent carbon reporting that presents huge and costly challenges.”

These stringent carbon reporting standards may indeed be imminent in other countries, but it remains to be seen whether Australia will even move forward with properly time-stamped renewable certificates, let alone carbon-intensity information.

There are already a number of companies, including Australia’s Enosi, which have developed granular energy tracing software. At this stage, it is not clear whether Quintrace has been developed in-house by Quinbrook or includes third-party programs.

Earlier this week, Quinbrook also announced plans to develop a green polysilicon manufacturing plant in North Queensland’s Lansdown Eco-Industrial Precinct. Quinbrook has been conditionally allocated a 200-hectare at the site, and is looking for an operational parter to complete the vertical play.

The company, it seems, is rapidly expanding outside its traditional wheelhouse as a renewable energy investor, looking to become involved in vertical supply chains as well as energy accounting software.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.