Australia-based startup Recharge Industries, owned by US fund Scale Facilitation, has acquired Britishvolt’s assets and business, after the company went into administration in January.

Before running out of capital earlier this year, Britishvolt had planned to build a $6.6 billion (GBP 3.8 billion, USD 4.71 billion) lithium-ion battery cell manufacturing plant in Cambois, northern England. At full capacity, Britishvolt’s proposed 30 GWh factory envisioned making enough cells for more than 300,000 lithium-ion batteries every year.

Recharge Industries has now acquired Britishvolt after finalising a deal with its administrators, who had selected Recharge as their preferred bidder from a field of contenders. The price of the deal has not been made public.

In January, Recharge Industries made a splash by announcing its plan to construct a lithium-ion gigafactory in Geelong, Victoria. It is aiming to begin construction on that project by the end of the year, targeting 2 GWh of production annually in 2024 before also scaling up to 30 GWh of storage capacity per year.

Image: Recharge Industries/LinkedIn

Recharge was founded by Australian David Collard, a former PwC partner now based in New York. The startup is part of the portfolio of another Collard venture, a US fund called Scale Facilitation.

Far from detracting from the Geelong plans, Collard says the acquisition of Britishvolt will supercharge its Australian vision. “This is the definition of synergy. We now have so many economies of scale, and we have a global manufacturing footprint that aligns,” Collard told The Australian Financial Review.

Crucial to Recharge Industries’ pitch is that it will use battery technology from US company C4V, removing the expense of developing its own process. “Our technology – including an exclusive license for the intellectual property and battery technology – has been developed and validated over the last decade through C4V in the US and will be the backbone of both gigafactories in Geelong and Cambois,” Collard said.

Image: Accenture

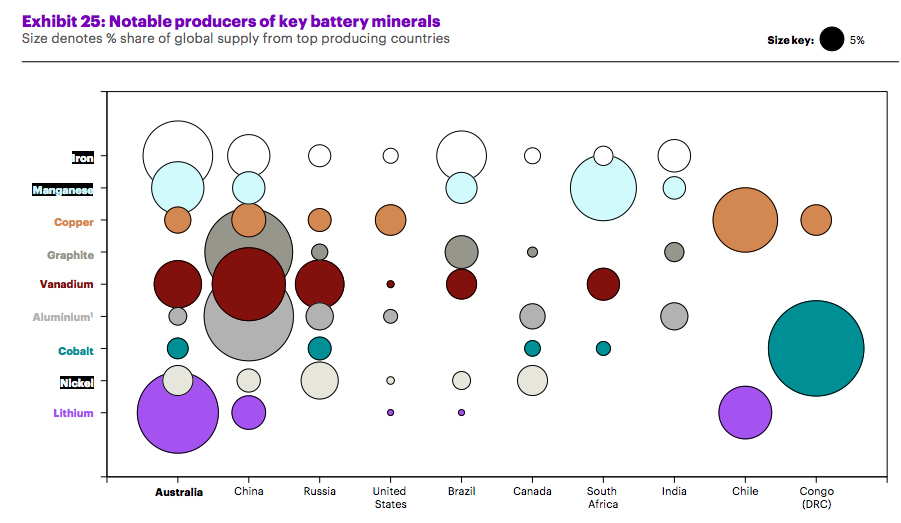

Recharge Industries has repeatedly publicised that its battery cells won’t use materials from China or Russia. Instead, the startup’s plans rest on partnerships between the three countries in the Aukus trilateral security pact: Australia, the United Kingdom and the United States. Indeed, Collard has described Recharge’s projects as “a flagship for friendshoring.”

Given this, it appears likely Recharge will opt to use Australian materials for its Britishvolt play. As part of the deal, Recharge will also reportedly take over the 27 battery experts still on Britishvolt’s payroll.

Collard has said he hopes Australian superannuation funds will get behind Recharge, which has now doubled its ambitions by taking on Britishvolt. “This provides a great opportunity for Australian superannuation funds to co-invest with the UK fund manager, or invest through their existing fund structure… helping an Australian company scale,” he told AFR.

Image: Recharge Industries/LinkedIn

It appears the Geelong gigafactory will be first cab off the rank, with Collard noting construction in the UK would take another year.

“Backed by our global supply chain, strategic delivery partners and a number of significant customer agreements in place, we’re confident of making the [Britishvolt] Cambois gigafactory a success and growing it into an advanced green energy project,” Collard said.

Shoring new energy supply chains

Today, China accounts for a vast majority of lithium-ion battery manufacturing. Australia, on the other hand, is the globe’s leading lithium supplier, and tops that list for a range of other commodities vital for making batteries and other renewable equipment.

Image: Future Battery Industries Cooperative Research Centre

The push to “friendshore” new energy supply chains has taken on a new sense of urgency with the shifting geopolitics of 2022, including Russia’s invasion of Ukraine. The move has also been propelled by US President Biden’s Inflation Reduction Act, which includes massive funding support to build clean energy manufacturing capability in the US and, seemingly, partner countries like Australia.

“Working with our closest allies, America (sic) and Australia, and using world-leading and proven technology, now we can take Britishvolt forward with real purpose,” said Edward Dawes, Scale Facilitation’s UK-based advisor.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.