Australia’s rooftop solar juggernaut continues to thrive in the face of uncertainty surrounding the Covid-19 outbreak, pushing fossil fuel generators out of the National Electricity Market (NEM). A new audit from The Australia Institute shows that without rooftop solar, South Australia and Queensland would have a considerably higher share of gas and coal generation, respectively.

From December to March, rooftop PV provided 16.3% of electricity in South Australia and 7.7% in Queensland, up from 10.1% and 5.3% respectively two years ago, the TAI audit finds. According to STC data, Australian rooftops across the NEM added some 203 MW, 215 MW and 254 MW in January, February and March respectively. If the trend had continued, unperturbed by the Covid-19 outbreak, something approaching 3 GW of sub-100kW systems could have been installed in 2020. This would have been a big jump on the 2.13 GW installed in 2019.

While the monthly STC market has not revealed any significant slowdown as yet, an industry survey has found that the further spread of residential PV is likely to slow down with confidence and many household incomes taking a hit. The survey carried out last month revealed that around 50% of respondents have seen customer enquiries decline by between 25-50%, with a further 20% reporting that new leads have dried up completely. Such a level of activity would represent a 50% contraction in installation rate of around 100 MW per month.

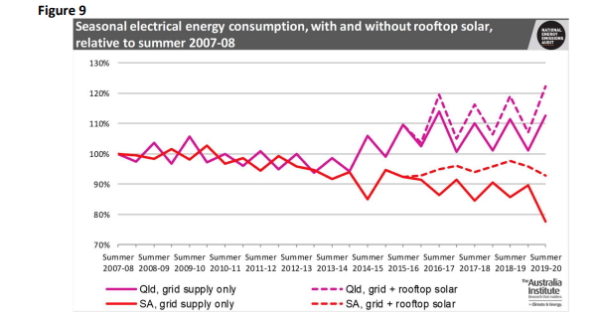

But for now, rooftop solar is continuing its record-breaking streak, making an increasingly contribution to total supply. Without rooftop solar, the situation would also look much different in Queensland and South Australia, the two NEM states with the largest shares of rooftop solar. Gas generation in South Australia would have had to supply 20% more electricity in summer 2017-18 and 44% more in summer 2019-20. The corresponding increases of coal fired generation required in Queensland would have been 6% in 2017-18 and 10% in summer 2019-20, TAI finds.

Over the past year, the steady growth in renewables has been displacing black coal generation. Most of the displacement has occurred at Mount Piper power station, in New South Wales, which has been having severe coal supply problems. Meanwhile, in Western Australia, two units at Synergy’s Muja Power Station are readying for retirement after being used only about 35% of the time thanks largely to rooftop solar reducing demand on the grid.

Combined wind and solar generation supplied to the NEM has increased by more than 4.3 TWh since May 2019, and if rooftop solar is also included, the same increase has taken only six months, TAI finds, and such growth will be sufficient to fill in the gap left by retiring coal-fired generators. “Notwithstanding the various problems now being encountered by the renewable generation industry, to suppose that growth in energy supplied over the next three years will be insufficient to the withdrawal of the roughly 10 TWh currently being supplied each year by the Liddell coal-fired power station, the oldest plant on the NEM, is a stretch. Unless, that is, the current electricity policy mess, which is the root cause of most of the problems, becomes so much worse,” the audit says.

In the year to March 2020, sent out renewable generation, together with rooftop solar, supplied 48.3 TWh, which represented a 24.9% share of total NEM generation. The share of renewable energy has occasionally for brief periods exceeded 50%, most notably on Easter Saturday. This was the first time that this mark has been achieved over a period of more than a few minutes, that is for nearly two hours.

Power sector emissions immune

The TAI audit has also analyzed the nation’s emissions profile and found that the Covid-19 pandemic response has led to massively reduced emissions by the transport sector, while the same cannot be said for the electricity sector. Australia’s coal-dominated power sector has only seen a 1% decrease in emissions over a five-week period which, according to TAI, confirms the need for strong structural and legislative reforms to reduce emissions in the electricity sector.

“Given the disruptive nature of the pandemic and its effect on sectors like transport, it might surprise some that the carbon emissions from electricity – the most polluting sector in Australia — have been so small,” said Hugh Saddler, author of TAI’s National Energy Emissions Audit. “With most Australians ‘grounded’ transport emissions have dropped significantly but major electricity and gas users are still operating as per usual, and there is higher household demand.”

While Europe and the US have seen massive reductions in electricity consumption due to Covid-19 confinement, the Australian market has seen no substantial impact. According to TAI, this is unsurprising given that the majority of major energy users like mining, mineral processing and manufacturing establishments are still operating. Air-conditioning and lighting had continued to run in many shopping centers, offices, hotels and education centers though fewer people were using them, and household electricity use rose as people stayed home.

From March 16 when major lockdowns and closures began to April 21, electricity consumption was slightly lower in 2020 than in either 2019 or 2018. In 2020 total consumption was 2.4% lower than in 2019 and 2.5% lower than in 2018, the audit finds. But more than half of that drop was likely attributable to it being warmer in 2019 in that period, leading to people running air-conditioners more often. “While reduced economic activity may have contributed to the reduction, it was certainly not the only causal factor, contributing about 1% in each year,” the report says.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.